[Few people realize that the 1997 cult hit GATTACA was actually just the first film in a three-movie trilogy. The final two movies, directed by the legendary Moira LeQuivalence, were flops which only stayed in theaters a few weeks and have since become almost impossible to find. In the interest of making them available to the general public, I’ve written summaries of some key scenes below. Thanks to user Begferdeth from the subreddit for the idea.]

GATTACA II: EPI-GATTACA

“Congratulations, Vincent”, said the supervisor, eyes never looking up from his clipboard. “You passed them all. The orbital mechanics test. The flight simulator. All the fitness tests. More than passed. Some of the highest scores we’ve ever seen, frankly. You’re going to be an astronaut.”

Vincent’s heart leapt in his chest.

“Pending, of course, the results of the final test. But this will be easy. I’m sure a fine specimen like you will have no trouble.”

“The…the final test, sir?”

“Well, you know how things are. We want to make sure we get only the healthiest, most on-point individuals for our program. We used to do genetic testing, make sure that people’s DNA was pre-selected for success. But after the incident with the Gattaca Corporation and that movie they made about the whole thing, public opinion just wasn’t on board, and Congress nixed the whole enterprise. Things were really touch-and-go for a while, but then we came up with a suitably non-invasive replacement. Epigenetics!”

“Epi…genetics?” asked Vincent. He hoped he wasn’t sounding too implausibly naive – he had, after all, just aced a whole battery of science tests. But surely there were some brilliant astronomers who didn’t know anything about biology. He would pretend to be one of those.

The supervisor raised an eyebrow, but he went on. “Yes, epigenetics. According to studies, stressful experiences – anything from starvation to social marginalization – change the methylation pattern of your genes. And not just your genes. Some people say that these methylation patterns can transfer to your children, and your children’s children, and so on, setting them back in life before they’re even born. Of course, it would be illegal for us to take a sample and check your methylation directly – but who needs that! In this day and age, everybody’s left a trail online. We can just check your ancestors’ life experiences directly, and come up with a projection of your methylation profile good enough to predict everything from whether you’ll have a heart attack to whether you’ll choke under pressure at a crucial moment. I’ll just need to see your genealogy, so we can run it through this computer here…you did bring it like we asked you, right? Of course you did! A superior individual like you, probably no major family traumas going back five, six generations – I bet you’ve got it all ready for me.”

Vincent reached into his briefcase, took out a slim blue binder. Here goes nothing, he thought.

Two weeks earlier, he had thrown a wad of cash down on a granite table in a downtown apartment.

The man across from him leaned forward in his wheelchair, extended a trembling arm to slowly take the cash.

“You’re, uh, sure you want to do this?” asked Vincent, suddenly feeling a pang of conscience.

“Yes,” rasped Jerome. “You’re young. You still have your whole life ahead of you. You can still make something of yourself. Me, I’m done.”

“Look,” said Vincent, despite his better judgment, “just because you’re partly paralyzed doesn’t mean you can’t…do anything, really. Write a book. Travel the world.”

“You want to know how this happened?” Jerome asked. “I did it to myself. I used to be the best swimmer in the state, maybe in the country. I was going to the Olympics. With a spotless family history like mine, there were no limits. Then it happened. I had a fluke defeat. Lost the Olympics qualifier by a hairbreadth to a guy I’d beaten twenty times before. After that, why go on?”

“But…couldn’t you have just tried again four years later?”

“You still don’t get it. It wasn’t the loss. That loss stressed me out, Vincent. It made me feel bad about myself. I experienced lowering of my social status. With my methylation profile that screwed, it wasn’t just my own body I had ruined. It was my future children too. How was I ever going to marry when I would have to look my wife in the eyes and tell her our kids would be epigenetically tainted forever? So I did the only thing I could. I threw myself in front of a car. Couldn’t even kill myself properly, that’s what happens when your methylation profile is ruined. So here I am.”

