Philip Tetlock, author of Superforecasting, got famous by studying prediction. His first major experiment, the Expert Political Judgment experiment, is frequently cited as saying that top pundits’ predictions are no more accurate than a chimp throwing darts at a list of possibilities- although Tetlock takes great pains to confess to us that no chimps were actually involved, and this phrasing just sort of popped up as a flashier way of saying “random”.

Although this was generally true, he was able to distinguish a small subset of people who were able to do a little better than chance. His investigation into the secrets of their very moderate success led to his famous “fox” versus “hedgehog” dichotomy, based on the fable that “the fox knows many things, the hedgehog knows one big thing”. Hedgehog pundits/experts are people who operate off a single big idea- for example, an economist who says that government intervention is always bad, predicts doom for any interventionist policy, and predicts great success for any noninterventionist one. Foxes are people who don’t have much of a narrative or ideology, but try to find the right perspective to approach each individual problem. Tetlock found that the hedgehogs did worse than the chimp and the foxes did a little better.

Cut to the late 2000s. The US intelligence community has just been seriously embarrassed by their disastrous declaration that there were weapons of mass destruction in Iraq. They set up an Intelligence Advanced Research Projects Agency to try crazy things and see if any of them worked. IARPA approached a bunch of scientists, handed them a list of important world events that might or might not happen, and told them to create some teams and systems for themselves and compete against each other to see who could predict them the best.

Tetlock was one of these scientists, and his entry into the competition was called the Good Judgment Project. The plan was simple: get a bunch of people to sign up and try to predict things, then find the ones who did the best. This worked pretty well. 2,800 people showed up, and a few of them turned out to be…

…okay, now we’re getting to a part I don’t understand. When I read Tetlock’s paper, all he says is that he took the top sixty forecasters, declared them superforecasters, and then studied them intensively. That’s fine; I’d love to know what puts someone in the top 2% of forecasters. But it’s important not to phrase this as “Philip Tetlock discovered that 2% of people are superforecasters”. This suggests a discontinuity, a natural division into two groups. But unless I’m missing something, there’s no evidence for this. Two percent of forecasters were in the top two percent. Then Tetlock named them “superforecasters”. We can discuss what skills help people make it this high, but we probably shouldn’t think of it as a specific phenomenon.

Anyway, the Good Judgment Project then put these superforecasters on teams with other superforecasters, averaged out their decisions, slightly increased the final confidence levels (to represent the fact that it was 60 separate people, all of whom were that confident), and presented that to IARPA as their final answer. Not only did they beat all the other groups in IARPA’s challenge in a landslide, but they actually did 30% better than professional CIA analysts working off classified information.

Having established that this is all pretty neat, Tetlock turns to figuring out how superforecasters are so successful.

First of all, is it just luck? After all, if a thousand chimps throw darts at a list of stocks, one of them will hit the next Google, after which we can declare it a “superchimp”. Is that what’s going on here? No. Superforecasters one year tended to remain superforecasters the next. The year-to-year correlation in who was most accurate was 0.65; about 70% of superforecasters in the first year remained superforecasters in the second. This is definitely a real thing.

Are superforecasters just really smart? Well, sort of. The superforecasters whom Tetlock profiles in his book include a Harvard physics PhD who speaks 6 languages, an assistant math professor at Cornell, a retired IBM programmer data wonk, et cetera. But the average superforecaster is only at the 80th percentile for IQ – just under 115. And there are a lot of people who are very smart but not very good at predicting. So while IQ definitely helps, it isn’t the whole story.

Are superforecasters just really well-informed about the world? Again, sort of. The correlation between well-informedness and accuracy was about the same as the correlation between IQ and accuracy. None of them are remarkable for spending every single moment behind a newspaper, and none of them had as much data available as the CIA analysts with access to top secret information. Even when they made decisions based on limited information, they still beat other forecasters. Once again, this definitely helps, but it’s not the whole story.

Are superforecasters just really good at math? Again, kind of. A lot of them are math PhDs or math professors. But they all tend to say that they don’t explicitly use numbers when doing their forecasting. And some of them don’t have any kind of formal math background at all. The correlation between math skills and accuracy was about the same as all the other correlations.

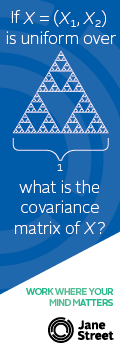

So what are they really good at? Tetlock concludes that the number one most important factor to being a superforecaster is really understanding logic and probability.

Part of it is just understanding the basics. Superforecasters are less likely to think in terms of things being 100% certain, and – let’s remember just how far left the bell curve stretches – less likely to assign anything they’re not sure about a 50-50 probability. They’re less likely to believe that things happen because they’re fated to happen, or that the good guys always win, or that things that happen will necessarily teach a moral lesson. They’re more likely to admit they might be wrong and correct themselves after an error is discovered. They’re more likely to debate with themselves, try to challenge their original perception, start asking “What could be wrong about this thing I believe?” rather than “How can I prove I’m right?”

But they’re also more comfortable actively using probabilities. Like my predictions, the Good Judgment Project made forecasters give their answers as numerical probability estimates – for example, 15% chance of a war between North and South Korea in the next ten years killing > 1000 people. Poor forecasters tend to make a gut decision based on feelings that superficially related to the question, like “Well, North Korea is pretty crazy, so they’re pretty likely to declare war, let’s say 90%” or “War is pretty rare these days, how about 10%?”. Superforecasters tend to focus on the specific problem in front of them and break it down into pieces. For example, they might start with the Outside View – it’s been about 50 years since the Koreas last fought, so their war probability per decade shouldn’t be more than about 20% – and then adjust that based on Inside View information – “North Korea has a lot fewer foreign allies these days, so they’re less likely to start something than they once were – maybe 15%”.

Or they might break the problem down into pieces: “There would have to be some sort of international incident, and then that incident would have to erupt into total war, and then that war would have to kill > 1,000 people. There are about two international incidents between the Koreas every year, but almost none of them end in war; on the other hand, because of all the artillery aimed at Seoul, probably any war that did happen would have an almost 100% chance of killing > 1,000 people” … and so on. One result is that while poor forecasters tend to give their answers in broad strokes – maybe a 75% chance, or 90%, or so on – superforecasters are more fine-grained. They may say something like “82% chance” – and it’s not just pretentious, Tetlock found that when you rounded them off to the nearest 5 (or 10, or whatever) their accuracy actually decreased significantly. That 2% is actually doing good work.

Most interesting, they seem to be partly immune to cognitive bias. The strongest predictor of forecasting ability (okay, fine, not by much, it was pretty much the same as IQ and well-informedness and all that – but it was a predictor) was the Cognitive Reflection Test, which includes three questions with answers that are simple, obvious, and wrong. The test seems to measure whether people take a second to step back from their System 1 judgments and analyze them critically. Superforecasters seem especially good at this.

Tetlock cooperated with Daniel Kahneman on an experiment to elicit scope insensitivity in forecasters. Remember, scope insensitivity is where you give a number-independent answer to a numerical question. For example, how much should an organization pay to save the lives of 100 endangered birds? Ask a hundred people, and maybe the average answer is “$10,000”. Ask a (different group of) a hundred people how much the same organization should pay to save the lives of 1000 endangered birds, and maybe the average answer will still be $10,000. So it seems you can get people to change their estimate of the value of bird life just by changing the number in the question. Poor forecasters do the same thing on their predictions. For example, a hundred poor forecasters might on average predict a 15% chance of war in Korea in the next five years, and a different group of a hundred poor forecasters might on average predict a 15% chance of war in Korea in the next fifteen years. They’re ignoring the question and just going off of a vague feeling of how likely another Korean war seems. Superforecasters, in contrast, showed much reduced scope insensitivity, and their probability of a war in five years was appropriately lower than of a war in fifteen.

