Why have prices for services like health care and education risen so much over the past fifty years? When I looked into this in 2017, I couldn’t find a conclusive answer. Economists Alex Tabarrok and Eric Helland have written a new book on the topic, Why Are The Prices So D*mn High? (link goes to free pdf copy, or you can read Tabarrok’s summary on Marginal Revolution). They do find a conclusive answer: the Baumol effect.

T&H explain it like this:

In 1826, when Beethoven’s String Quartet No. 14 was first played, it took four people 40 minutes to produce a performance. In 2010, it still took four people 40 minutes to produce a performance. Stated differently, in the nearly 200 years between 1826 and 2010, there was no growth in string quartet labor productivity. In 1826 it took 2.66 labor hours to produce one unit of output, and it took 2.66 labor hours to produce one unit of output in 2010.

Fortunately, most other sectors of the economy have experienced substantial growth in labor productivity since 1826. We can measure growth in labor productivity in the economy as a whole by looking at the growth in real wages. In 1826 the average hourly wage for a production worker was $1.14. In 2010 the average hourly wage for a production worker was $26.44, approximately 23 times higher in real (inflation-adjusted) terms. Growth in average labor productivity has a surprising implication: it makes the output of slow productivity-growth sectors (relatively) more expensive. In 1826, the average wage of $1.14 meant that the 2.66 hours needed to produce a performance of Beethoven’s String Quartet No. 14 had an opportunity cost of just $3.02. At a wage of $26.44, the 2.66 hours of labor in music production had an opportunity cost of $70.33. Thus, in 2010 it was 23 times (70.33/3.02) more expensive to produce a performance of Beethoven’s String Quartet No. 14 than in 1826. In other words, one had to give up more other goods and services to produce a music performance in 2010 than one did in 1826. Why? Simply because in 2010, society was better at producing other goods and services than in 1826.

Put another way, a violinist can always choose to stop playing violin, retrain for a while, and work in a factory instead. Maybe in 1826, when factory owners were earning $1.14/hour and violinists were earning $5/hour, so no violinists would quit and retrain. But by 2010, factory workers were earning $26.44/hour, so if violinists were still only earning $5 they might all quit and retrain. So in 2010, there would be a strong pressure to increase violinists’ wage to at least $26.44 (probably more, since few people have the skills to be violinists). So violinists must be paid 5x more for the same work, which will look like concerts becoming more expensive.

This should happen in every industry where increasing technology does not increase productivity. Education and health care both qualify. Although we can imagine innovative online education models, in practice one teacher teaches about twenty to thirty kids per year regardless of our technology level. And although we can imagine innovative AI health care, in practice one doctor can only treat ten or twenty patients per day. Tabarrok and Helland say this is exactly what is happening. They point to a few lines of evidence.

First, costs have been increasing very consistently over a wide range of service industries. If it was just one industry, we could blame industry-specific factors. If it was just during one time period, we could blame some new policy or market change that happened during that time period. Instead it’s basically omnipresent. So it’s probably some kind of very broad secular trend. The Baumol effect would fit the bill; not much else would.

Second, costs seemed to increase most quickly during the ’60s and ’70s, and are increasing more slowly today. This fits the growth of productivity, the main driver of the Baumol effect. Between 1950 and 2010, the relative productivity of manufacturing compared to services increased by a factor of six, which T&H describe as “of the same order as the growth in relative prices”. This is what the violinist-vs-factory-worker model of the Baumol effect would predict.

Third, competing explanations don’t seem to work. Some people blame rising costs on “administrative bloat”. But administrative costs as a share of total college costs have stayed fixed at 16% from 1980 to today (really?! this is fascinating and surprising). Others blame rising costs on overregulation. But T&H have a measure for which industries have been getting more regulated recently, and it doesn’t really correlate with which industries have been getting more expensive (wait, did they just disprove that regulation hurts the economy? I guess regulation isn’t a random shock, so this isn’t proof, but it still seems like a big deal). They’re also able to knock down industry-specific explanations like medical malpractice suits, teachers unions, etc.

Fourth, although service quality has improved a little bit over the past few decades, T&H provide some evidence that this explains only a small fraction of the increase in costs. Yet education and health care remain as popular (maybe more popular) than ever. They claim that very few things in economics can explain simultaneous increasing cost, increasing demand, and constant quality. One of those few things is the Baumol effect.

Fifth, they did a study, and the lower productivity growth in an industry, the higher the rise in costs, especially if they use college-educated workers who could otherwise get jobs in higher-productivity industries. This is what the Baumol effect would predict (though framed that way, it also sounds kind of obvious).

I find their case pretty convincing. And I want to believe. If this is true, it’s the best thing I’ve heard all year. It restores my faith in humanity. Rising costs in every sector don’t necessarily mean our society is getting less efficient, or more vulnerable to rent-seeking, or less-well-governed, or greedier, or anything like that. It’s just a natural consequence of high economic growth. We can stop worrying that our civilization is in terminal decline, and just work on the practical issue of how to get costs down.

But I do have some gripes. T&H frequently compare apples and oranges; for example, the administrator share in colleges vs. the faculty share in K-12; it feels like they’re clumsily trying to get one past you. They frequently describe how if you just use eg teacher salaries as a predictor, you can perfectly predict the extent of rising costs. But as far as I can tell, most things have risen the same amount, so if you used any subcomponent as a predictor, you could perfectly predict the extent of rising costs; again, it feels like they’re clumsily trying to get something past me. I think I can work out what they were trying to do (stitch together different datasets to get a better picture, assume salaries rise equally in every category) but I still wish they had discussed their reasoning and its limitations more openly.

The main thesis survives these objections, but there are still a few things that bother me, or don’t quite fit. I want to bring them up not as a gotcha or refutation, but in the hopes that people who know more about economics than I do can explain why I shouldn’t worry about them.

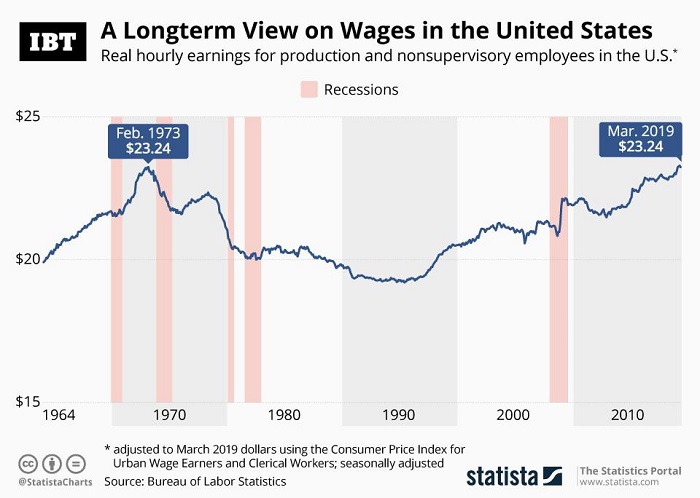

First, real wages have not in fact gone up during most of this period. Factory workers are not getting paid more. That makes it hard for me to understand how rising wages for factory workers are forcing up salaries for violinists, teachers, and doctors.

I discuss whether issues like benefits and inflation can explain this away here here, and conclude they can do so only partially; I’m not sure how this would interact with the Baumol effect.