“I’m so sorry,” said Vincent, who was starting to regret ever having come. “We can help you. We can find some way to…”

“No,” said Jerome, and he put the cash in his pocket. “What’s done is done.” He took a slim blue binder, slid it over the table to Vincent. “My geneaology. Absolutely perfect. Not a single microaggression against any of my ancestors since the Mayflower.”

Vincent considered saying something, but finally just nodded. “I won’t let you down. I’ll use the gift you’ve given me in a way that would make you proud.”

He’d been so close. And now, this…whatever it was.

“It’s not a problem with you,” said the supervisor, though he looked haggard and did not exactly inspire confidence. “It’s just…there’s been an incident. We’re interviewing everybody.”

It was two days before launch. Everything had been set up. Now, as the supervisor ushered him into a sterile-looking interview room, he could already imagine the headlines. MAN BUYS FALSIFIED GENEAOLOGY, TRIES TO HIDE EPIGENETIC INFERIORITY. Or, FRAUD DECEIVES EPIGATTACA CORPORATION, MISSION CALLED OFF.

He was so busy generating worst-case scenarios that he didn’t even notice the identity of the detective seated across from him until the door had closed and they were alone together.

“Anton?”

“Vincent?”

“Um…yeah…” was the best Vincent could think of to say to his older brother.

They’d been in touch, sure. But Vincent had thought it prudent not to mention his exact job description, lest his brother start asking the wrong questions. He’d just said he worked for the Epigattaca corporation, letting Anton infer that he was sweeping floors or validating parking tickets or something else suitable to someone with his inadequate histone pattern. Finally he put himself together and spoke.

“What are you doing here?”

“There’s been a death. One of the executives. Foul play suspected. I’m a detective, so…”

Then it had nothing to do with him. Or, at least, it hadn’t. Now…

“Okay, Anton. Before you ask, yeah. I admit it. I faked my epigenome. There’s a black market in geneaologies. I found a guy willing to sell his identity. I saved up, bought it from him, gave it to the suits here. They think I haven’t had a microaggression in my family line since the Mayflower. And they’re going to do it. They’re going to let me go to space.”

“But why, Vincent? You were always such a good kid!”

“Of course you wouldn’t understand,” said Vincent.

It was true. Anton was five years older. He’d been born perfect, the product of the latest eu-epigenics program. Female infants with good epigenes were sent to live a sheltered existence in Denmark, the most equitable country in the world, and kept drugged on heroic doses of beta-blockers to prevent them from feeling any trauma or anxiety. They were raised in special houses by caretakers who denied them nothing, then sent to special schools where it was impossible to fail or feel inadequate. Then, when they reached puberty, they were artificially fertilized – no way the program was going to let them deal with something as stressful as sexual relationships – until they pumped out five or ten kids each. The most innocent were brought back to the shelters to restart the cycle.

It had all gone so well with Anton. But a year after he was born, everything had changed. One of the nurses had gotten sick, and an untrained nurse was brought in to cover. She had told Anton’s mother that she was looking “a little chubby”. Faced with this sudden awareness of patriarchal beauty standards and devaluing from a human being to a sex object, her histones had wilted instantly, her precious DNA inundated with methyl groups. When the scientists found out, they discharged her from the breeding program, she married a similarly damaged man, and the result, a few years later, had been Vincent.

“You’re right,” said Anton. “I can never understand what you go through. But I’m going to clear you. Right now. No conditions.”

Vincent could barely believe he’d heard correctly. “What?”

“It’s…my son. Your nephew. I never told you this, but a few years ago, he broke his leg biking. We got it treated by a black-market doctor, covered it up, no trace of it in any of the records, but – I can’t help worry about him. He remembers what happened. He’s going to need role models to look up to when he grows older, people who overcame epigenetic determinism and succeeded despite the changes our experiences impose on our DNA. He’s going to need someone like you. And besides, we’re brothers. I’ve already figured out who committed the murder – it was another executive whose department would profit by delaying the launch. I’m going to report that you’re innocent. And I’m also going to report that I didn’t discover anything else of note about you. Nothing that should delay this week’s launch.”