Maybe all this stuff about probability calibration, inside vs. outside view, willingness to change your mind, and fighting cognitive biases is starting to sound familiar? Yeah, this is pretty much the same stuff as in the Less Wrong Sequences and a lot of CFAR work. They’re both drawing from the same tradition of cognitive science and rationality studies.

So as I said before, Superforecasting is not necessarily too useful for people who are already familiar with the cognitive science/rationality tradition, but great for people who need a high-status and official-looking book to justify it. The next time some random person from a terrible forum says that everything we’re doing is stupid, I’m already looking forward to pulling out Tetlock quotes like:

The superforecasters are a numerate bunch: many know about Bayes’ theorem and could deploy it if they felt it was worth the trouble. But they rarely crunch the numbers so explicitly. What matters far more to the superforecasters than Bayes’ theorem is Bayes’ core insight of gradually getting closer to the truth by constantly updating in proportion to the weight of the evidence. That’s true of Tim Minto [the top superforecaster]. He knows Bayes’ theorem, but he didn’t use it even once to make his hundreds of updated forecasts. And yet Minto appreciates the Bayesian spirit. “I think it is likely that I have a better intuitive grasp of Bayes’ theorem than most people,” he said, “even though if you asked me to write it down from memory I’d probably fail.” Minto is a Bayesian who does not use Bayes’ theorem. That paradoxical description applies to most superforecasters.

And if you’re interested, it looks like there’s a current version of the Good Judgment Program going on here that you can sign up to and see if you’re a superforecaster or not.

EDIT: A lot of people have asked the same question: am I being too dismissive? Isn’t it really important to have this book as evidence that these techniques work? Yes. It is important that the Good Judgment Project exists. But you might not want to read a three-hundred page book that explains lots of stuff like “Here’s what a cognitive bias is” just to hear that things work. If you already know what the techniques are, it might be quicker to read a study or a popular news article on GJP or something.

“So as I said before, Superforecasting is not necessarily too useful for people who are already familiar with the cognitive science/rationality tradition, but great for people who need a high-status and official-looking book to justify it.”

This is how I felt about Bostrom’s book.

I read Superintelligence after being immersed in LW for over a year and I certainly didn’t share your feeling, I think that it’s excellent and informative.

Updating based on evidence and avoiding simple biases like anchoring or scope insensitivity is first, a very basic of the sequences and second, something that you could have heard from any number of other sources from Kahnemann to Silver.

In contrast, the specific details of various AI development/control/alignment approaches are something that LW gives only a vague and one-sided idea of and something that you can’t really find compiled anywhere else. To put it in Tetlock’s terminology: Superintelligence is a fox book, it teaches you about a whole lot of things, more things than I thought could even be relevant to SAI.

(Typo: “Superforecasters, in contrast, showed much reduced scope sensitivity” — they’re more scope sensitive, less scope insensitive.)

Warning: mostly nonsense.

“So as I said before, Superforecasting is not necessarily too useful for people who are already familiar with the cognitive science/rationality tradition, but great for people who need a high-status and official-looking book to justify it.”

So, Tetlock looks at the world and sees how to actually work with it, the rationalists sit back and revel in fanfiction and fandom, lolololol.

That said, I wonder if there are any weirder cultural affinities of superforecasters. What sort of music to they like? What books do they read? What cultures did they grow up in, or are descended from? Do superforecasters peak at a certain age? Are they nerds, or physically fit and mentally healthy? I suppose I should read the book.

Followup thought, can you do this in reverse, have them predict history?

“What’s the probability that North Korea attacked South Korea in the last 50 years?”

It depends on what you mean by “attacked”.

From what I remember they were older and well educated. He mentioned some of them having a decent amount of time on their hands but I’m not sure how that generalized to all the super forecasters. The impression I got was they were basically older nerds.

So you do know that aside from one guy writing fanfiction, there was the entire Less Wrong Sequences which was hundreds of posts attempting to synthesize and build upon the cognitive science literature, plus CFAR, plus…eh, I don’t even know why I bother with you people anymore.

I was kidding, come on, I read “The Sequences” before HPMOR was a thing (there was a lot of nerdiness there too, though), I enjoy fandom, I lurked LW, unrepentant, etc. “Warning: mostly nonsense?” and I followed it with “lolololol”. Banter!

(also being provactive gets responses to the other questions, ideally)

Kicking people in the shins probably also gets responses. It might even start an interesting conversation occasionally. I would still generally prefer it not to be done.

Prior updated: can dish out, but can’t take.

What do you mean by “dish out” here?

What exactly do you consider that I’ve dished out but can’t take? (It sounds like you haven’t noticed I’m not the same person as Scott, though actually I think my question would be reasonable even if I were.)

Insults can hurt. Keep that in mind next time.

If you are attempting self-deprecating humor, a minor change in phrasing like saying “we rationalists” might do wonders to make your meaning clear instead of making it seem like a attack.

Insults can hurt? What’s insulting is:

“So as I said before, Superforecasting is not necessarily too useful for people who are already familiar with the cognitive science/rationality tradition, but great for people who need a high-status and official-looking book to justify it.”

because it alleges that only lesser nerds need status, and us True Geeks know the score before it was cool. This is an incredibly stupid and damaging way of looking at the world, a classic nerd failure mode, and everytime nerds sneer at those of high status they emphasize their own weakness and make their situation worse.

honestlymellowstarlight, I think you have misunderstood the sentences you are quoting.

They are not talking about two groups of people and saying one is superior. The second group is the subgroup of the first that wants help sharing their knowledge with others in a particular way.

They are saying: if you’re already familiar with this way of thinking, you probably won’t find anything new TO YOU, but you may find an easily-presentable-to-other-people summary of things you know.

I am curious why you jumped straight to your “insult” interpretation. I don’t even see any derogatory language in there at all. Are you interpreting the tone as sarcastic?

honestlymellowstarlight, I have no idea how you managed to read an insult or a sneer into that sentence, and I would not bet money that you’re not just trolling us even more, just finding more and more ways to insult and distract.

So this post is my final response to you: Stop insulting people, and I suggest that you’re not so quick to find an insult in what another says, but if you’re indeed actually insulted by something, then fucking COMMUNICATE THAT (as we’re trying and seemingly failing to do with you), just in case, you know, no insult was meant.

But as I said I have no idea if you’re being sincere or trolling, but if you’re trolling stop that too. It’s bad, ‘kay?

Sean, I think he (probably he) interpreted the word “need” to mean “should not actually need,” because that does seem like common usage on the Internet. Here it seems like the exact opposite of the intended meaning, but that may not be obvious to someone unfamiliar with Scott.

Note that Scott is also a political dirty-tricks expert and may in fact have a sinister motive for writing statements with double meanings; but this would still be incompatible with starlight’s reading of the situation.

While I can’t get mad at some good old banter, your comment mapped really well to a certain internet demographic that’s been generally pretty awful to scott and pals, which might be why they weren’t too receptive of your joke.

Between this comment and Scott’s “you people”, I’m really (genuinely) interested what Persecuting Outgroup I’m apparently a part of.

Well, I don’t know who Scott’s talking about, but what I mean is… well, I’m not sure it’d be accurate or fair to talk of a group, but I think “The Rationalwiki Crowd” kind of summarizes the type of people I mean.

EDIT: Or maybe the “SA PYF crowd”, I think there’s a whole bunch of overlap (they styles are strikingly similar), but I don’t want to start assuming things.

Yudkowsky calls them haters and sneerers.