Second, other data seem to dispute that salaries for the professionals in question have risen at all. T&H talk about rises in “instructional expenditures”, an education-statistics term that includes teacher salary and other costs; their source is NCES. But NCES also includes tables of actual teacher salaries. These show that teacher salaries today are only 6% higher than teacher salaries in 1970. Meanwhile, per-pupil costs are more than twice as high. How is an increase of 6% in teacher salaries driving an increase of 100%+ in costs? Likewise, although on page 33 T&H claim that doctors’ salaries have tripled since 1960, other sources report smaller increases of about 50% to almost nothing. Conventional wisdom among doctors is that the profession used to be more lucrative than it is today. This makes it hard to see how rising doctor salaries could explain a tripling in the cost of health care. And doctor salaries apparently make up only 20% of health spending, so it’s hard to see how they can matter that much.

(also, this SMBC)

Third, the Baumol effect can’t explain things getting less affordable. T&H write:

The cost disease is not a disease but a blessing. To be sure, it would be better if productivity increased in all industries, but that is just to say that more is better. There is nothing negative about productivity growth, even if it is unbalanced.In particular, it is important to see that the increase in the relative price of the string quartet makes string quartets costlier but not less affordable. Society can afford just as many string quartets as in the past. Indeed, it can afford more because the increase in productivity in other sectors has made society richer. Individuals might not choose to buy more, but that is a choice, not a constraint forced upon them by circumstance.

This matches my understanding of the Baumol effect. But it doesn’t match my perception of how things are going in the real world. College has actually become less affordable. Using these numbers: in 1971, the average man would have had to work five months to earn a year’s tuition at a private college. In 2016, he would have had to work fourteen months. To put this in perspective, my uncle worked a summer job to pay for his college tuition; one summer of working = one year tuition at an Ivy League school. Student debt has increased 700% since 1990. College really does seem to be getting less affordable. So do health care, primary education, and all the other areas affected by cost disease. Baumol effects shouldn’t be able to do this, unless I am really confused about them.

If someone can answer these questions and remove my lingering doubts about the Baumol effect as an explanation for cost disease, they can share credit with Tabarrok and Helland for restoring a big part of my faith in modern civilization.

It is probably too late to reply to your comment, but

the inflation adjustment I use leaves services about the same price across time (nominal changes being 100% inflation)

but food and car manufacture are both undergoing increasing productivity at different rates (each productivity innovation is special to its individual industry or even factory) So, both food and cars become cheaper relative to what people earn in an hour. That means they become cheaper in real terms. As one saw with large screen HD TVs, iphones, or computers.

That’s true, but wouldn’t it be better to compare teachers/doctors to college educated workers? College educated workers have received much more significant wage growth during that time period.

A high school math teacher isn’t really in the set of (someone who might otherwise be working in a factory), they’re much closer to being in the set of (someone who might otherwise be programming computers).

The document linked has some graphs showing results of my inflation adjustment of historical prices on the basis of “equal value for equal average work” across time, but not yet explanations.

https://docs.google.com/document/d/16rNp087cIPbiG6TlT5Lo4Xek-h8d-FV5ZtlVtGaahco/edit

I will not put it in the open thread until I have added much more to it, but I’ve already mentioned some of this data in earlier comments, so want it available.

HOWEVER, I realized that what I really have neglected to communicate clearly and directly is the error in the ‘Baumol Effect’ argument which Scott repeated at the beginning.

In the real world, a rise in productivity by a factor of 5 does NOT in fact lead to making 5 times as much money by selling the more numerous products at the same price and paying the worker 5 times more.

Instead, such an improvement in productivity, in the long run, always leads to selling items at close to 1/5 the original price while paying the worker about the same he has always received for his grade and difficulty of the job.

And if a service job involves a similar grade of work, it gets paid at that rate as well.

True, the market demand expands with the lower price, so more money is made that way by the company selling to an enlarged customer pool. The plant owner can pay the workers more from this profit for a while, but if it’s a salary much above the going price for the skill level involved, a competitor can hire similarly skilled workers at their usual rate and undercut the more generous owner/managers.

Basically a barber who switches to an assembly-line cutting wires instead of hair will earn at the same rate he always has. There was never any need for people to pay barbers more to keep them from running off to make their fortune. But it was a windfall for car factory owners when they could replace skilled master mechanics, rare and expensive and slow, with common diligent barbers and cab drivers who could do one small job repeatedly at near their usual rate of pay.

I’m amazed economists don’t seem to know that this is what happens. They inhabit a very different world from business people. When I first met my wife, three decades ago, she was working as an intern at a big management consulting firm, and every strategy revolved around “the experience curve.”

They had discovered that as predictably as a law of nature, every time a new product line or process was started up the cost per unit would decrease by some amount, maybe 20%, every time the number of units produced from the last price mark doubled, a self-similar power law.

So they would determine this coefficient in a particular industry’s case and could say, if we keep manufacturing at a high rate, in a month the price will be this much lower, so let’s set the price now at less than half what it is costing to make now, but the demand will get us through the doubling quickly and we’ll fall below that mark and be making a profit.

They’d then keep the price set there as long as the techniques developed during the continuous improvement phase are able to remain proprietary. But when competitors learn to do it and try to catch up, then the strategy is to keep lowering the price you sell at in proportion to the cost of production as it declines.

So continuous improvement = continuous price reduction.

That is the dynamic that positive feedback of the market place drives. The negative feedback classical economists concentrate on has nothing to do with productivity increase. If you don’t lower price, you don’t increase market share or make more profit, so you might as well not have bothered to manufacture more per person as , people rich enough to buy at that price are probably already doing so.

The workers might indeed be paid better as the profits come in from lower production cost, a lot of the improvements were skills and knowledge built-in to the worker expertise, that raises their work grade and necessitates protecting secrets. But it never rises in proportion to the ratio of product sent out per employee as Baumol assumes

So, you’re saying that I could go there because this is one is no longer live,

but either way I have to put my plots online somewhere (make a google document?) and then provide a link for people to see them?

Presumably I could do that here, but no one is looking?

I really wanted to get the ideas to Scott, does he go back over these comments before closing them?

It is because his references to “cost disease” a few years ago stuck in my mind that I eventually came to this conviction that the cause was something deeper than job market incentives viewed in the conventional framework.

Instead it seemed to signal severe mistakes of practice at the foundation of economic measurement and the interpretation of money value and economic “growth.”

As a physicist who has worked

I’m new to this,

post it where?

excel plots don’t appear in these comment boxes

I don’t think there is any fundamental way to measure inflation except mine

”””””””””””””””””

The real data is the nominal data, the more economists put in different hidden ways of ‘adjusting’ or ‘correcting’ to ‘real’ current dollars before graphing trends, the more muddled things become, and the harder it is to reconstruct what objective conditions existed at a given time relative to another. It’s also hard to use earlier published results because every year of publication needs another scale; an old article might show history in ‘1978 dollars’ and have even used a different method to correct 1930 prices relative to 1978 than we use now (decades ago I remember the conversion being a factor of 20-25, while today’s CPI deflator it is 14, even though inflation should have made it even larger).

They are always changing the ‘basket of goods and services’ used, perhaps because everything about quality and quantity and relative need of the component goods and services change with time. But there is no way to quantify that (except mine, a measure of how dearly humans at the time value them), nevertheless they make up some official fudge or other.

Imagine if we used the price of a desktop computer to estimate inflation since 1973 (about zero change in nominal price range, while nominal pay per hour increased by factor of 11) you’d find mean wages today up 1000%. If you used the price of computing power as the standard, you’d find salaries up by a factor of 100 million. That would be a wage / productivity coupling to celebrate as it raises all incomes uniformly across quintiles!

The point? Economists are always comparing apples to oranges when they correct ‘value’ across time using items produced in an evolving economy. Food prices are a good comparison to make if you want to judge relatively how easy it is to feed a family at some point in time, but the real cost of food in a city a century ago had to be very different when half the country’s workforce was needed to produce it, transportation and preservation of goods were incredibly difficult prospects, and each item other than bread was in relatively lower supply.