“You…you’d really do that for me?”

“Good luck in space, bro.”

Vincent walked out of the office in a daze. By the time he reached his desk, the email was already on the screen “Detective has said you’re good to go – launch is still on for Wednesday”. He read it three times, lost in thought.

He had always wanted to be an astronaut. Now he realized why – it was to escape his own epigenome. More than that – it was to escape a world that held epigenetics in such high regard that his epigenome mattered. He would still go to space. He would do it for Anton’s son, and for all the other individuals with a history of personal or family trauma. But he no longer felt like there was nothing for him on Earth. There were people who would judge him as a full human being, not just a methylation pattern shaped by familial disadvantage. And someday – he vowed – everyone would be able to say the same.

GATTACA III: EDU-GATTACA

“Congratulations, Vincent”, said the supervisor, eyes never looking up from his clipboard. “You passed them all. The astrogation test. The crisis simulation. All the physicals and health panels. More than passed. Some of the highest scores we’ve ever seen, frankly. You’re going to be an astronaut…”

Vincent broke out into a giant smile.

“…pending, of course, the results of the final test. But this will be easy. I’m sure a fine specimen like you will have no trouble.”

“The…the final test, sir?”

“Well, you know how things are. We want to make sure we get only the strongest, most intelligent individuals for our program. We used to do genetic testing, make sure that people’s DNA was pre-selected for success. But after the incident with the Gattaca Corporation and that movie they made about the whole thing, public opinion just wasn’t on board, and Congress nixed the whole enterprise. Then we tried epigenetics, but it turned out they made a movie about that one too. Really, our luck in all of this has been terrible. But this time, we’ve really got it! This time, we know how to identify truly superior human beings who deserve to be astronauts, no creepy biology involved. We’re going to base our decision on…what institution you spent four years in during your teens and early twenties!”

“Oh, come on,” said Vincent. “Can’t you just give up already and judge people on their merit?”

The supervisor pounded the desk. “Never! So-called meritocracy is a sham designed to justify inequality. No, we’ve made our choice, and we’re going to judge you by which university accepted you at age 17 based on a combination of illegibly-inflated grades, recommendations by people who barely knew you, and how much money your parents were willing to donate. You can complain all you want, but that’s just how we roll, here at the…” He pointed out the window, to the gleaming sign outside “…at the PhDMSMABSBA corporation.”

“How do you even expect people to pronounce that?” asked Vincent.

“Irrelevant! Now tell us what college you went to, so we can figure out what Greek letter to assign you on your application.”

“Greek letter?”

“Just an internal company code we use. We got tired of saying ‘top-tier institution’, ‘second-tier institution’, and so on, so now you’re Alphas, Betas, Gammas, Deltas, and Epsilons. The Alphas get positions like executive or astronaut. The Betas get positions in middle management. The Gammas and Deltas have jobs like clerks and call center reps. And the Epsilons do the really dirty work, the stuff nobody else will touch.”

“That’s terrible!” said Vincent.

“That’s what everybody does,” the supervisor corrected. “The only difference is we use Greek letters. Is your moral system so fragile that its results depend on whether you refer to something with Greek letters or not?”

“Wow,” said Vincent, “this conversation has taken a disturbing turn.”

“That’s right. So why don’t you just show us your college degree, and we can get your application going?”

Vincent reached into his briefcase, took out a slim red binder. Here goes nothing, he thought.

Two weeks earlier, he had thrown a wad of cash down on a marble table in a suburban apartment.

The man across from him leaned forward in his wheelchair, extended a trembling arm to slowly take the cash.

“You’re, uh, sure you want to do this?” asked Vincent, suddenly feeling a pang of conscience.

