Meta

Metaculus is a platform for generating crowd-sourced predictions about the future, especially science and technology. If you're interested in testing yourself and contributing to their project, check out their questions page

80,000 Hours researches different problems and professions to help you figure out how to do as much good as possible. Their free career guide show you how to choose a career that's fulfilling and maximises your contribution to solving the world's most pressing problems.

B4X is a free and open source developer tool that allows users to write apps for Android, iOS, and more.

MealSquares is a "nutritionally complete" food that contains a balanced diet worth of nutrients in a few tasty easily measurable units. Think Soylent, except zero preparation, made with natural ingredients, and looks/tastes a lot like an ordinary scone.

Giving What We Can is a charitable movement promoting giving some of your money to the developing world or other worthy causes. If you're interested in this, consider taking their Pledge as a formal and public declaration of intent.

The COVID-19 Forecasting Project at the University of Oxford is making advanced pandemic simulations of 150+ countries available to the public, and also offer pro-bono forecasting services to decision-makers.

Substack is a blogging site that helps writers earn money and readers discover articles they'll like.

Altruisto is a browser extension so that when you shop online, a portion of the money you pay goes to effective charities (no extra cost to you). Just install an extension and when you buy something, people in poverty will get medicines, bed nets, or financial aid.

Norwegian founders with an international team on a mission to offer the equivalent of a Norwegian social safety net globally available as a membership. Currently offering travel medical insurance for nomads, and global health insurance for remote teams.

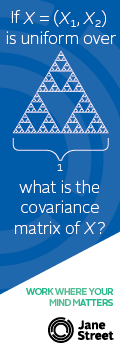

Jane Street is a quantitative trading firm with a focus on technology and collaborative problem solving. We're always hiring talented programmers, traders, and researchers and have internships and fulltime positions in New York, London, and Hong Kong. No background in finance required.

Support Slate Star Codex on Patreon. I have a day job and SSC gets free hosting, so don't feel pressured to contribute. But extra cash helps pay for contest prizes, meetup expenses, and me spending extra time blogging instead of working.

Seattle Anxiety Specialists are a therapy practice helping people overcome anxiety and related mental health issues (eg GAD, OCD, PTSD) through evidence based interventions and self-exploration. Check out their free anti-anxiety guide here

.

The Effective Altruism newsletter provides monthly updates on the highest-impact ways to do good and help others.

Beeminder's an evidence-based willpower augmention tool that collects quantifiable data about your life, then helps you organize it into commitment mechanisms so you can keep resolutions. They've also got a blog about what they're doing here

Dr. Laura Baur is a psychiatrist with interests in literature review, reproductive psychiatry, and relational psychotherapy; see her website for more. Note that due to conflict of interest she doesn't treat people in the NYC rationalist social scene.

AISafety.com hosts a Skype reading group Wednesdays at 19:45 UTC, reading new and old articles on different aspects of AI Safety. We start with a presentation of a summary of the article, and then discuss in a friendly atmosphere.

Monthly Archives: April 2019

Buspirone Shortage In Healthcaristan SSR

(Epistemic status: Unsure on details. Some post-publication edits 5/1 to make this less strident.) I. There is a national shortage of buspirone. Buspirone is a 5HT-1 agonist used to control anxiety. Unlike most psychiatric drugs, it’s in a class of … Continue reading

Open Thread 126.5

This is the twice-weekly hidden open thread. You can also talk at the SSC subreddit or the SSC Discord server.

Links 4/2019

[Epistemic status: I have not independently verified each link. On average, about two of the links in each links post turn out to be wrong or misleading, as found by commenters. I correct these as I see them, but can’t … Continue reading

Open Thread 126.25

This is the twice-weekly hidden open thread. You can also talk at the SSC subreddit or the SSC Discord server.

1960: The Year The Singularity Was Cancelled

[Epistemic status: Very speculative, especially Parts 3 and 4. Like many good things, this post is based on a conversation with Paul Christiano; most of the good ideas are his, any errors are mine.] I. In the 1950s, an Austrian … Continue reading

OT126: Ovum Thread

Happy Easter and Passover! This is the bi-weekly visible open thread (there are also hidden open threads twice a week you can reach through the Open Thread tab on the top of the page). Post about anything you want, but … Continue reading

Open Thread 125.75

This is the twice-weekly hidden open thread. You can also talk at the SSC subreddit or the SSC Discord server.

Increasingly Competitive College Admissions: Much More Than You Wanted To Know

0: Introduction This is from businessstudent.com: Acceptance rates at top colleges have declined by about half over the past decade or so, raising concern about intensifying academic competition. The pressure of getting into a good university may even be leading … Continue reading

Open Thread 125.5

This is the twice-weekly hidden open thread. You can also talk at the SSC subreddit or the SSC Discord server.

Highlights From The Comments On College Admissions

HalTheWise discusses a factor I missed (until I sneakily edited it in, so you may have read the later version that included it): One very powerful contributor that Scott did not mention is that in many cases schools are directly … Continue reading →