They might think production of commodities like steel and useful industrial metals is a good indicator to use as a standard across time, or gold, but nothing about these substances in themselves carries a fixed value. NASA is sending a probe to the 200 mile wide metallic asteroid Psyche, a possible target of future mining. The principle investigator mentions that the iron content alone would be valued at ten thousand quadrillion dollars or over a billion dollars per human on earth, I estimate the gold would be 100,000 times as much as has ever been mined ‘worth’ 40,000 times US GDP.

So what happens to those valuations when the metals are brought to earth. How will you judge how big the change is (except by market price and that will be constrained only by how many people and how much energy are involved in mining and transporting them to earth.

Meanwhile the materials become more useful, not less, gold nanoparticles by the ton for new technologies, etc. How much does that raise prices? We’ll only know when we see the demand and how hard people will work to buy those products.

We have air and water almost free now, despite them being the substances most important to our existence

it could be a similar situation with metals in the future.

Moon colonies will have to mine and refine all their water and air.

How much will they value them?, Can you calculate the value from their intrinsic worth? You have to see what the market price is in my universal currency: work and time that people are willing to exchange for them

Which IMO causes a structural undercounting of inflation, because it results in upward trends being removed from the data and downward trends to be included.

For example, imagine a situation where domestic help starts relatively cheap, but goes up in cost over time and washing machines are very expensive, but become cheaper over time. Then over time, more and more people will start buying washing machines instead of having domestic help & the basket of goods and services is going to be adjusted to weigh the price increases of domestic help less and those of washing machines more. So the price increases of domestic help is going to be counted less, as more people are being priced out, while the price decreases of washing machines is going to be counted more, as more people are priced in.

Yet this effect is equally going happen when people would prefer domestic help, but are priced out of having it vs them preferring washing machines. By changing the basket, the entire change to behavior is assumed to be motivated by desire, rather than people being priced out/in, so it will count changes in behavior that people are forced into due to financial reasons as changes in desire.

Of course, not changing the basket would have the opposite problem, where changes in behavior are assumed to be forced by financial reasons, rather than changed desires.

The most accurate might be to calculate both and then use these as the upper and lower bounds of actual inflation, but this would result in a huge range, probably.

They’re suggesting you post in in the “open thread” (a new one opens up roughly every few days). This is a general thread for discussing everything under the sun, more or less. You can see them in the left bar under “Recent Posts” titled (currently) “Open Thread 129.75”. If you go to Archives from the main menu bar you can also see them listed there.

Here is a link to the current one.

The overall “Productivity” increase that provides a rising standard of living is not about growing some NEW pool of money to distribute, it’s about getting more and more tangible stuff from less and less of our total potential work budget. This is clear when one looks through my filter: take mean compensation per hour as the standard by which to deflate nominal prices across time periods,

(This is not because work per se creates the value, instead, how long and hard one will work to get something indicates the current human valuation of that thing, whatever the period and context. At root, the’ cost’ of our self-generated effort is all we intrinsically possess with which to ‘pay’ for things, and naturally we don’t take that trouble unless the value received outweighs it.)

Look at agriculture: In 1930, 123 million people were fed by 30 million farmers (20% of US population) and agriculture composed ~20% of GDP. Today 330 million people are fed by less than 3 million primary agricultural workers (< 1% of population) with a much greater quantity & variety of food per person. However, these fewer farmers do not now get to split up 20% of GDP: agriculture also now represents less than 1% of GDP.

Why did the agricultural ‘wage’ decouple from productivity but stay coupled to the number of people involved? Because money is a marker for work value invested and can be traded for the tangible results of someone else’s comparable work effort invested. The way in which agricultural productivity lifts all ships is that food is now ubiquitous and super cheap in real terms (unless one insanely defines inflation to keep ‘real’ food prices constant across time, which is what the current deflators seem effectively to accomplish: i.e. defining a 1930 dime begged for a cup of coffee as equivalent to $1.50 in real 2018 dollars, when in terms of time worked to earn the dime, it is $10 such).

In parallel with the story of agricultural productivity above, US manufacturing has been generating around 3 metric tons/capita of physical output since 1947, yet the manufacturing work force has shrunk from near 30% then, to 8% now, meaning almost 4 times as much mass of physical stuff is now produced for the same number of work hours (presumably in the form of more numerous, lighter, more capable & sophisticated, devices). Comparable manufactured items are therefore now ~1/4 the 1947 price in terms of how long a consumer has to work to earn enough to buy them.

Supporting this expectation, the US chamber of commerce reports that from 1970 to 2010 manufacturing’s share of US GDP fell from 24% to 13%, (about halving) while the price of goods fell 52% relative to services (i.e., also halving, as I’d expect (USchamber.com/blog/2012/03/manufacturing).

That ‘relative to services’ used in the chamber of commerce quote is a proxy of my standard for judging inflation: if a ‘service’ always takes one person’s direct work to accomplish, while a manufactured object now takes a quarter as many people to generate, the one whose ‘real’ price has changed in the market place is the manufactured one.

The 'real' money that went to the more numerous workers in these sectors in the past now stays in the consumer’s hands, to be spent on new inducements, TVs, travel, books, lessons, music, the newest devices..

As I understand it you made 3 disputes:

1. Real wages haven’t gone up so what hocus pocus is causing a price war for talented workers to drive up wages in all industries while leaving real wages unchanged.

2. Professor and physician wages don’t appear to be skyrocketing in any public data other than the specific source they chose

3. Back of envelope calculations demonstrate college is most certainly expensive nowadays relative to current wages.

1. As many have noted, the “correction” for inflation is where thinking gets very muddy when we are attacking this problem. Inflation necessarily includes Baumol effect for many industries, since healthcare and education will be included in the CPI. I attempted to find a place that simply broke out CPI by industries but the BLS breaks it into about 5000 groups which I did not have the time to decompose inflation by each factor. The best thing I could find was Figure 1 in WATPSDH (“Why are the Prices So D*mn High”). This most certainly doesn’t tell you all the contributions and education and healthcare might be massively under weighted in CPI calculations.

For the sake of argument, assume CPI is the best we can do and Figure 1 is a good representation of the decomposition. Wages staying in line with inflation implies that you are spending an ever greater portion of your lifetime income on education and healthcare and an ever decreasing portion on microwaves and dishwashers. Thus, you would expect a 1971 worker to work 24 months (arbitrary number) and 5 months goes to college tuition, 9 months goes to appliances and 10 months goes to car payments, the 2019 worker spends 14 months on tuition, 3 months on appliances and 7 months on car payments. They are both in the same spot.

The question of whether the world is in a better place due to this is hard to answer. Costs for education and healthcare certainly are higher. People are using more healthcare and education than ever before. Those are 2 clear cut facts. However, we can attempt to use consumer behavior to guess whether people are better off on average. If this increase in cost leads to more consumption (!) either 1971 people really hated education and loved goods and 2019 people love education and hate materialism (ie preferences drastically changes) or, as T&H argue, people are maximizing their utility and buying more healthcare and education with the plunge in cost of goods. That argument might be circular but I can’t find where I can disentangle it.

Another thing to think about is college graduation is not a median good. The current state of the world is probably an improvement for those that can easily afford college and it is hopefully an improvement for those that do not purchase college but, there will most certainly be a middle zone that it is unclear, hopefully government support and financial aid makes it positive across all populations.