“Yes,” rasped Jerome. “You’re young. You still have your whole life ahead of you. You can still make something of yourself. Me, I’m done.”

“Look,” said Vincent, despite his better judgment, “just because you’ve got some kind of condition doesn’t mean you can’t…do anything, really. Write a book. Travel the world.”

“You want to know how this happened?” Jerome asked. “I did it to myself. I used to be the best football player in the state. Maybe the country. Got accepted to Harvard on a football scholarship. Then I learned that college football causes so many concussions that it increases your risk of chronic traumatic encephalopathy. I didn’t know what to do. Stick around, and I risked degenerating into the condition you see me in now. Leave, and I’d lose my scholarship, never get a degree, and have to go to community college. I’d never be anything higher than a Delta.”

“A Delta?”

“Some new corporate jargon people are using.” Jerome shrugged. “So I kept it up and got my degree. Now I can barely walk, and half the time I can’t remember my own name. So here I am.”

“I’m so sorry,” said Vincent, who was starting to regret ever having come. “We can help you. We can find some way to…”

“No,” said Jerome, and he put the cash in his pocket. “What’s done is done.” He took a slim red binder, slid it over the table to Vincent. “My Harvard degree. Top-tier institution, absolutely Alpha quality. With this, every single door in the world will be open to you.”

Vincent considered saying something, but finally just nodded. “I won’t let you down. I’ll use the gift you’ve given me in a way that would make you proud.”

He’d been so close. And now, this…whatever it was.

“It’s not a problem with you,” said the supervisor, though he looked haggard and did not exactly inspire confidence. “It’s just…there’s been an incident. We’re interviewing everybody.”

It was two days before launch. Everything had been set up. Now, as the supervisor ushered him into a sterile-looking interview room, he could already imagine the headlines. MAN BUYS FAKE DEGREE, TRIES TO HIDE EDUCATIONAL INFERIORITY. Or, FRAUD DECEIVES PHDMSMABSBA CORPORATION, MISSION CALLED OFF.

He was so busy generating worst-case scenarios that he didn’t even notice the identity of the detective seated across from him until the door had closed and they were alone together.

“Anton?”

“Vincent?”

“Um…yeah…” was the best Vincent could think of to say to his younger brother.

They’d been in touch, sure. But Vincent had thought it prudent not to mention his exact job description, lest his brother start asking the wrong questions. He’d just said he worked for the PhDMSMABSBA corporation, letting Anton infer that he was sweeping floors or validating parking tickets or something else suitable to someone with his educational background. Finally he put himself together and spoke.

“What are you doing here?”

“There’s been a death. One of the executives. Foul play suspected. I’m a detective, so…”

Then it had nothing to do with him. Or, at least, it hadn’t. Now…

“Okay, Anton. Before you ask, yeah. I admit it. I faked my degree. I found a guy willing to sell his identity. I saved up, bought it from him, gave it to the suits here. They think I’m a Harvard alum. And they’re going to do it. They’re going to let me go to space.”

“But why, Vincent? You were always such a good kid!”

“Of course you wouldn’t understand,” said Vincent.

It was true. Vincent had spent years working ten-hour days after school teaching the saxophone to underprivileged children to build his resume, but the Admissions Departments hadn’t been impressed. Anton had learned from his mistake, hired an admissions coach, and with her guidance had founded the country’s first Klingon-language suicide prevention hotline; the Ivy League had eaten it up. Vincent had ended up with a degree from a Gamma-level state institution; Anton had gone to Yale.

“You’re right,” said Anton. “I can never understand what you go through. But I’m going to clear you. Right now. No conditions.”

Vincent could barely believe he’d heard correctly. “What?”