Flipping out at your hatedom never ends well, even when they’re being unreasonable. There are more of them, and they’re better at making you look stupid than you are them, because this is what they do for fun and so they have more practice. I wish Eliezer understood this.

(But maybe I’m interrogating the text from the wrong perspective.)

Hell, even Scott has this problem sometimes, and I think Scott’s a lot better at navigating these waters than Eliezer is.

same

Can’t help but smile at the people who used to badmouth trolls and write about how pacifism was killing their gardens or whatever now getting what they deserve.

“Yudkowsky calls them haters and sneerers”

Yudkowsky’s reaction to humorists and critics may not be optimal.

Humor on the internet and via purely text is weird. I’ve seen several other people make jokes while trying to be friendly towards the rationalist, LW, and SSC crowds and it often just doesn’t work as intended unless it’s an awkward pun.

Sometimes it falls flat and other times it blows up in the person’s face. Someone ends up getting offended, states it publicly, and then the good-intending jokester gets stuck in a position of having clashed a portion of the group in unintended ways. (At which point I hope they just update their expressions of humor slightly to fit the group better rather than get pushed away.) I think the cultures are just missing an element of humor mores that many/most other cultures possess.

Puns are often the exception to this.

(At which point I hope they just update their expressions of humor slightly to fit the group better rather than get pushed away.)

Why wouldn’t you hope for option 3: a change in the culture? (Or is such hope futile?)

Don’t bother. Just ban!

Actually, it would be nice to see periodic feedback from the commentors on whether bans are too common or too uncommon.

My experience says that they are almost always too uncommon.

I too support blanket bans by ingroups of outgroups, especially if “you people” is invoked. Trigger warning: meant seriously!

Most likely too uncommon here. Definitely too uncommon on LW in the past. I also think that proactive bannings are important for a healthy and vibrant internet community.

Sidenote: I think honestlymellowstarlight was attempting humor that didn’t work out well. I read the sentence, “So, Tetlock looks at the world and sees how to actually work with it, the rationalists sit back and revel in fanfiction and fandom, lolololol.” as contrasting two groups who are doing the same thing but then get accused of having massively different statuses and connotations culturally when they obviously shouldn’t. Then again, I very well may be steelaliening him.

I was using intentionally abrasive humor to demonstrate the weird relationship the LW community has with the idea of status, as per my other comments. But it’s not as visceral when I say it like that, which is also part of the point.

(My dearest hope was that someone would attempt to steelman my original post, and I am happy at least one person mentioned it explicitly.)

The post claims zie was “just joking” but remains rather hostile. The poster also made a strange comment about Scott being insulting. I doubt there is a good “culture fit” between the “joking” poster and SSC.

This poster, zie has a name, you know. “Banter” is not “just joking”, “confrontational” is not “hostile”, these distinctions are important, think about it a little more.

We’re already under a Reign of Terror, we hardly need to add lynching mobs to the mix.

There’s a REIGN OF TERROR going on?? How did I miss this???*

OK, I know how I missed. Still curious, though.

I am not going to pretend I wouldn’t be happy to see mellow go.

If you go around being a hostile, aggressive, “confrontational” poster you should expect people to express their displeasure.

TBH, there have been many hostile, aggressive, and confrontational posters toward whom no one has expressed anything approaching pleasure. But, people get singled out seemingly at random, depending on who they happen to rub the wrong way.

Beware the fundamental attribution error. Right now honestlymellowstarlight had made a post people are objecting to and is defending themself. In a less confrontational context they may make valuable contributions.

If Scott were trustworthy to ban the right people they’d be way too uncommon, but given Scott as the flawed human he is I’d say they’re just about right.

If Scott were to be appointed government czar of all message boards, maybe. But given that the whole reason I come here is that I enjoy his insight and trust his judgment, I support him banning whoever he wants.

That being said, I think the situation is pretty reasonable. I can’t really think of any problem people who need to be banned. And the people he does ban pretty much have it coming.

I guess the bigger problem is this place turning into a conservative and libertarian echo chamber. I mean, I’m a libertarian myself, but a large part of the reason I come here is to hear from sensible members of the left. I don’t know that this is happening for sure, and I wouldn’t know what to do about it without making thing worse, but it would be unfortunate.

In college, I was part of a great debate club that used to have a fair number both of conservatives and of relatively far-left people. But by the time I graduated, it was completely dominated by “establishment liberal”, center-left Hillary Clinton types. They were nice people and objectively more reasonable than the far-left ones, but it made things a lot less interesting.

I agree with Vox. I’m right-wing myself, and the main appeal of this place was one with honest, intelligent liberals and leftists who actually treated conservatives as human beings with opinions, rather than Orcs needing only to be crushed.

Now, though, a lot of those leftists are disappearing, and I’m losing that really valuable perspective.

@ Vox Imperatoris

Hey Vox, I just wanted to say — “a reasonable objectivist*” used to be an oxymoron to me, but you have changed that. Thanks.

(* I don’t know if you identify as an Objectivist, but you seem close to that cluster in terms of… intellectual background? — so I hope this approximation is OK with you.)

@ Nita:

Thank you!

I do “identify” as an Objectivist, of the Atlas Society inclination. Unfortunately, there are a lot of unreasonable Objectivists out there.

One of the most interesting things I’ve read in this regard is Nathaniel Branden’s essay “The Benefits and Hazards of the Philosophy of Ayn Rand”. It is interesting in that he retains a fundamentally positive outlook on Objectivism, despite his acrimonious personal relationship with Ayn Rand. But he points out several areas in which Rand’s intellectual style and outlook set a bad example—in a way that runs counter the fundamental elements of the philosophy.

I thought the comment was perfectly fine for a public forum, but perhaps not for the comment section of a private blog (in the vein of “don’t walk into someone’s house and insult the host before you’ve taken your shoes off”).

I’m not sure which this comment section is. Certainly the open threads are more like a public discussion forum for an online community.

This is more or less the perspective I’m coming from:

http://fredrikdeboer.com/2014/06/10/did-nir-rosen-deserve-an-expectation-of-privacy-on-twitter/

>Actually, it would be nice to see periodic feedback from the commentors on whether bans are too common or too uncommon.

Bans have been more common than before the reign of terror, which I don’t like. But what I really don’t like is the higher rate of indefinte (permanent, in practice) bans.

Actually, it would be nice to see periodic feedback from the commentors on whether bans are too common or too uncommon.

I don’t think that SSC can remain viable in the long run without either more hands-on moderation than Scott can afford given that he has a day job, or frequent banning (and, yes, arbitrary permabanning) of commenters that would otherwise make hands-on moderation a particularly tedious and unwelcome task.

I can’t see a credible alternative to either the Reign of Terror or the end of SSC in anything like its present form, and I would prefer the Reign of Terror. I haven’t seen anything so far that would suggest it is excessive or substantially mistargeted in its application

Cosigned in every detail.

What do you mean by “remain viable”?

Less seriously but for the record, I am also pro-Reign of Terror, and only mostly because of the name.

In other words, the Superforecasters are the people who did their homework.

No, reading up on the conflicts involved had some effect, but no more than other things like high IQ and numeracy, and less than a generally good understanding of probability.

In other words, they study smarter and not harder.

I strongly prefer the specifics described in the main post over the ambiguous-to-the-point-of-being-impossible-to-correctly-interpret “smarter and not harder”.

Doing homework also takes the form of being willing to calculate the probabilities instead of guessing. It looks like the non-superforecasters didn’t bother doing that.

Sort of. I don’t think of this as “doing homework” in the sense of working at the same thing harder, or even more formally. I think of it as a completely different thought process. I’m not sure if the sort of thing I’m doing is the same sort of thing they’re doing, but if it is, I can do it (badly) in my head in a couple of seconds. Its quick-and-dirty form is as simple as saying “It’s been 60 years since the last Korean War, so if nothing’s changed maybe the probability of a Korean War per year is somewhere on the order of 1/60. Certainly not 1/6 or 1/6000.”

