Chris Stucchio recommended Matt Rognlie’s criticisms of Piketty (paper, summary, Voxsplainer).

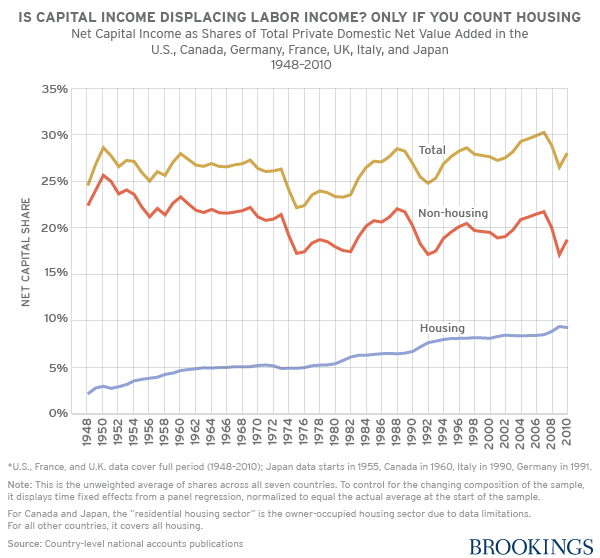

Rognlie starts by saying that Piketty didn’t correctly account for capital depreciation (ie capital losing value over time) in his calculations. This surprises me, because Piketty says he does in his book (p. 55) but apparently there are technical details I don’t understand. When you do that, the share of capital decreases, and it becomes clear that 100% of recent capital-share growth comes from one source: housing.

I think it’s saying the same thing Piketty was in that housing is a real thing, and if there’s inequality in housing, then that’s real inequality. And landlords are a classic example of the rentiers Piketty is warning against.

But it’s saying a different thing in that most homeowners use their homes by living in them, not by renting them out. That means they’re not part of Piketty’s rentier class, and so using the amount of capital to represent the power of rentiers is misleading. Rentiers are not clearly increasing and there is no clear upward trend in rentier-vs-laborer inequality. I think this does disprove Piketty’s most shocking thesis.

Rognlie also makes an argument for why increasing the amount of capital will decrease the returns on capital, leading to stable or decreasing income from capital. Piketty argues against this on page 277 of his book, but re-reading it Piketty’s argument now looks kind of weak, especially with the evidence from housing affecting some of his key points.

Grendel Khan highlights the role of housing with an interesting metaphor:

Did someone say housing?

As an illustration, the median homeowner in about half of the largest metros made more off the appreciation of their home than a full-time minimum-wage job. It’s worst in California, of course; in San Jose, the median homeowner made just shy of $100 per working hour.

See also Richard Florida’s commentary. See also everything about how the housing crisis plays out in micro; it is precisely rentier capitalism.

In the original post, I questioned Piketty’s claim that rich people and very-well-endowed colleges got higher rates of return on their investment than ordinary people or less-well-endowed colleges. After all, why can’t poorer people pool their money together, mutual-fund-style, to become an effective rich person who can get higher rate of return? Many people tried to answer this, not always successfully.

brberg points out that Bill Gates – one example of a rich person who’s gotten 10%+ returns per year – has a very specific advantage:

Not sure about Harvard’s endowment, but it’s worth noting that the reason Gates, Bezos, Zuckerberg, and other self-made billionaires have seen their fortunes grow so quickly is that each of them has the vast majority of their wealth invested in a single high-growth company.

This is an extremely high-risk investment strategy that has the potential to pay off fantastically well in a tiny percentage of cases, but it’s not really dependent on the size of the starting stake. Anyone who invested in Microsoft’s IPO would have seen the same rate of return as Gates.

This is a good point, but most of Piketty’s data focuses on college endowments. How do they do it?

Briefling writes:

I’m not sure you can take the wealth management thing at face value. The stock market since 1980 has 10% annualized returns. Instead of trying to replicate whatever Harvard and Yale are doing, why don’t you just put your money in the stock market?

Also a good point, but colleges seem to do this with less volatility than the stock market, which still requires some explanation.