“It’s…my son. Your nephew. You remember how he started a synchronized underwater molecular gastronomy team at his high school? Apparently all the other kids have been going to the Third World and starting synchronized underwater molecular gastronomy teams there, and we never knew about it. Now there’s no way he’s going to be competitive. I can’t help worry about him. He’s going to need role models to look up to when he grows older, people who overcame going to a low-tier college and succeeded anyway. He’s going to need someone like you. And besides, we’re brothers. I’ve already figured out who committed the murder – it was another executive whose department would profit by delaying the launch. I’m going to report that you’re innocent. And I’m also going to report that I didn’t discover anything else of note about you. Nothing that should delay this week’s launch.”

“You…you’d really do that for me?”

“Good luck in space, bro.”

Vincent walked out of the office in a daze. By the time he reached his desk, the email was already on the screen “Detective has said you’re good to go – launch is still on for Wednesday”. He read it three times, lost in thought.

He had always wanted to be an astronaut. Now he realized why – it was to escape his own low-tier college degree. More than that – it was to escape a world that held degrees in such high regard that the college he went to mattered. He would still go to space. He would do it for Anton’s son, and for all the other individuals with a subpar secondary education. But he no longer felt like there was nothing for him on Earth. There were people who would judge him as a full human being, not just a set of letters after his name. And someday – he vowed – everyone would be able to say the same.

Highlights From The Comments On Piketty

Chris Stucchio recommended Matt Rognlie’s criticisms of Piketty (paper, summary, Voxsplainer).

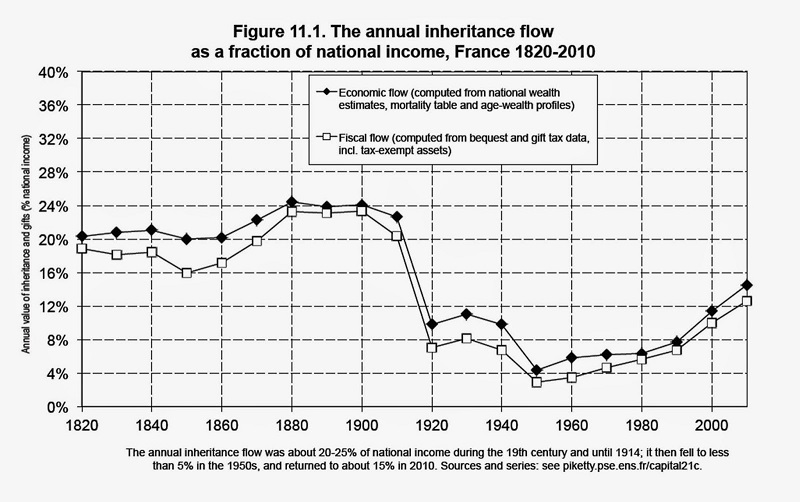

Rognlie starts by saying that Piketty didn’t correctly account for capital depreciation (ie capital losing value over time) in his calculations. This surprises me, because Piketty says he does in his book (p. 55) but apparently there are technical details I don’t understand. When you do that, the share of capital decreases, and it becomes clear that 100% of recent capital-share growth comes from one source: housing.

I think it’s saying the same thing Piketty was in that housing is a real thing, and if there’s inequality in housing, then that’s real inequality. And landlords are a classic example of the rentiers Piketty is warning against.

But it’s saying a different thing in that most homeowners use their homes by living in them, not by renting them out. That means they’re not part of Piketty’s rentier class, and so using the amount of capital to represent the power of rentiers is misleading. Rentiers are not clearly increasing and there is no clear upward trend in rentier-vs-laborer inequality. I think this does disprove Piketty’s most shocking thesis.

Rognlie also makes an argument for why increasing the amount of capital will decrease the returns on capital, leading to stable or decreasing income from capital. Piketty argues against this on page 277 of his book, but re-reading it Piketty’s argument now looks kind of weak, especially with the evidence from housing affecting some of his key points.