You really need to do research to figure out base rates if you’re going to do prediction as well as the top forcasters. For things like war on the Korean peninsula it’s easy since I think most people have a good idea of the history off the top of their head. But I was in the experiment in one year and for most questions I would need to do a fair amount of research despite the fact that I read The Economist.

I also was in the experiment for a year and they would ask things about the probability of president X being ousted in the next year in small african country Y. I am a person that reads alot, but every question usually involved quite a bit of reading to do basic background probabilities.

The bird question is not number independent at all. My price depends on how many are left. In the second case you informed me that there are at least 1000, in the first there might only be 100. I have no idea what the distribution of endangered bird populations is, but I’d go with a log prior, in which case I’d pay about the same whether you told me 100 or 1000.

Well, you beat me to it 🙂 One could also say that the marginal utility I have from an additional bird is decreasing. After all, if the question was about billions of birds, people would probably pay killing some of them to keep their population in check.

The question is actually hard to answer if you are not provided with the information about how many birds there are in total. Saving 10 birds is a big deal if there are only 10 birds in total, saving ten birds in a population of millions is not worth a dime.

So basically the superforecasters are saying “Well, 100 birds are a lot fewer than 1,000 birds, so plainly they are more endangered and need more money faster to save them”?

The “bird question shows ordinary people just guess by the seat of their pants” isn’t quite fair, as does it say how many birds in all? Is that “only 100 birds left in the entire world” or is it “only 100 birds in this particular area but there are more birds elsewhere”? That would certainly make a difference to me, for one! The same with asking a different group about 1,000 birds; that sounds like a reasonably high number in a flock, or at least that we’re not down to our very last breeding pair of dodo birds, save them today or no more dodos ever!

This has nothing to do with superforecasters. It is a study from 24 years ago that EY cited in a post where he argues in favor of total utilitarianism.

On the other hand, 1000 birds may be enough to bring the species back from the brink pretty easily, while a population of 100 turns out to be a hopeless money pit (for comparison, it has cost $35 million to turn 27 California condors into 425). The point is well-taken, though, there are too many extra factors here.

There are cases where biases are really just people running a deeper strategy that the ‘correct’ answer doesn’t take into account.

This isn’t one of them, and this should make you skeptical of your ability to tell the difference between right and wrong answers.

Why not?

I suppose I should be clear about what “this” is, since a lot of these references may be less clear if you don’t know the relevant literature.

The actual source Scott is pointing to is a 1992 experiment done by Desvouges et al., in which it was specified that there were 8.5 million migratory waterfowl, and that N of them died, and that it would be possible to prevent those deaths, but doing so is costly and the costs would be passed on to the consumers. So, how much are you, as a consumer, willing to pay to prevent the N deaths?

The three cases were 2k, 20k, and 200k. The willingness to pay was statistically indistinguishable between the three groups.

The straightforward interpretation of this result, that lines up with other experiments, is that people are imagining a single bird, deciding how much sympathy they have towards that one bird, and choosing a price accordingly. They are not making use of the number of birds, or of the fraction of all birds that this represents.

I’m not making the stronger claim that people have to value the number of birds linearly. It seems to me like a log scoring might make sense there.

(One could point out that people are comparing log(8.5e6-2k) which is roughly the same as (8.5e6-200k), and so both are similar, but this is both wrong mathematically (the larger the base you’re subtracting off of, the less the log matters and the closer the marginal value is to linear) and psychologically (that’s inconsistent with the results of other experiments and the self-reports of the people doing the experiment).)

“A bunch of cute birdies are going to die. Their species will not go extinct because of it, but (as you might guess from the fact that I am talking to you about this) people are going to talk about these cute birdies if they die. Expect to see fifteen minutes of very sad footage of dead cute birdies on your television, computer, or phone, spread out over a couple of weeks in little bits you won’t be able to anticipate or avoid.

How much do you think we should pay to make sure you don’t have to watch sad videos of dead cute birdies for fifteen minutes, and feel sad after than because you didn’t help?”

Why would anyone expect the answer to be more than vaguely correlated with the number of birds?

I signed up for the Good Judgement Project. It’s hard to say how well I will do considering I skipped many of the more obscure questions. There are many questions on foreign elections and treaties I haven’t heard of(and I would consider myself reasonably well-informed).

I’m surprised the precision of the forecasts affected their accuracy.

Me too! I always associate the person who says “82% chance of this happening” with an annoying pretentious person who watches too much Star Trek.

I originally thought maybe these people were better not because that level of precision helped but because this signified they were using math (eg maybe some complicated process that spits out 82 – nobody would just start by guessing that). But the rounding experiment seems to show that’s not true. Wow. My hat is off to people who can be that precise.

Do you know if the data is publicly available somewhere? The whole thing just screams “implausible” to me. How many predictions did each person make, anyway? Wouldn’t you need dozens or hundreds of predictions to detect the difference between 80% and 82%?

Not necessarily. I don’t know how predictions are actually rated, but intuitively, I would measure the difference between the predicted value and the actual value, sort of like golf scoring.

In retrospect, an event has a probability of either 100% or 0%, depending on whether it happened or not. Take the difference between the predicted and the actual value, maybe square that number to more heavily punish strong mispredictions. Assign that value as an absolute as penalty points, and the person with the lowest penalty score wins. Then repeat that same scoring except with the prediction values rounded, and compare the scores.

Regardless, dozens or hundreds of predictions is not implausible, especially when you do them as part of a study/program i.e. when it becomes your job for a while. People like Scott make dozens of such predictions each year on their own time.

I don’t believe Scott does not make enough predictions to detect the difference between 80% and 82%. This is exactly what I’m talking about.

If the real probability of an event is 82%, and you’re predicting 80%, you’re only wrong on an extra 1 event out of 50. So at the very least, we’re talking 50 events to even have a chance of seeing the difference. But if we want to detect this difference with confidence, we need more – maybe 200 events or something. And if we’re rounding 82% to 80% but 58% to 60%, the error partially cancels out, so we’d need *even more* events.

anon85, the errors don’t cancel out like that. The magnitude of the errors is added, not the errors themselves. 2% too high +2% too low does not equal no error.

For an example. Suppose someone predicted that dimes have a 60% chance of landing on heads when flipped. Pennies have a 40% chance of landing on heads. Those predictions don’t cancel out and make the set of predictions as good as predicting 50% for both.

It might be because they’re multiplying probabilities in necessary causal sequences. Even if the individual numbers are “round”, the result will be non-round.

War between the Koreas (~4%) = incident (75%) * declaration issued (5%).

(Don’t read too much into my prediction here. 😉 )

It’s maybe my mathy background, but I can imagine some superforecaster predicting between 4/5 and 5/6, translating it to 80% to 83.3% and coming out with 82%, which ends up more accurate than either rounded figure. No need for anything more complicated than that.

It is worth noting that around the 80s and 90s (%), rounding can make a very large difference when you think in terms of log odds or bits. E.g. many people would round 85% to 90%, or might feel a bit more than 90% confident and call that 95%, or a bit more than 95% confident and call it 99%. The last one is particularly bad.

Obviously this is all mirrored at the low end.

They used Brier scoring, not log.

Making small frequent updates increases both accuracy and apparent precision.

I’ve read that this is the explanation.

Ultimately I think this doesn’t show that they had great precision per se, it just shows that if you are genuinely using the whole range of probabilities without unconscious bias towards round or frequently-used numbers, rounding is going to hurt.