Tyrathalis, a financial planner, adds more information:

One of the things that having /any/ major financial planner does for you, though, is it opens up access to private equity funds that are only advertised to sufficiently high-net-worth individuals and businesses. The primary asset class that super high gains come from is private equity, generally meaning investments in angel funds and off-market startups. The way these funds operate involves you pledging a certain amount of money that they can invest as they choose, but they only call up parts of it periodically. This means that dealing with a few really rich people is much easier than dealing with a ton of poor people, in particular because it is really, really bad if they can’t manage to get all of the money. Their current business model requires only dealing with people who will definitely be able to make their payments when they need to, and since the funds are so large, that means they need to have a few very rich investors. Investment advisors known to advise large fortunes are where they go to find those people.

Also, any given private equity fund is still likely to make a negative return, which is a much bigger deal if you don’t have a lot of money in the first place, so very few people would recommend that you invest in a private equity fund instead of something safer if you aren’t already rich. Higher returns implies higher standard deviation. That’s also why a long time horizon is so significant. The basic activity of asset class investing is to diversify to balance out high variability without diminishing returns too much, but over a long enough time frame the variability matters much less and you can afford to make riskier investments.

Although, getting 10% returns doesn’t require any special connections. The stock market grows at 11% a year, it just has very high variability, so you need to be able to be in the market for several decades to ensure those gains with an all-stock portfolio. A 60/40 split of stocks and bonds will get around 8%, while not requiring more than a few dollars to invest. You can do it on Schwab with only a bit of research. The reason why super rich people and organizations /only/ get 10% returns is that despite private equity managing 20% or more, even they don’t have enough capital and long enough time horizons to stay fully invested in such risky markets. They diversify heavily too, cutting returns in favor of making those returns basically guaranteed.

My main point is that financial planners do things besides stock picking, but one of the things they do is get you into private equity funds, which are the main source of the better returns that rich people can get. However, for reasons of risk management, this isn’t something people who aren’t super rich necessarily ought to imitate. There are only slightly less effective strategies that anyone could imitate, but its not smart for everyone to have the same amount of risk. Realistically, most people ought to do something like the 60/40 split I mentioned, and the difference between that and what most people end up getting is due to people being bad at performing optimal strategies even when they know what they are.

And Vaniver adds:

There’s a mutual fund called the Magellan Fund, which was famous for its extreme performance (I believe it was annual growth of 15-20% per year) for about 20 years.

At the end of that streak, someone ran the numbers and discovered that most of the people who had invested in the fund had lost money, because they bought in when the market was high and sold when the market was low.

The problem that mutual funds have is that they don’t know how much money they’re going to have tomorrow, because there are thousands upon thousands of customers who might want some of their money back, or might want to add in some more money, and as a result there are lots of unplanned trades they’ll have to make that only benefit their customers, not them. Many of the best managers insist on terms of the form “you give me money and then can’t take it out for N years” so that they don’t have to deal with this kind of thing (in the short term, at least).

For private equity servicing one large customer, there are far fewer moves of that form, and they’re much easier to predict, and you averaging across many small customers still doesn’t duplicate that effect.

I still don’t feel like this explains everything; surely a college with $500 million has about the same risk tolerance and ability to give money on the right time scale as a college with $1 billion? Maybe all of this is just false? J Mann writes:

Is it consensus that Harvard and Yale consistently get better returns than other endowments and than the market? It looks like Harvard at least has had a number of recent bad years, and that some people are suggesting that its results may be based on taking on more risk.

And Anon256 adds:

Indeed; Havard has done badly enough in the years since Piketty’s book was published that it’s now considering switching to just using index funds.

And Will4071 says:

Just to note, I don’t think large endowments/the very rich really do anything special. This analysis suggests that they actually underperform a levered 60/40 portfolio (which is fairly standard, and something you could easily set up yourself).

Chris Stucchio has a different perspective on rich people making higher rates of return:

It’s also worth reflecting on a point which Piketty makes mathematically, but literally never says in words. If rich people are the best investors, then the best way to create economic growth is to ensure that rich people are the ones controlling investment decisions. Intuitively this makes a lot of sense; Travis Kalanick (and now Dara “the D” Khosrowshahi) are a lot better at transportation than the average autowale. Bezos is a lot better at logistics than my local cell phone store.

See also Paul’s answer to one of my objections to this. Right now it looks like (assuming Piketty is right about this at all), Chris has a point. Does anyone want to try to convince me otherwise?