Grendel Khan highlights the role of housing with an interesting metaphor:

In the original post, I questioned Piketty’s claim that rich people and very-well-endowed colleges got higher rates of return on their investment than ordinary people or less-well-endowed colleges. After all, why can’t poorer people pool their money together, mutual-fund-style, to become an effective rich person who can get higher rate of return? Many people tried to answer this, not always successfully.

brberg points out that Bill Gates – one example of a rich person who’s gotten 10%+ returns per year – has a very specific advantage:

This is a good point, but most of Piketty’s data focuses on college endowments. How do they do it?

Briefling writes:

Also a good point, but colleges seem to do this with less volatility than the stock market, which still requires some explanation.

Tyrathalis, a financial planner, adds more information:

And Vaniver adds:

I still don’t feel like this explains everything; surely a college with $500 million has about the same risk tolerance and ability to give money on the right time scale as a college with $1 billion? Maybe all of this is just false? J Mann writes:

And Anon256 adds:

And Will4071 says:

Chris Stucchio has a different perspective on rich people making higher rates of return:

See also Paul’s answer to one of my objections to this. Right now it looks like (assuming Piketty is right about this at all), Chris has a point. Does anyone want to try to convince me otherwise?

Phillip Magness, himself an economic history professor, writes:

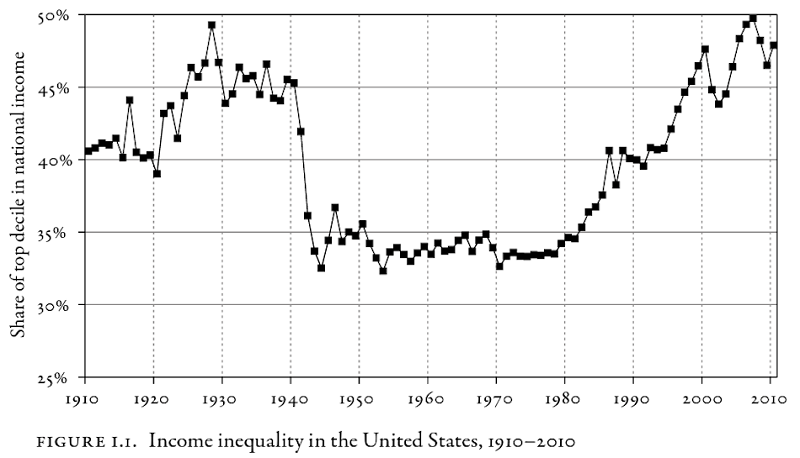

Magness also recommends his 2014 paper and Richard Sutch’s 2017 conceptual replication questioning Piketty’s data. It’s inherently hard to find good data on inequality over the last few centuries, but Magness finds that of the many datasets available, Piketty cherry-picked the ones that best fit the u-shaped curve he wanted to show, estimated some missing data points kind of out of thin air, and made some other questionable decisions. The result is a much less pronounced change in inequality, especially in the US.

The paper is pretty confrontational (on his own blog, Magness’ co-author describes Piketty as making “no-brainers…boneheaded historical errors [that] would be shocking if contained in a high school term paper”. Piketty sort of says a few words in his own defense in this article. But one thing I notice is that it looks like, aside from these authors, everyone is working together on this – the author of one of the pro-Piketty datasets was also a co-author of one of the anti-Piketty datasets, and the author of one of the anti-Piketty datasets has worked with Piketty in the past. This suggests to me that a lot of this is legitimately hard and that the same people, working from different methods, get different results. My main takeaway is that there are many different inequality datasets and Piketty used the most dramatic.