Seen on MR and relevant: When Negotiating a Price, Never Bid With a Round Number

Yes; I realized that, but it’s for a different purpose.

I comment constantly on the Marginal Revolution, but Tyler keeps deleting my comments since I used a bad word a few times over two months ago.

What sort of bad word?

If doing the probability calculations (even Fermi estimate style) is the best you can do, then rounding them off will tend to give you less accurate numbers.

One reason for hyper-precise estimating is that you get credit for your prediction on each day, so it pays to boost your percentage frequently as time is running out . Say with a month to go you say there is an 80% chance X won’t happen. Then 3 more days go by with nothing of interesting happening and no new news, so there are only 27 days left in which X could happen. So you boost your estimate of X not happening from 80% to 82%.

80% is 1 in 5, whereas 83% is 1 in 6. If an event happens once every 6 years, then it makes sense that rounding that to once every 5 years would hurt your accuracy.

Eliezer often refuses to give precise numerical probability estimates. I think he’s wrong about this, and to the extent this view is common in LW/CFAR circles this might be an area for improvement.

I wonder whether most of this effect concerned probability estimates near to 0% or 100%, where rounding to the nearest 5% can be a really big change.

(I think the right thing to look at is the log odds. Rounding 48% to 50% changes that from log 48/52 ~= -0.08 to zero, whereas rounding 3% to 5% changes it from log 3/97 ~= -3.48 to log 5/95 ~= -2.94, a change more than 6x bigger.)

They used Brier scoring, not log.

To anyone with experience playing poker, the link between granularity of estimates and accuracy will seem very obvious.

e.g. the expected value of any decision in poker depends upon how your hole cards compare the range of hole cards that a villain may hold. Estimating that opposing range is everything—a 3-5% swing will be the difference between winning and losing money in the long run. Good players are thinking something like “he could have any 2 pair, all broadway cards, any 2 suited cards with an Ace, suited connectors above 67s, suited 2-gappers above 9Js.” Putting villains on this range involves first starting with the outside-view: “what position is the villain in relation to the button?, what does the median villain do at these limits” then considering the inside view, eg. “specific reads about villains tendencies. Prior betting action by the villain.” Conclusions about both the inside and outside views involve a Bayesian kind of updating, in the former case as the macro game evolves, in the latter case as you learn more about a specific villain.

In fact, nearly all of the differentiating characteristics of the superforecasters are prerequisites to making money at professional poker. When I read the book, I couldn’t shake the feeling that he was abstracting the poker mindset for use in predicting geopolitical affairs.

I think both sets of skills boil down to making good decisions under uncertainty.

I and at least one of the other supers had an extensive poker background. Several others had dabbled profitably at lower stakes.

Nate Silver made a nice living as a professional poker player fleecing fish during the Poker/Housing Bubble of 2004-2006. In late 2006, all the fish suddenly disappeared and the only poker players left at the Mirage in Las Vegas were pros. So he lost a lot of money in early 2007 and then quit to get into election forecasting business. The funny thing is that Silver never noticed that the poker bubble in Las Vegas was a side effect of the housing bubble in Nevada, Arizona, and California and thus the poker bubble popped at exactly the same time as the subprime bubble. If he’d noticed the connection, he could have gotten in on the Big Short, but he’s never noticed it yet:

http://takimag.com/article/silver_cashes_in_steve_sailer/print#axzz3zMdUB3rR

Aim small, miss small.

Which is to say – why is it surprising that someone who approaches a problem at a more precise level tends to be more accurate? Would it surprise you if a shooter who aimed at the center of a cut-out target hit the target more often than the individual who aimed at the target as a whole?

The Cognitive Reflection Test may be confounded by childhood mathiness, as questions like those are quite common in math contests. If you ran into them there, you don’t need reflective capability to avoid the traps.

Yeah, good point. I’ve seen all three before.

Is there an updated version of the cognitive reflection test? I have seen it in 20 different places, it doesn’t seem that hard to come up with new questions that actually test system 2 and not whether you lucked into seeing the test before.

Wouldn’t it be confounded just by knowing that you’re taking a cognitive reflection test? If someone tells you beforehand that the questions are tricky, you’re already primed to use System 2.

Of course, you would never tell people you’re asking trick questions.

That’s the problem with the current 3 questions: even people who have no clue what “system 2” is are very likely to have seen them before with a vague impression that these are trick questions.

Right, so that means it’s permanently useless as an evaluation of anyone who has read about this kind of thing before.

I suppose you could get around that limitation by presenting something like a 30 question test where only three of them are tricky questions with obvious false answers.

Increasing familiarity with testing is probably one cause of the Flynn Effect.

But that could equally indicate that you’ve read a lot of psychology/behavioural economics books and blogs and what not, such as those of Tetlock. I’ve noticed that there are a handful of experiments or studies that seem to be repeated again and again in this kind of book; I’m sure I’ve read about Asch’s conformity or the bystander effect 20 times across various pieces of literature.

I would also imagine that knowing the system 1/system 2 reasoning behind the question would help a lot more in answering future questions of that style than simply seeing one such question and having a wrong answer.

Something seems off about the numbers. 2,800 people agreed to predict things? And they agreed to predict enough things, repeatedly over enough years, to get be able to find the top 2% of predictors without being subject to selection bias (e.g. “the dice that rolled the most 6s are the best at rolling 6s”)? And not only that, but it was possible to do stats on the IQ and knowledgeability of these people, and subject them to non-standard tests, all while remaining statistically significant?

It seems suspicious, in the “too good to be true” kind of way.

They did pay the forecasters a little for their time. And plenty of people will do plenty of stuff to win competitions. Doesn’t seem implausible to me.

This was a government project funded by a group affiliated with the CIA and run through multiple universities. When you’ve got that level of resources, sure.

I participated in all GJP seasons. Let me point out that we got paid a decent amount for the work involved – my ledger says I was paid a total of $922. We also had to fill out the IQ and political knowledge surveys at the start of our first season, which is where that comes from. This was a big content, and 2k people is not too implausible. As for the non-standard tests… well, I don’t think it’s much worse than any other study you might be reading which wasn’t pre-registered.

Tetlock already had a fairly high-status reputation due to his book Expert Political Judgment. An obscure professor probably couldn’t have done as well.

I participated in the GJP for two seasons on two different teams while I was working the nightshift as a 911 operator (between calls).

I didn’t take any IQ tests, but I did take abridged versions of the cognitive reflection test as well as answered general knowledge questions (I think I was also asked for my SAT score at one point). If my experience was typical, I don’t see any reason why they couldn’t learn all kinds of interesting things from it.

The contest was well publicized ahead of time on the highbrow public affairs and forecasting blogs. Tetlock is a big name in certain circles, so there was much interest in it among the kind of people who might do well on it.

I’m familiar with the standard foxes/hedgehogs story, but here’s a new angle that’s just occurred to me: what if part of the reason foxes do better than hedgehogs is because they’re imitating the chimps, because reasoning by using many diverse sources of information somewhat resembles random guessing? In other words, maybe when we praise foxes we are overstating the benefits of having lots of eclectic knowledge, and in truth the benefits of foxiness come about in an accidental triumph of randomness over stupidity.

Also, for anyone who wants to look at more information related to this, there’s a relevant recorded discussion group on Edge’s website. Tetlock, Kahneman, and a whole bunch of friends and industry specialists attended. There’s a typed out transcript in addition to video, for those who prefer to read.

One thing in that discussion that stood out to me is that the “one weird trick” all superforecasters use is looking for comparable events in history with known base rates. I haven’t read the book, so I don’t know whether or not it’s mentioned in there also. I like this piece of advice because it’s simple and highly actionable. It’s easy to apply it to specific things, and when I do so my thoughts almost automatically start being detailed and productive.