2. The only real reason I posted this: I found a Dartmouth 1998 factbook with comparable college professor wages by rank. (https://www.dartmouth.edu/~oir/data-reporting/factbook/1998_factbook.pdf on pages 81-83) Using the factbook in addition to chronicle.com (https://data.chronicle.com/182670/Dartmouth-College/faculty-salaries/) I estimated that these colleges had about 3.75 – 4.25 CAGR on professorial wages from 1989 -2017. ie Professor’s nominal salaries tripled arithmetically in that time period. Full professors at Dartmouth were paid 61k in 1989 and 188k in 2017.

You can also look at tuition for 1989 and it was 13k and in 2017 it was 51k. That outpaces professor’s wages (which would imply 40k tuition) but not by a lot. I am guessing there are many reasons that is not a 1-1 correlation in the additional tuition but I would honestly believe a large portion is the fact that those are sticker prices and not the actual costs each student is paying. College’s have perfect price discrimination and “tuition” is just .. well you know all that.

Let’s assume professors’ wages are a good proxy for the population of similarly educated, high ability workers. They probably pay full tuition, but they also probably have good healthcare that is not included in the wage increase.

Who would you rather be professor in 1989 getting paid 61k + whatever benefits they had or professor in 2017 getting paid 188k + current benefits?

Personally, I am willing to pay the extra 10k in tuition for myself and maybe a higher deductible on healthcare for the remainder to be spent on current goods.

Even the assistant professor wages (36k to 96k) look like a very large improvement.

3. I don’t think this is at odds with the Baumol effect. Refer to above.

Since this is a random comment on a slightly old post and it will get very few reads, I am pretty hand wavy above. If anyone presses me for details I can try to improve this.

One point on the idea that some fields, such as education, can’t make much use of technology.

When I started my academic career almost fifty years ago universities had lots of secretaries, a large part of whose job was typing and retyping the professors’ papers, exams, etc. Currently, that job has almost entirely vanished, because professors can type and use word processors. But there still seem, by casual observation, to be about as many secretaries. That suggests that what may be happening is not that technology doesn’t increase productivity in such a field but that something about the incentives results in neutralizing the effect—what I don’t know.

I had a similar thought but with a different conclusion.

Scott rules out “administrative bloat” as a driver of cost by stating that total administrative expenses, as a share of all college expenses, are about constant. But there are two things we know:

1. Technology has produced productivity improvements that should result in dramatically decreasing costs for administrators specifically (typists being one category, accountants being another, etc.) But it hasn’t. Why not? Potential answer – for every “lost” administrator due to productivity improvement, the colleges used that money to “gain” an administrator in another area (like say, the diversity bureaucracy).

2. Give that costs are rising massively, the question of “where is the money actually going?” seems relevant. If administrative costs are basically constant and if professor salaries are basically constant… well, someone is taking this money. Is it just piling up in the endowment, or what?

> 2. Give that costs are rising massively, the question of “where is the money actually going?” seems relevant. If administrative costs are basically constant and if professor salaries are basically constant… well, someone is taking this money. Is it just piling up in the endowment, or what?

I think you are assuming that the number of professors is constant. I haven’t found figures I can point to, but I was told in a recent conversation that for Williams College, the cost of administration has remained almost constant as percentage over the last 30 years, but the student to faculty ratio almost dropped in half. In 1990, there was one faculty member for each 14 students. Today, there is one faculty member for every 7 students (and I’ve seen some sources claiming it’s as low as 6).

These exact numbers may be a little misleading, as the definition of “full time faculty” appears to have changed somewhat over this time period. Still, I think this is probably the right place to be be looking: while per-faculty costs have not risen, faculty cost per student is probably significantly higher. And by extension, if the faculty to administration ratio is constant, this means that administrative cost per student is probably a lot higher as well.

Scott,

It’s very simple: when you look out the window of your parked car and see all the houses and people moving past you at a uniform speed, you aren’t parked. — You are the one who is moving!

The illusion that the costs of services rise is just due to viewing them relative to a similarly moving reference frame:

In terms of average compensation per hour (how long the average person works to pay for something) haircuts, rents, new homes, college tuition, all cost about the same in any era. It is the output of sectors with productivity growth that are continually getting cheaper.

But this is covered up by a ceaseless surge of inflation (which is actually nearly twice as big in my ‘real terms’ as economists typically assume, averaging near 5% a year since 1930).

Productivity increase means producing more output with less (or lower grade) work. Therefore the items produced become cheaper in terms of work.

In turn, prices paid for manufactured items, food, and so on, decline in terms of how long the consumer must work to buy them, because fewer man hours were used to make them. Money is basically a way that people can barter their work effort for the products of other people’s work effort. As US manufacturing requires only a quarter as many workers per ton of output in 2019 as it did in 1950 the real price of comparable items are about a quarter of what they were in 1950. Standards of living rise because we get more and more stuff for the same or less work.

As for the “paying for college” case you thought violated these rules: I think the problem must be in some inconsistent definition of salaries in the numbers you found for the two time periods:

I calculate $19,300 as the true equivalent of the 1971 four year college nominal $1410 from your link; the actual 2017 tuition was $20,100, so obviously pretty constant in terms of compensation per hour

BTW, I’m a physicist, not an economist (thus the relativity lesson at top)

I could elaborate the economics that go with this at moderate length if you are interested

(and also provide plots of prices of various things from 1929 to present or 1910 to present, corrected for my “real” wage inflation )

> I could elaborate the economics that go with this at moderate length if you are interested

(and also provide plots of prices of various things from 1929 to present or 1910 to present, corrected for my “real” wage inflation )

I’m not Scott, but if you think you have what you think is a convincing argument with plots that mainstream economists are drastically underestimating the true rate of inflation, please post it! I think it would generate lots of discussion in an appropriate Off-Topic thread.

Alright friend Nkurz,

I’ll try to offer a convincing argument that mainstream inflation adjustment must be drastically off

Two examples:

(1) How about the fact that CPI gives the equivalent modern food prices for 1930’s cities as equal to, or lower, than the price we would pay today.

And yet, 20% of the population was needed to produce that food, versus only 1% now (didn’t farmworkers then need to be paid?

he gas mileage of the tractors then was much worse than modern ones, so their fuel costs higher (and where horses were still used higher still).

Relatively profligate fuel consumption also disadvantages the 1930s food distribution system, which in every dimension was generally slower and less efficient than ours. Food refrigeration on the way to the city and in stores was, at best, primitive and spotty: much spoilage must have occurred. Yet the food is cheap according to CPI (though choices meager)

If the food was cheap, why didn’t people consume more calories and meat than has been recorded?

If there were shortages shouldn’t that have driven the prices up relatively high?

This all violates common sense!

But, the rejoinder must doubtless come:

The prices were low in CPI “2019 real dollars”, yes, but people were poorer as well by CPI so couldn’t buy it.

So what’s so “real” about this money? How is it supposed to relate to our present meaning of money?

Doesn’t this just sound like it should all be rescaled by some factor to give numbers that we would derive today in similar circumstances?

By what metaphysics do the economists know that this is the correct number to attach to money because its 1930. We couldn’t use all those old trucks and farm methods and had such prices in 2019!

(2) The average price of a new car in 1969 is found by CPI to be $23,000 while the current average price is $27,000.

However, a car in 1969 (full disclosure, my first car was a used 1969 Catalina convertible) was more massive: 4,200 lbs vs 2,800 lbs ( so more material cost) had more elaborate chrome fittings and decorations, more parts, more options, a larger more complicated engine, was built by unionized workers with higher pay and benefits with fewer robots and foreign completion to drive down prices.

So tell me again why the resulting vehicle is supposed to be even a little cheaper than today’s?

Or

If I could show my Excel plot using my patented “equal value for equal work” inflation adjustment on the data for average new car price from 1968 to present you’d see instead a gradual decrease in price (yeah! Progress does exist) from $55,000 to $27,000 now. That could explain why people own more cars per person now and use fewer car loans

So, why should I think that the conventional inflation adjustment is anywhere close to correct? By what magic can they prove that?