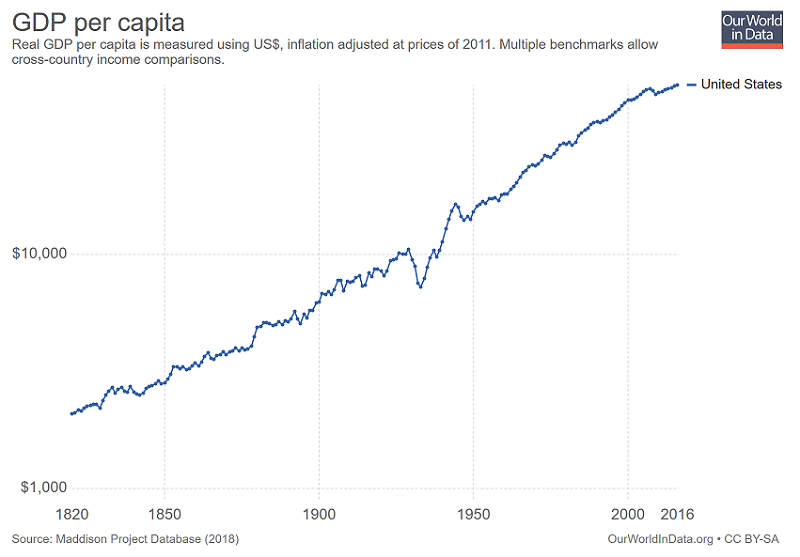

Tlaloc on the Discord provides the European log GDP graphs I wanted:

I think it’s fair to ask – what the heck? Taken literally, doesn’t this suggest WWII was long-run good for Europe – that its “recovery” brought it well above trend?

Eyeballing the Maddison Project data elsewhere shows France, Germany, and the US all having very similar growth of 200% between 1960 and 2016.

I need to look into this more, but right now I’m not really buying it.

VPaul doesn’t believe in straight-line GDP growth anyway:

Several people point out that “increasing number of rentiers” is not necessarily bad; after all, this is what the post-scarcity robot future should look like. For example, from Virriman:

This could maybe make sense around number of rentiers, but amount of money per rentier could work the opposite direction, and Piketty’s numbers awkwardly combine both.

Paul Christiano on some of Piketty’s other statistics:

Swami brings up an IGM poll of economists on r>>g:

Overall, it looks like the claim that the super-rich get much better returns on investment than everyone else doesn’t really hold up, except in obvious predictable ways, eg they can take more risks.

The claim that there is a rising rentier class who will dominate the 21st century doesn’t really hold up.

I’m not qualified to say whether Piketty’s empirical data holds up, but there seems to be significant academic debate over it.

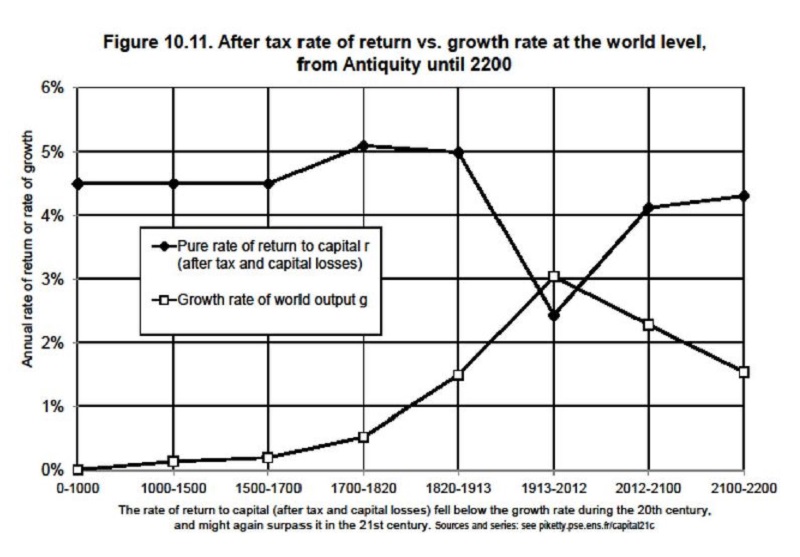

And although Piketty’s rules of thumb for growth (g = 1 – 1.5%, r = 4-5%) hold up more than I would have expected before reading him, they still don’t hold up that well.

Now taking recommendations about if anything from Piketty is still worth keeping.