If the benefits of foxiness are purely from randomness, why do the foxes repeatedly outperform random guessing? And why do good predictors remain good predictors over time rather than regressing to the mean?

I wasn’t saying *purely* from randomness. I suppose my point is that comparing their performance to hedgehogs is a low bar in some ways that’s easy to get overexcited about, at least for me.

A more likely alternative explanation is that most people aren’t utilitarians and certainly not linear utilitarians, so those responses indicate nothing whatsoever about their “estimate of the value of bird life” or even that they have such a thing that applies per bird at all.

Also, as Karsten points out above, the fact that the number 100 or 1000 is even used in the question normally communicates information about the situation, making it legitimate to give “inconsistent” replies. It doesn’t communicate this information if the number is specifically chosen to test people’s responses to different numbers, but they don’t know you’re doing that and won’t reply on that basis.

Do you predict that the same groups of people who get the Kahneman-approved right answer on the bird problem will get the Tetlock-approved right answer on the “does Korea go to war in 5 years vs. 15 years” problem?

What is the Kahneman-approved right answer on the bird problem? Saving the lives of birds has no objective value. It’s a cause you can donate money to, or agitate for other people to donate money to, in order to signal that you are The Right Sort Of Person. And with that in mind, it seems quite reasonable that the amount of money people would wish to donate would be determined much more strongly by how much money they have than by “the value of saving one bird”.

“Saving the lives of birds has no objective value. ”

Well, it might. As witness the horrors of when Communist China went after the sparrows. But that’s hard to judge, likely to be small with so small a group, and may be negative.

The amount of money you have (or the amount of money you are asked to imagine you have) is a constant. The variable is the number of birds.

Something fishy is going on if the amount of money is negatively correlated with the quantity of birds saved.

Like maybe you don’t give a shit about birds (raises hand). But if I would only give a nickel to save 100,000 birds, it doesn’t make sense for me to say I would give a dime to save 100.

I’m being deliberately unhelpful here, but maybe people’s beliefs about the quality of a program are correlated with its cost effectiveness? If they see something that promises to save 100,000 birds for a penny, they might implicitly recognize it as too good to be true. Yay confounders.

@ Michael Watts

Saving the lives of birds has no objective value.

Objective moral value .. is rather a quaint notion, anyway.

If you are asked whether North Korea will go to war in X years, the X gives you information in the same way that being asked how much you’d pay to save X birds does (so long as you are unaware that the X is being put there solely to test your reaction to X). So that part would apply to both cases and I would expect some correlation.

Obviously whether someone is utilitarian wouldn’t affect the North Korea answer. However, if most people are not utilitarian, and if whatever error is made in the North Korea case is common, the answer to your question as written is yes because people who have extremely common trait X are likely to have extremely common trait Y, regardless of whether they are correlated. If I steelman your question as “do you expect correlation”, I of course wouldn’t expect correlation due to this reason.

> If you are asked whether North Korea will go to war in X years, the X gives you information in the same way that being asked how much you’d pay to save X birds does (so long as you are unaware that the X is being put there solely to test your reaction to X).

How? The birds question implies that there ARE that many birds. With NK and SK, the existence of that many years was not, presumably, in question.

Suppose I spun a wheel, labeled 1 to 200, and the wheel came up X. Then I asked you how many countries are in Africa.

Would the value of X affect answers given by people? Should it?

In actual discourse, people use numbers in their questions because the numbers are relevant, and in such cases the fact that the number was used provides information. You can, of course, cheat this by deliberately picking the number for irrelevant reasons, in which case it provides no information. And that’s what you did by spinning the wheel.

Jiro: …is that a yes or a no to my second question? You seem to have correctly ascertained that random numbers do not have a bearing on the number of countries in Africa, but the first sentence seems to suggest that I am somehow wrong in putting that piece of information next to my question, because the proximity will trick someone into believing they are relevant.

Which, sure, it will, but that’s a demerit on the person answering the question that they’re unable to handle that case.

If you picked a number randomly, and you asked a question using the number, and the person answering wasn’t told that you picked the number randomly, he would probably give a different answer for a different number and would be justified in doing so. Numbers in such questions normally carry information. They don’t carry information in the unusual case where they were picked randomly, but he doesn’t, after all, know that you did that.

(This scenario is not what you literally described, since that doesn’t try to connect the number to the question. If you did what you literally described, the number would obviously carry no information.)

[This is Jiro, an errant cut/paste killed the user name]

Jiro: the experiment is done by spinning the wheel in front of the person. The point is that people by default don’t seem to have the ability to consciously zero out the effect of the number, or the knowledge that they should do so.

The bird question is kind of ill-defined because unlike the probability of korea going to war, it depends on a value judgement, namely how much a species and an individual animal is worth. These numbers will either have to be pulled out of thin air by each individual participant, or else estimated based on the amount of funding similar bird-saving initiatives receive in the real world. I think the relevant information is hard to find and interpret in this case, again unlike the korea example.

This introduces a huge amount of noise into the picture, so I would expect both groups to do equally badly.

I would, besides scope insensitivity both example also have anchoring bias in common (why is 5 years or 100 birds an important number? it isn’t) and can be avoided just by thinking in terms of standard rates ($/bird, wars/year). I feel like converting everything to base rates is an either/or skill that once you figure it out makes you a better predictor on a wide range of topics.

I’d guess there’s a correlation, and the correlation is this: Treating the numbers as important.

Some people will look at the problem of birds and read it entirely as “Save the birds.” Likewise, some people will look at the problem of a war between Koreas as “Does Korea go to war.”

Which is to say, some of the people are answering a different question than is being asked. (I think schools train students to do this by inserting red-herring numbers into word problems, training people to think of the question first, and the numbers second.)

If schools have an effect, it is likely that they train people to assume the numbers are relevant, not irrelevant. (See Who Is The Bus Driver? as an example.)

The simplest, and thus default, explanation is that people are conserving on thought and replacing a harder question with an easier question.

I think most people would have no idea how much it costs to run a bird sanctuary or save a habitat, so $10,000 seems like a reasonable sum – high enough to get stuff done, not so high that it’s arguable you’d be better spending it on the homeless or cute cancer kids or something.

So it’s not necessarily “people in group X think 100 birds are worth more per bird, people in group Y think 1,000 birds are worth less per bird”, it’s the amount they think reasonable if it’s coming out of the public purse.

Alternatively, it’s a number high enough not to offend the bird-savers, but low enough not to offend people who can think of other ways to spend the money.

It probably depends how your question is worded, too: “These are the last 100 Greater Purple Wattled Grabblenecks in the world, how much do you think is reasonable to spend on saving them?” might induce people to suggest a higher figure than “How much do you think is reasonable to spend on saving 100 Greater Purple Wattled Grabblenecks?”

It seems strange to me that anyone would be a “linear utilitarian” about birds. How are birds different from apples? I consume apples by eating them, I “consume” birds by feeling good about them being out there, watching them in the zoo, etc. If my taste for apples is about average (mine isn’t, I don’t like apples very much) and I have 10 apples or 10 apples a month I am going to be less willing to pay for an extra apple than if I only have 1 apple a month. If there are 1000 birds in total on average at any point in time, I am going to pay quite a lot to prevent a bird genocide (saving 1000 birds) but if there are 10 million birds, I might not be interested in paying much to prevent reducing the average population by 10 thousand birds. I might even favour that.

You miss the point. It’s not about saving or not saving the birds, it’s about consistency between the answers. Utilitarianism is completely irrelevant.