(BTW, Ford got his model-T down to $30,000 2018 equivalence before the model-A boosted up to $35,000 or something, so there really were cars cheaper than the 1968 ones further back in history)

PS

what’s an Off-Topic thread?

> PS what’s an Off-Topic thread?

Apparently it’s my personal and incorrect terminology. I meant that you should probably post in the most recent semi-hidden “Open Thread” as listed in the Recent Posts list in the top left of this page, currently 129.75. This post has been up for a while, and it’s possible that a post here will not be seen by too many people. A post in a more lively Open Thread will probably get more attention.

As for your actual argument, yeah, that makes sense to me! I’m not sure though how it meshes with your earlier comment that inflation is actually “nearly twice as big in my ‘real terms’ as economists typically assume”. If food and cars were the same relative price then and now, wouldn’t that make inflation between then and now just the difference in wages? Thus if they were relatively more expensive then (as your argument suggests) wouldn’t this make “real” inflation lower than economists claim rather than higher?

But I’m not really economically literate. Hopefully you’ll get a more learned critique from others in an Open Thread.

This does not appear to be the case.

https://fred.stlouisfed.org/graph/?g=ob89

Data for food prices in 1930 I do not have.

Imagine there is a particular vitamin that all people need to include regularly in their diet in order to survive. The problem is, the vitamin is produced only from the milk of a type of goat that, while once extremely common, due to climate change is now an endangered species. Furthermore, the goat only produces the vitamin in its milk during three days a year, and only if the temperature is between 67 and 72 degrees F. This places a hard cap on the amount that can be produced (just barely enough to sustain the current population).

And while technological progress has continued over the centuries at a steady pace, unfortunately, scientists have not discovered a way to synthesize this particular enzyme. In fact, it is the only thing that, strictly speaking, is necessary for survival AND has not also been easily and cheaply mass produced. For that reason, the prices of nearly all other goods and services have fallen dramatically, while the price of procuring the goat nutrient has stayed the same – and dramatically increased in terms of the percentage of income people typically pay for it.

The result of this has been that, over the years, the elite of the small country in which the goats are farmed have been able to acquire a gargantuan share of wealth, almost mythical in splendor and scale – and in order to protect their claim have used this power almost entirely to ensure their own defense, via funding of various foreign conflicts and pulling the strings in regional politics. Their most dreaded nightmare is that someone, one day, will figure out a way to synthesize their vitamin, and suddenly the entire empire will collapse in a single day. As they’ve acquired so many enemies over the years, who curse the ground they walk on as they have been forced to pay them massive tribute or face death, they know that vengeance will be fierce and unstoppable if ever, one day, they lose that power.

Eventually, they decide to make a bold move: They will sacrifice their wealth in exchange for safety, by artifically lowering the price far below what they could potentially charge for it. They still make a good, solid, and secure income from it, while also seeming like saints for doing what seems to everyone like the morally correct thing to do. And in the process they also manage to use their political influence to engineer international treaties that govern and regulate the production and distribution of the vitamin, declaring it a human right for all. They end up trading wealth for prestige.

Eventually, the vitamin finally is synthesized, but at that point no one really notices – everyone had been getting it for free anyway. The small, rich country that used to be the sole owner of something the whole world needed is still small and rich, just not blindingly rich, and not an enormous target anymore. Even though it was their only industry at the time, they used their prestige to hire, I dunno, a lot of scientists and bankers or something.

The point is, the difference in consequences with Baumol effect stuff is that, for things you can live without, it may get really unaffordable, but just becomes a luxury item anyway. What we really should be asking is why education and healthcare are getting more necessary than they were in the past.

This scenario is not at all credible. If such a goat existed, there’d be more of them than we have cows. If you come up with enough farfetched technical reasons this can’t be, the world looks so much different than it is now that there’s no analogy. Most likely you’d have a hydraulic empire.

Recently enrollment at liberal arts colleges has been plummeting, to the point of many of them going out of business, apparently because new college students are getting much savvier about what degrees are actually useful. This probably implies a meaningful increase in college productivity, because they’re delivering a more valuable product.

I grasped an intuitive understanding/metaphor for the post which I didn’t see expressed elsewhere for this effect which doesn’t help take it away from a ‘just-so’ story, but helped me engage with the concept in a more relatable way than a stringed quartet vs a construction worker.

I took the Baumol effect to treat workers like a series of buckets. The size of each bucket might change, i.e. there are more doctors or teachers than in the past, but the amount that it can contain matches demand.

Instead of being filled with non-agentic water; each bucket is filled with frogs which have limited jumping power. If the bucket is overflowing then the frogs simply don’t fit and will spill out – matching when there is oversupply and a drop in wages. Crucially though, the frogs can choose to jump out of their bucket to another bucket if they feel they can earn more there / have more room to live-better conditions in that other bucket. Workers are not equivalent and there are barriers to access, but overall the Baumol effect is to keep the frogs happy. Tadpoles get to chose, to a limited extent, which bucket they want to join. If you are poorer you might pick locksmith over roofer, if you are richer you might pick accountant over secretary.

If you’re a software engineer and earn a high salary, you’re very unlikely to jump into a crowded bucket doing another job. The cumulative effect mixes markets and agency to seek a constant labour to wages productivity coupling scenario, but I’m not sure how this links to cost as labour costs are increasingly less important in determining cost, i.e. 20% of doctor wages are what patients pay.

If the productivity etc. works out that you can earn $25/hr as a construction worker, but $30/hr doing another job which is accessible to you, then at least some frogs will jump buckets/switch until a new equilibrium is reached through wage rises and declines, or continue for a while until new demand is met, etc. with waves of new educational choices evening this out over time for those jobs with higher barriers to access.

I’m taking the Baumol explanation to treat workers like a sort of chemical equilibrium equation mixed with worker agency and is fairly agnostic to industry with the only variations being caused by protectionism, regulation, changing market conditions on their way towards new equilibria, etc.

I think this means the ‘disease’ part of the cost disease somehow relates to scale where the importance of the individual diminishes as there are more people (Black death and the Renascence caused by increased value of individuals – killing peasant farmers was tougher because you needed them more?) . If there are only 5 doctors in a 10,000 person town vs if there are 50 doctors in a 100,000 person town, then each individual doctor is less valuable/more replaceable due to scale. I think the idea is that value isn’t entirely linked to a simplistic demand/supply equation but that there is some effect to the replacebility of any given person beyond the mere fact of their wages.

We often assume a limitless supply of workers or retrained workers which is only true in the modern context. Increased numbers of people lead towards more efficient ‘sorting’ of people into jobs, but this efficiency can depress wages precisely because it is so easy to find another worker. Your supply of frogs isn’t limited to those frogs currently in your bucket, but is expanded out in a wage-depressing way to all those other unhappy frogs in other buckets. Saying there are 3 million teachers in a country and counting that as your ‘supply’ is incorrect, there is a shadow factor caused by scale/replacability/bucket jumping frogs from other fields which impacts wages. There could be 5 million or 10 million other people who might also go into teaching if their jobs get worse or if teaching gets better. This highly efficient sorting and devaluation of people has increased worker supply and decreased worker value/wages to create the ‘cost/wage’ disease?

If you don’t want to work for a certain rate, then there are 49 other doctors to take your place? Or there are 3 million other teachers to take your place. There are wage limits to how much anyone can be paid, if you are the only teacher in a town you wont be able to demand super high wages, but somehow the dilution of your value in high numbers of people collectively dilutes wages, leading to a ‘cost’ disease which could be more of a ‘wage’ disease? Baumol talks a lot about productivity, wages, and labour and a lot less about costs, so it seems like the problem is a decoupling of wages and costs – so the answer could be due to disruption in coupling coming from costs, wages, or both.

I can’t say that’s super satisfying as an explanation for cost disease (but maybe for at least part of ‘wage disease’), but I think I’m understanding the Baumol explanation via the buckets of frogs metaphor? And the absolute scale of workers which are not being counted as a ‘shadow supply’ who can switch fields/jump buckets based on perceived wage advantages in other buckets?

How much of the increase in the cost of healthcare is people having more expensive health problems (or problems that were previously untreatable but now can be treated at great cost)? I don’t remember seeing this discussed in the previous cost disease post. Are there any articles someone can link to that do [attempt to] address this?

Example: a frequently quoted stat in the UK press is that ~1/10th the NHS budget goes on complications from type 2 diabetes. Given that the prevalence of type 2 diabetes has roughly doubled over the past 20 years, wouldn’t that disease alone explain a non-trivial increase in British health spending?

While I agree with the general discussion that costs of college have gone up, we need to remember that this has not necessarily led to decreases in affordability outside of elite universities.

The below study shows that two year colleges continue to be quite affordable (less than $3k per year), especially considering the continuing increases in payoff to a good degree (outside of the humanities). In addition, many students are getting grants paid by others. And this doesn’t even count the benefits of switching to partially online degrees which MBAs seem to gravitate toward.

In most larger states, it is still possible to get a good college education for the cost of two years of community college and a transfer to two years at a state school while living with parents or friends.

https://trends.collegeboard.org/sites/default/files/college-pricing-2012-full-report-121203.pdf

Here is from the summary….

Some things have gotten cheaper. For example, pre-Internet, for Scott to write essays citing as many sources as he does, he would have had to have had multiple research assistants with access to a university or major city flagship library.

On the other hand, the basics of a bourgeois life:

– Enough higher education for a respectable white collar job

– Unrationed health care for the family

– A house with a yard in a decent school district without an onerous commute

have gotten dramatically more expensive.

One obvious explanation is that the population has grown substantially, as has the cost of desirable real estate.

There are really two ways to look at the Baumol effect: (1) changes in relative productivity in one sector vs another cause the sector with increasing relative productivity to become relatively cheaper. And (2) inflation as measured with respect to a basket of goods which have mostly become much more efficient to produce is being massively underestimated by changes in price.

It’s this second interpretation of the effect that best positions itself to explain why college appears to be much more expensive today. Real wages are nominal wages deflated by a CPI deflator, but this deflator has been computed with respect to the prices of goods that have become much more efficient to produce. If industrial farming techniques make apples easier to produce by a large amount, but we see the prices of apples go up by a small amount, we shouldn’t think inflation is low; we should think inflation is so big that it swallows up the efficiency increase in the production of apples.

If this is the case (and it is if Baumol’s effect explains the significant increase in education costs as a stagnation in efficiency, rather than a marked decrease) then the real effect we have to explain is why real wages have gone down so much in the last half century, not why healthcare and education have gotten so much more expensive. This bears directly on Scott’s post on Technological Unemployment: unemployment may not be increasing as a result of increased automation but real wages certainly are.

So violinists must be paid 5x more for the same work, which will look like concerts becoming more expensive.

Yes, and that has happened. But something else has also happened with concerts: a much smaller number of people go to them. Which means there are a much smaller number of them, and hence a much smaller number of people who can actually make their living as professional musicians, even with the salaries of professional musicians forced to keep parity with other professions.

And the thing about education and health care is that they have not experienced this second effect. The number of people going to college has continued to rise as costs have risen. The amount of health care being provided has continued to rise as costs have risen. And, as you point out, much of the cost growth cannot be linked to growth in wages and salaries anyway.

It seems to me that this can only be because education and health care are subsidized–individual people are paying less of the cost (student loans and grants, employers paying a portion of health insurance premiums–and those premiums being pre-tax, etc.). This means people will want more of these things, and it also means they can’t judge whether the things are worth what they actually cost (because the people receiving them don’t see the actual cost). This seems like an obvious recipe for increasing costs uncoupled from productivity.

Except the percentage of costs borne by consumers has increased, not decreased. This is explicitly stated in T&H figure 6.

In 1980, 50% of costs were subsidized and today 25% are subsidized.

That did NOT decrease the enrollment…

I don’t really know the Baumol effect, but if it indeed only acts on the price of labour, as your article suggests it does, then I think you’re right to conclude that it cannot explain cost disease.

On reading the article though, I did have a small niggling question about the CPI-indexing that is a common factor through these sorts of comparisons. If the CPI incorporates costs of healthcare, or other cost-disease goods such as housing, education, etc. in an inappropriate way couldn’t that throw off all of the calculations? And indeed, since it is a single number and different classes of people will definitely be buying different proportions of these types of goods, it seems like it must be a bad index for at least some significant group of people.

Baumol can act on any input used in sectors where the rate of growth of output relative to that input diverges; labor is just the motivating example. It’s fundamentally a story about opportunity cost.

Okay, I think I can imagine how it would work on an input of, let’s say, land. But how much of cost disease can be explained by Baumol operating on non-labour inputs? I’m still inclined to think that monopoly power plus financialisation contributes the greater part at this stage.

Probably very little which, I suspect, is why labor is the classic example of the effect. For the health care & education sectors, I agree that other factors (I’d genericize “monopoly power” & “financialization” as “inelastic supply” & “subsidized demand”, respectively) likely each contribute a greater share of the price increase than Baumol.

Typo: “Maybe in 1826, when factory owners were earning $1.14/hour and violinists were earning $5/hour, so no violinists would quit and retrain.” seems to be missing a primary clause. Delete the “when” or the “so”.

Also, factory workers, not owners.

More broadly, I think that the Baumol effect is less plausible for health and education than the following:

1. In both sectors, consumers have few feedback loops or good metrics for quality. Huge asymmetries of information.

2. In both sectors, there are many third party payers — government, insurance, etc.

3. In both sectors, there are huge political disincentives for the actual payers (government, insurance) to ever crack down on expenses. (You can attribute this to public choice theory, or to Robin Hanson’s theory of how expenditures here are a signal of “caring,” or whatever.)

4. In both sectors, the people who make money find ways to make their services mandatory or close to it. School attendance is literally mandatory for many years. For college, many jobs (perhaps due to signaling) make college attendance mandatory as well. For health, there aren’t as many legal mandates (other than where children are involved), but doctors and hospitals do their best to persuade people that they absolutely must have such-and-such a test, service, etc. And given asymmetries of information, plus third-party payers, this works a lot of the time.

Put all those together, and it’s a perfect recipe for inefficiency.

Then why, as another commentator points out, does veterinary care have the same cost disease as health care for humans? Or does it actually not?

I’ve never seen that evidence, but there is good evidence that things like plastic surgery and lasik have not followed this pattern.

I think it does not, especially for farm veterinary. Contrary to pet veterinary, for farm animals is no signaling and no attachment, it’s regulation and cost/benefit analysis. Regulation has obviously increased, but I doubt veterinary cost for farm animals has followed other medical expenses, it’s probably on a completely different slope.

Human and pet medicine have the “there is nothing too costly, you can not skimp on health” coupled with a largely opaque industry: As a patient, it’s difficult to have an idea of treatment efficiency, and impossible to know of practitioner efficiency. So a cost/benefit analysis is both difficult to do for psychological reasons (high personal stake) and for pratical reasons (lack of reliable information). And don’t forget that medical expenses get kind of unbounded for end of life treatments, basically it could absorbs all surplus/savings. I do not see how this could change, it’s inexorably linked to a wealthy society with low accidental death rate, and Pet-as-quasi-children status.