But it is entirely consistent not to want to spend more money on extra birds when those extra birds bring you virtually no extra utility. I think that the phenomenon these questions try to explore is probably real but the questions are not formulated all that well. The most reasonable answer is neither “my value of one bird’s life times number of saved birds” or a number which my gut tells me represents “how much I care about birds” but that I cannot give a meaningful answer without additional information. Without knowing how many birds are out there, I don’t know how much I value saving the marginal bird and so I cannot give a sensible answer.

“Shut up and do the math.” Many folks in the effective altruism circles seem to follow a principle that we should value the lives directly, rather than indirectly through our own personal utility. It is a crazy alien idea, so far as I am concerned. And basically makes them paperclip maximizers who I cannot trust to act human.

I completely agree with you on the craziness of valuing the lives terminally rather than instrumentally.

But this egoism is no better rationalization of the finding in regard to birds. If you don’t want to give any money to save birds, that’s one thing. But if you want to give a certain amount to save 100, it is very peculiar that you would give the same or lesser amount to save 100,000.

I mean, we’re not talking about saving your pet parrot vs. 99,999 other birds. We’re talking about 100 abstract birds vs. 100,000 abstract birds.

The findings indicate either irrational scope insensitivity (the good explanation), or very implausible preferences (the bad explanation).

It doesn’t matter how much you value birds. The point is that whatever that value is, the value for 100,000 of them should not be less than 100, or even equal except possibly at the zero bound.

Saving 100000 birds is a larger number than saving 100 birds. However, it may not be a larger percentage of the bird population, and I might gain constant utility from saving a fixed percentage of the bird population rather than from saving a fixed number of birds. Furthermore, someone asking me a question about saving birds will normally name a number that roughly scales with the size of the population.

From that I would conclude that I should pay a constant amount for saving X birds, no matter what X is, under the assumption that the speaker is acting like speakers normally do (and did not, for instance, pick X randomly or specifically choose it to test people’s reaction to different numbers).

(Note that “I assume that they are asking me how many birds are needed to keep the species from going extinct” is just a subcase of this.)

@ Jiro:

Yes, you can fight the hypothetical.

If you’re arguing, “Is there some convoluted way I could rationalize this?” then the answer is always yes.

The question does not say or imply anything about percentages. The people who are being asked know it’s one of these types of artificial scenarios.

If you throw in weird assumptions about implicit premises the questioner didn’t tell you, you can get a result like this. That’s why you’re almost always told not to read anything into the question. But would everyone have the same weird assumptions such as to produce a consistent result?

Your hypothesis here is that a) people get utility from saving fixed percentages of bird populations, b) everyone knows that when someone gives you a figure of the number of animals you can save by donating to a charity, it’s a fixed percentage of the population, and c) the results are explained by the respondents reading these premises into the question. That’s not completely impossible, I guess, but I find it unlikely. And the way you detect this sort of thing is by asking people to explain their answers to detect misunderstandings of the question.

Let me apply this sort of analysis to the trolley problem.

“Hmm, well, in real life no morally sane person would ask me whether I wanted to let a trolley run over five innocent people instead of one, so in the example the five must be assholes who had it coming, and the question is like a test to see if I’ll realize this. Therefore…yep, I choose not to press the button.”

Someone could think that, I guess.

Edit: this probably came off as meaner than I intended. That last paragraph was intended in a joking manner. I just think this whole discussion is silly. Clearly scope insensitivity is a real phenomenon, and I think these results are much more likely attributable to it than to other strange implicit premises.

What I am describing is a line of reasoning to rationally get the answer you consider irrational. Unless your hypothetical is “suppose you don’t reason that way”, that isn’t fighting the hypothetical.

It’s unlikely that anyone would explicitly spell it out in so many words, but the fact that someone cannot spell it out doesn’t mean that’s not what their reasoning is. (Honestly, how many people would even know what you mean when you ask if their utility is linear in number of birds?)

In real life, trolley problems involving literal trolleys don’t happen at all. So nobody would deduce anything about some aspect of the real life situation, such as the victims being assholes, because there is no real life situation. Saving birds does happen in real life.

And even ignoring that, suppose that reasoning that way in trolley problems was common. All that that shows is that the trolley problem has the same flaw as the bird problem. I don’t hold “trolley problems are flawless” as a premise, after all.

@Vox:

I think that if someone asks me about saving 100 birds or 1000 birds, it is quite natural to thing that both numbers probably mean something like “save that species of birds from extinction”. Given that most people do not care whether there are 100 birds or 1000 birds but do care about that species existing or not existing, it should not come out as such a surprise that they say more or less the same figure in both cases, because they more or less the same result in both. What you buy is the continued existence of a species. There are probably people who care about lives of individual birds but there are not that many of them.

But there is a simple way to find out whether that is correct or not – ask the same people about saved lives of people. I’m pretty sure that most people think about humans differently that they do about animals and also it is obvious that the question is not about a species’ extinction. If they are again willing to pay more or less the same for saving 100 people (let’s say it is always people they don’t know, they’re even from a different continent and you also tell them that) and 1000 people then the interpretation from the article is probably correct. If they give different answer, then it is not.

I suspect that the issue here is that the original bird question was in relation to the exxon valdez accident and framed so that all the questions taken in context can be reduced to

“how much money should we spend on saving one bird species”

Asking the exact same question to three different groups should normally yield roughly the same answer, independent of exact wording.

This does not mean that scope insensitivity isn’t real, only that using birds affected by one particular oil spill is perhaps not the optimal way of measuring it.

Performing at chance because you’re braindead is one thing, but for hedgehogs to perform *below* chance it seems like there has to be something weird going on. Does he discuss why this happens?

If possible options aren’t equally probable, always choosing the same one is likely to lead to performance under random, because you’re quite unlikely to have chosen one of the options that have higher probabilities than most others.

I think.

So there is one big truth to the universe, but since there are many potential big truths the median hedgehog will not have found it and so will always be wrong? But you’d think that the one hedgehog who did find the right big truth would bring up the score enough to equal chance again.

The zealots/hedgehogs believe strange things, but they don’t believe random things. More likely, they believe things they would like to be true, and proceed from there. If, say, you’re convinced Communism is the salvation of mankind, it will skew your perceptions. As it turns out, Communism likely isn’t the salvation of mankind, so that’s one wrong thing you believe, upon which you base your modeling.

Am I making sense?

Further:

Suppose the question is, “will adopting Xism be beneficial to the nation of Y?” – what’s the guarantee that the proportion of Xists and anti-Xists in the sample matches the probability that the statement is true?

Yes, if you’re convinced of some nonsense proposition, it will skew your perceptions and be a wrong thing to base your modeling on. But to do worse than chance it doesn’t have to be worse than ideal, it has to be worse than completely braindead.

Is your point that things that people want to believe are especially likely to be false, and this causes people who believe things to be worse than completely braindead?

My point is, I think, that people like to be consistent. If you have a deeply held belief about the nature of the world, you obviously also believe that this belief holds, and if it holds, then events in the world will be consistent with it.

The problem is not just that the belief may be false, but it may be irrelevant – but they’re still going to pick a consistent option. Also, if only have a hammer, every problem looks like a nail. Knowing just one thing and viewing everything through that lens will distort things.

Crap. I feel as though I have this intuitive understanding of what’s happening here, but when I try to put it into words, only garbage comes out.

I think you’re missing my point. You don’t merely have to argue that a hammer is the wrong tool for most jobs, you have to argue that a hammer is a worse-than-random tool. But if a hammer is a worse than average tool, then something like a wrench must be better than average. So then do more people use hammers than wrenches? Why?

Because this isn’t a hammer-or-wrench question. This is people thinking a hammer is the be-all, end-all tool for every task, and there’s a whole tool shed of different tools. The chance that a random task happens to be one where hammers excel is small, and hammers aren’t particularly universal tools either. A random choice of tool to a random task at least has the chance of selecting something like a multitool that works on multiple different problems.