For education, there is the typical inefficiency of an old bureaucratic institution heavily sponsored by the state, and the fact that research is sponsored by education cost, in a way.

Absent from other western coutries, the exploding student debt in US is imho a ready to burst signaling bubble…

I had a discussion with Tabarrok on Twitter several days ago about one of these points, i.e., that salaries actually haven’t gone up very much in K-12. https://twitter.com/StuartBuck1/status/1133477305416847360 He pointed to an increase in benefits, but I said that health insurance and pensions couldn’t possibly explain the massive increase he had claimed. I also said that it was odd to pick the chart on instructional expenditures and divide it by the number of teachers, just to get a (very rough) proxy for salaries, when in fact the same government agency has been tracking actual salaries. If I were cynical, I might say that they found a way to manufacture a K-12 salary figure that showed the most dramatic and implausible increase, rather than using the actual numbers. But that might be unkind.

My impression is that public K-12 spending in California is not that high on annual costs, but in recent decades has climbed considerably for capital costs: e.g., most Baby Boomer Californians were schooled in buildings that were basically big shacks. But lately public schools have built insanely expensive edifices, like the Giant Japanese Robot from Outer Space high school pointing its flamethrower at the L.A. Cathedral across the 101.

The common denominator I see is government subsidies.

Figure 6 in T&H show that subsidies have substantially decreased for education from 1980 to today but more students are entering college.

Please explain how it is all subsidies when they decreased the subsidies, the cost went higher?

Imports are a huge factor. Thanks to cheap imports official inflation numbers are way below what they would be otherwise. If we paid American workers to make televisions, toasters, dresses, etc. the ratio of wages for medicine and education with respect to the rest of the economy would be much less dramatic.

Back in the 1970s high end department stores sold dress patterns along with fully assembled clothes. Upper middle class people (like lawyers) still felt the bite from the cost of buying clothes. This is also why clothing stores weren’t self service: they were more expensive relative to local wages.

Factory wage earners compete with cheap imports to sell their labor. Their wages have been driven down with respect to professionals which aren’t outsourceable.

This is why they are angry enough to vote for Trump.

(And many of them were angry enough to vote third party when H. Ross Perot ran.)

—

BTW, if we have “free trade” then imports don’t get taxed. We thus tax domestic labor to pay for the government services by the cheapened domestic laborers who must now depend on the government to pay for local professional services. The cheap merchandise at Wal Mart is subsidized by the tax system/welfare state.

It’s hard to take theses like this very seriously.

String quartets are selling an inferior good versus a DJ with a pile of digital songs and a decent sound system. People want to dance to a variety of music that a string quartet can’t create.

Academia and health care are two of the most (self) regulated industries in America.

Music and professional cartels are hardly related in either barriers to entry or demand.

Certain economists will argue that this is all part of a grand objective reality that means teachers should be poor and bankers rich because of “productivity.” I was a banker, and wouldn’t even try to say that with a straight face.

String quartets are selling an inferior good versus a DJ with a pile of digital songs and a decent sound system.

says who

It’s surely not just baumol. Also the more you have to dpend the more useless stuff you buy.

Civil service policy. Our policy making hasn’t gotten better but our publications are better produced and we spend more on consultants to provide “evidence” for whatever we were going to do anyway.

I use a $10/mo phone. It allows text and has an internet connection. The phone itself cost about $50.

Doesn’t Baumol’s disease say that it is just as affordable if the cost in time of everything else he used to buy has gone down in total cost by fourteen months?

This made me wonder if we simply ignoring things that aren’t subject to Baumol effects.

For example in education, Duolingo provides a basic introduction to language learning to people all over the world at essentially zero marginal cost. Wikipedia and Google and MOOCs make it easier to learn things then ever if you are sufficiently dedicated. Sure there are things that having an actual teacher do which are impossible to replace, but a surprising amount of instruction is available for free.

Likewise, live music is more expensive than ever, but recorded music is almost too cheap to meter (and the costs we do pay are only due to government intervention, rather than technical limitations)

Wage stagnation is a myth. Three reasons explaining this:

1) Most charts only take into account money wages, not total compensation. Benefits have risen very substantially in the last 40 years.

2) Comparing the 70s to today does not take into account the much better quality of today’s products.

3) The Consumer Price Index (CPI-W) overstates inflation and understates real compensation.

Here is a good overview from last month: https://www.wsj.com/articles/the-myth-of-wage-stagnation-11558126174

@ConnGator

I still get the Journal delivered. I read that article by Phil Gramm and John Early. I would like to believe in a world where it was true but as far as I can tell its bunk. Their article opens with:

I am reminded of the joke about the wife who comes home to find her husband in bed with another woman. The husband insists he’s innocent: “Who are you gonna believe, me or your lyin’ eyes?”

I started working in construction as a teenager between stints at college in the late 1980s. Real wages today in construction are far less. Obviously some other industries have fared somewhat better, others not. My mother is a PhD psychologist. Since I was a kid through today wages in her field have risen several fold in dollar terms 3 to 4 times. But price levels have gone up by a 7 to 8 times.

I am going to believe my lyin eyes over Gramm and Early.

That’s a horrific mistake

See https://slatestarcodex.com/2019/02/25/wage-stagnation-much-more-than-you-wanted-to-know/ .

Benefits are mostly irrelevant. CPI considerations are relevant, but wouldn’t they be equally relevant in discussing eg the cost of health care?

Scott, in that Feb 25 2019, post seems to have landed in the middle: that wage stagnation is not a myth, but is being exaggerated:

“Contrary to the usual story, wages have not stagnated since 1973. Measurement issues, including wages vs. benefits and different inflation measurements, have made things look worse than they are. Depending on how you prefer to think about inflation, median wages have probably risen about 40% – 50% since 1973, about half as much as productivity.”

Regarding the degree to which wages have lagged behind productivity, Scott concluded that about half of the effect is a matter of how increases are wages is being distributed:

“This leaves about a 50% real decoupling between median wages and productivity, which is still enough to be serious and scary. The most important factor here is probably increasing wage inequality.”

If I’m understanding his conclusions section correctly, Scott’s literature review concluded that only a quarter to a third of the wages lag is actual as opposed to being a matter of distribution. Right?

A couple points on affordability:

(1) The Baumol effect would only have affordability remain constant if the quantity demanded was also constant. In education and health care, this is not the case. In education this is easier to see as we send an order of magnitude more people to college than we did in 1970. Notwithstanding that, I don’t think affordability has changed much for the marginal student. Sure, with ten times as many people competing and fixed places at Ivy League schools, they have gotten more expensive. I don’t see any evidence that community college — where the marginal college student is — is less affordable.

(2) Similarly, Baumol effect would only maintain relative affordability if labor productivity growth were evenly distributed with who is doing the consuming. That’s a reasonable assumption for say, haircuts, but not for education and health care. The substitute occupation for a college professor may be say, finance, where productivity is increasing strongly. But at the same time, the productivity in industries where the average person paying for college works may not be going up. There isn’t a necessary correlate between the two.

Also note that there is not really a conflict between other explanations and the Baumol effect. For example, administrative bloat may be the reason why education productivity is not increasing at the same rate as other industries. The Baumol effect is agnostic to what the cause of the differences in relative productivity are.

There’s a lot of overcomplication in a lot of the discussion.

Starting from a normal market (downward-sloping demand, upward-sloping supply), Baumol is merely a description of a situation in which opportunity cost increases due to increased productivity elsewhere, thereby shifting the supply curve left. P goes up, Q goes down ceteris paribus.

That last is relevant for health care & education. Effective subsidization in these sectors simultaneously shifts the demand curve to the right. P goes up, Q goes up.

Throw in highly inelastic demand, and you see P going up a lot and Q moving indeterminately.

Finally, P is total cost (i.e., compensation); if the composition of individual compensation is shifting over time (which health insurance’s growing share of labor costs drives), isolating a single component (e.g., salary) will provide a biased estimate of effects.

@Ghillie Dhu

Where did you get your masters degree?

@Ghillie Dhu

From our last discussion on the topic:

Fair enough. Then I shall define Proper Wage. Then such thing will exist.

Proper Wage: A wage rate mutually agreed upon by buyer and seller of some service for some period of time whereupon each party is maximally wealthier at the end of said period of time. In mathematical terms, of the set of all possible wages select the wage that maximizes the wealth gain of all parties to the contract.

As an example of Not Proper Wages, see the Soviet Union where workers joked “We pretend to work and they pretend to pay us.” Also see most wages paid in Venezuela today.

Previously you used “proper” normatively (i.e., coupling it with “should”); providing a positive definition for “proper wage” is an attempt to hide the ball.

Good day sir.

Given the society that I was raised in, there did exist a pattern of wage rates relative to the size of the economy. One could certainly say that the continuing pattern was ‘normative.’ That pattern ended in 1972 [Bureau of Labor Standards] or 1973.

Of course it must be naive of me to think that discussing such is the game in play here. You have indeed bested me in comedy.

Thanks for providing this, Alchemist.

A question though…. Why are you restricting a proper wage to “each party being maximally wealthier?”. Maximumly wealthier compared to what? Does this include (is it net) the costs of research to determine what is maximum?

Seems that a better and more useful definition would be a wage rate mutually agreed to by both parties subject to (relatively) free entry and exit into the market. This ensures win win interactions, and minimizes rent seeking and exploitation.

Correct me if you think I am missing or misunderstanding anything.

That is a very good start, and in line with classical liberal theory. But it turns out to be not enough.

tldr: Employees use historical data of the cost of living, subtract it from a wage offer to see what’s left over, and then decide what wage to accept for the future. If the government lowers the value of money in between the months in the past that tell the person what the cost of living is, and the months in the future when they get paid and have to make mortgage payments, then people get less than they expected to out of the bargain. If inflation is 2% annually that seems like no big deal compared to all of the other uncertainties in life. But it adds up and worse, it compounds over time.

Under a gold standard there were periods of some inflation, and mostly slight deflation as the economy grew faster than the money supply. Now we have always inflation. Economists are very happy to make the calculations that you see in their charts “in 2019 dollars” or “in constant dollars.” All of the ordinary people deciding whether or not to accept a job/salary offer do not include the 3.87% inflation compounded annually in their calculations. Because inflation always works against them, there is a constant drift toward lower wages. Year in and year out. A few percent here, a few percent there. This shows up very clearly in the data, as shown throughout this discussion. Gramm and Early have their heads in the sand. They don’t want to see it. The implication could be that they are doing a bad job, and that would feel bad to them. So their brains simply ignore the data.

Alchemist,

We were discussing the definition for a “proper wage”, and for some reason you go off on a tangent on the effects of inflation on wage rates. Honestly, I have no idea why.

Swami,

Questions are helpful. Thanks.

So we have a definition, the interesting question is how does society go about discovering what wages should be?

The mechanism we have developed is the market. Markets exist for price discovery. All of the participants get a vote. And some consensus developes as to what the answer is to the question ‘what is the proper wage?’

The reason that I keep ranting on about inflation is this: Consistent inflation of the money supply over time breaks the wage market. The effect is very strong and very striking and it stands out clearly in the data. The details of how this happens are perhaps a distraction, but I offer them up in support of the notion that the well observed correlation between inflation of the money supply and stagnated wages is there for us to see because the former causes the latter.

Huh? Didn’t you mention Baumol in your initial post on this? Didn’t many people reply saying, “It’s Baumol”? Not to be too self-focused here, but this includes me.

Real wages have gone up. The widely quoted factoid to the contrary refers to median wages. Admittedly wages have increased less than GDP. Partly this is due to increases in other forms of labor compensation, but not all. Probably the best metric here is the labor share of income, which has declined a bit.

By the way, take a look at costs of veterinary care. Much less regulated, little insurance, and costs have mostly tracked human medicine.

Re: SMBC: most classes aren’t taught by adjuncts, and those that are (e.g. community colleges) are pretty cheap.

This is partly explained by rising inequality.

Well, I certainly wouldn’t want to be responsible for doing that!

The point of SMBC was to highlight that hiring 3 full time PhD students to tutor you was cheaper than college tuition.

Also a cool cat on top of the tutoring.

@Eponymous

You’re on the right track 😉

The first chart you point to https://fred.stlouisfed.org/series/COMPRNFB

shows the very real inflection point in wage growth that occurs in 1973. The US dumps the gold standard completely.

I have some criticisms of the methods used to calculate ‘real wages’ by the bureau of labor statistics in the last few decades, but the data is still clear. Wage growth has stagnated.

64% to 57% is not what I would describe as “declined a bit.” 7% of GDP is real money.

Also the effect compounds. Some portion of that 7% gets reinvested and leads to further year over year gains.

Owners of capital generally reinvest income and become even wealthier. Either because it is in their nature (See Warren Buffet) or because they simply can’t spend money on consumption fast enough to become poorer (See Bill Gates, Rockefeller &c.) Usually it takes a few generations to spend off the accumulated wealth. Picketty was correct in the sense that wealth can accumulate at the expense of the working class. He just has no understanding of the mechanisms that lead this. (Picketty enjoyed great success selling books and lecturing, so I won’t call him dumb. And he wrote for an audience that is not numerate. He himself may or may not be numerate. His theory is hogwash.)

Actually, this IS rising inequality. A few people have no problem affording university educations. They can even afford a few extra hundred k $$ to get their moron offspring through the admissions process.

The operative word here is completely, in 1973 the major change was to make previous changes permanent. Claims that only this last step should be viewed as causal here are very suspicious as the US took multiple major, and arguably larger, steps along the way. The US abandoning the standard in 1973 was also driven by economic conditions in the world, and viewing it as causal is suspect on its own.

GDP has risen by way more than 7% across that period though, nor is there anything special about 1973 as an inflection point for labor share of income.

The violinist as Baumol example bothers me because it ignores a different but highly-relevant demand curve: the demand to be a professional musician.

It is a widespread lament in the contemporary American arts sector that “nobody but the stars can make a living wage anymore”. Everyone has stories of their uncle or whoever who, during the mid-20th century, made a solid middle-class living as a musician or stage actor or set designer or whatever. Whereas today in every sizeable performing-arts local economy (NYC, Chicago, Seattle, Bay Area, etc) the actual wages offered to the thousands of “working artists” who haven’t yet “hit it big” are lower (in real dollars) than they were in 1980 or 1950 or whatever. Mostly a _lot_ lower.

It’s not a matter of reduced audience demand: Broadway keeps setting new attendance records for itself, Chicago’s live-theater sector is vastly larger than it was in 1980, there are far more professional dance performances today than a few decades ago, there are today 200 salary-paying symphony orchestras in the U.S. compared to 10 in 1950, etc etc. Americans for the Arts’ annual data survey is full of statistics like that. And yet all those big cities are today full of hordes of highly-trained highly-skilled performing artists who are patching together a living with teaching or “day jobs” or temping or whatever in addition to their actual performing. If anything those hordes seem to be growing, and spreading to more and smaller cities. Huh?