I think the issue is that the sample of people in question did not, on average, happen to hold useful ideological viewpoints compared to the questions asked.

Yeah but to do worse than random on a large average it’s not enough to always select a particular tool, you have to have people systematically selecting a particularly unsuited tool.

What Tetlock showed the first time around is that pundits were operating without feedback– no one was keeping track of their errors. This would increase the odds of them having theories which felt good to themselves and their audiences, but which had little or no predictive power.

Also, it can take time for a trend to make itself clear, and meanwhile, it’s easy to say that the trend would be what you want it to be if people only did things differently or tried harder.

I suspect that there is a correlation between theories that sound nice and theories that don’t predict well. Theories that predict well may mean that the forecaster has difficulty getting audience enough to count as one.

I don’t know what, in this context, “worse than chance” means. To define chance outcomes you need a probability distribution.

What’s the chance distribution for how soon the Koreas go to war?

@ David Friedman:

I am not sure on this, either, but I think someone explained that, at the end of the time period, they rate the probability as either 0% (if it didn’t happen) or 100% (if it did). And then they measure how far off your guess was. So if you predict a 70% chance that the two Koreas go to war and they don’t, you gain 30 points. And if they do, you gain 70 points.

This makes sense because if you were an omniscient, ideal predictor, you would only predict either 100% or 0%, assuming the events are actually determinate.

Of course, this would be terrible to use for just one question, but averaged out on lots of questions it works.

If that’s true, that would also mean guessing 50% on every question comes out the same as alternating between 0% and 100%. Doing the latter sounds like metagaming it to me, however.

I don’t know if this is right, though.

Why are you assuming that any of the hedgehogs happen to find the correct big truth?

Or, indeed, that the hedgehogs’ big ideas are themselves randomly distributed? It’s entirely possible that there’s a bias to total population of hedgehogs’ beliefs, even if it’s just something like “favors round numbers” or the related “favors simple answers”.

Suppose, out of a range of 100 values, the correct one is 63. That’s a weird number. It’s neither very close to any extremes, nor to the middle. It’s deliberately chosen to not be round, either in a conventional sense nor in a “really easily computed” sense like 2/3 or 1/4. It is, however, both

A) The nearest rounded value to “halfway between 3/5 and 2/3”

B) One of two acceptable roundings to the range of permitted values for “5/8”.

In other words, it’s actually not an unreasonable number even if you’re working with things that we only have really low-precision estimates about, or if you’re doing pretty off-the-cuff sorts of math. You can easily find “weirder” numbers, in terms of trying to produce plausible things that compute to them, but many of them are actually closer to “big round numbers” too. “60%” is a reasonable hedgehog-y estimate for “a bit more than half” or “a bit less than 2/3”, but that still leaves a huge margin for error. An awful lot of people are just going to say “about half” or “about 2/3” or even “about 60%” without applying the *only slightly further step* of getting “between 2/3 and 3/5” or “about 5/8”, just because those are slightly more complicated answers.

If the evaluation function punishes overconfidence (e.g. score = (correct answer – your answer)^2)), that might explain it.

Indeed, I think it would be just as interesting to study the Unterforecasters and figure out what the heck was going wrong there.

Unless it turned out they just had low IQ, which would be boring. But I’m assuming that the group was already above the average IQ.

That’s a good question. One possible answer might be that the hedgehog approach emphasizes dramatic, counterintuitive predictions (because it’s selecting for a strong narrative as much as for truth), and those predictions are more likely than chance to be wrong.

The most likely predictions are usually along the lines of “things stay the same”; no revolution, modest gains in the market, the establishment candidate wins again. But that’s much less compelling than revolution, or a crash, or a political upset favoring the underdog.

That’s the best answer I’ve seen. If hedgehogs consistently make counter-intuitive predictions, I can see how they’d be consistently wrong. Think of all the book deals and speaking fees people earned from predicting the financial crisis. You’d never get a book deal from successfully predicting business as usual.

I think the economist who deserves credit for taking a fox approach to macroeconomic predictions is David Henderson. He disagreed with Krugman when Krugman was predicting runaway inflation in the early 1980s, and he bet against Bob Murphy when Bob was predicting runaway inflation after 2008. Krugman and Murphy are both smart hedgehogs, and Henderson was able to out-predict both of them by just projecting the status quo forward.

I didn’t think of this when I was writing the ancestor, but a data point in favor of my theory might be all those studies showing simple algorithmic models outperforming human experts. Not all those models boil down to simple regressions, but a lot of them do, and the ones that don’t will at least be measuring what they measure in a way that has nothing to do with narrative.

If hedgehogs consistently predict lower than chance, does that mean they can predict greater than chance if they just predict the inverse of whatever they think?

And does this cause them to explode in a puff of logic like a computer in Star Trek?

Sadly, most real-life situations are multipolar in a way that doesn’t allow for that. It’d work for binary choices like “which party is going to win the next American presidential election”, but I’d be astonished to find anyone performing worse than chance on that over long enough timescales.

I think the moral of the story is to make less-edgy predictions. Jehovah Witnesses have been predicting that “the end is nigh” almost every year for the past century. But the highlight of the week is more often something like “Dow Jones rose 37 points”. The AGI narrative used to be “We’ve found the Great Filter, the end is nigh.” Nowadays, it’s more like “It’s a big deal, but feedback effects don’t seem as strong as we thought.”

Incidentally, DAE remember the 2012 Mayan Apocalypse? The Y2k crash? Man Bear Pig? #NeverForget

The Y2K crash actually demonstrates a dynamic in prediction-making that deserves a little more scrutiny. Yes, there wasn’t a huge catastrophe, but in large part that was because people had predicted a huge catastrophe and had worked diligently to avert the catastrophe. If no one had predicted the Y2K crash, it could easily have been real. If forecasters are actually respected and paid attention to, self-fulfilling/self-negating prophesy becomes a real concern.

@ Nornagest:

Well, that makes a lot more sense. I was still thinking in the context of these “Probability that X will happen or not in 3 months” kinds of questions. So people are, in fact, not worse than chance on those?

Still, I suppose by definition it does prove on those multipolar questions that they’re better off getting out the dartboard.

@suntzuanime:

I’ve seen the claim that Y2K wasn’t a catastrophe because people took precautions against it, but I’m suspicious. Surely there were some firms and even some countries that didn’t do anything much–did terrible things happen to them?

What’s the evidence that if people had not made a big deal about it, there would have been a catastrophe?

[Re Y2K.] Surely there were some firms and even some countries that didn’t do anything much–did terrible things happen to them?

Why would a problem have to be considered a catastrophic threat for qualified people to take it as a problem, and as deserving reasonable action? In this case, qualified programmers did notice the flaw, reasonable action was taken, there was no catastrophe — so this means there was never need for any action at all?

So non-qualified third parties did start a flap — as usual, Sturgeon’s Law.

“Your radiator has developed a leak. If you don’t replace it, X will fail and you’ll hit a school bus and start a catastrophic fire!”

The school bus and the fire are unlikely, but not impossible, and we’d still better replace the radiator.

How about, there was reasonable need; reasonable action was taken?

I was there in the mid-90s. I was already running into things that went 1998, 1999, 1900. Also, 1999 was a popular flag meaning “stop”. Later systems without these flaws could have been affected by bad data fed from the dinosaurs, even if no dinosaurs had crashed (which we have no guarantee of).

The company I worked for in 1999 had a revision control system that was not Y2K compatible. Exceptionally so; it not only didn’t work but corrupted its own proprietary database leaving all our source code inaccessible. We found this out when a system accidentally had a clock set ahead.