Phillip Magness, himself an economic history professor, writes:

I’d also urge you to look more skeptically on his income distribution stats (the figure 1.1 above). Several economists, myself included, have been working on the measurement problems that arise from attempting to determine income shares from tax data in recent years. The aforementioned figure comes from a 2003 study by Piketty and his coauthor Emmanuel Saez. While it represented an innovative contribution to the literature, this paper gives generally insufficient treatment to the effect of changes to the tax code itself upon data that derive from income tax reporting.

To put it another way, taxpayers – both wealthy and poor – respond to the way that income tax laws are structured so as to minimize their own tax burdens. They take advantage of incentives and loopholes to lower what they owe. They engage in wealth planning strategies to legally shelter income from high rates of taxation. And some even illegally evade their obligations by misreporting income.

Tax avoidance and evasion rates vary substantially over time and in response to tax code changes, and so do the statistics they generate with the IRS. A major problem in Piketty-Saez is that they do very little to account for this issue over time, and instead simply treat tax-generated stats as if they are representative. Doing so yields a relatively sound measurement of income distributions, provided that the tax code remains relatively stable over long periods of time (e.g. what the U.S. experienced between roughly 1946 and 1980). When the tax code undergoes frequent and major changes though, tax-generated stats become less reliable. And it just so happens that the two periods of “high” inequality on the Piketty-Saez U-curve are also periods of volatility in the tax code: 1913-1945 and 1980-present.

The 1913-45 period is marred by both frequent tax rate swings and an initially small tax base that was rapidly expanded during WWII, combined with the introduction of automatic payroll withholding in 1943. When you account for these and related issues, the extreme inequality of the early 20th century and especially the severe drop it undergoes between 1941-45 become much more subdued. The period from 1980-present is similarly marred by Piketty and Saez’s failure to fully account for the effects of the Tax Reform Act of 1986, which induced substantial income shifting at the top of the distribution to take advantage of differences between the personal and corporate tax rates. Adjusting for that has a similar effect of lowering the depicted rebound.

Taken together, what we’re probably experiencing is a much flatter trend across the 20th century – one that resembles a tea saucer rather than a pronounced U. And that has profound implications for Piketty’s larger prescriptive argument in favor of highly progressive tax rates.

Magness also recommends his 2014 paper and Richard Sutch’s 2017 conceptual replication questioning Piketty’s data. It’s inherently hard to find good data on inequality over the last few centuries, but Magness finds that of the many datasets available, Piketty cherry-picked the ones that best fit the u-shaped curve he wanted to show, estimated some missing data points kind of out of thin air, and made some other questionable decisions. The result is a much less pronounced change in inequality, especially in the US.

The paper is pretty confrontational (on his own blog, Magness’ co-author describes Piketty as making “no-brainers…boneheaded historical errors [that] would be shocking if contained in a high school term paper”. Piketty sort of says a few words in his own defense in this article. But one thing I notice is that it looks like, aside from these authors, everyone is working together on this – the author of one of the pro-Piketty datasets was also a co-author of one of the anti-Piketty datasets, and the author of one of the anti-Piketty datasets has worked with Piketty in the past. This suggests to me that a lot of this is legitimately hard and that the same people, working from different methods, get different results. My main takeaway is that there are many different inequality datasets and Piketty used the most dramatic.

Tlaloc on the Discord provides the European log GDP graphs I wanted:

I think it’s fair to ask – what the heck? Taken literally, doesn’t this suggest WWII was long-run good for Europe – that its “recovery” brought it well above trend?

Eyeballing the Maddison Project data elsewhere shows France, Germany, and the US all having very similar growth of 200% between 1960 and 2016.

I need to look into this more, but right now I’m not really buying it.

VPaul doesn’t believe in straight-line GDP growth anyway:

I don’t trust inflation statistics, so I don’t trust inflation adjusted GDP statistics. During the time period covered by Piketty’s GDP growth trend line, there have multiple different methodologies for measuring inflation, with adjustments to fix obvious errors in previous versions of inflation adjusters. Since we know inflation statistics have been wrong, and there is good evidence they are still wrong, I think the steady GDP growth rate is an artifact.

Several people point out that “increasing number of rentiers” is not necessarily bad; after all, this is what the post-scarcity robot future should look like. For example, from Virriman:

A world where 1% of people can avoid drudgery seems preferable to a world where only 0.1% can do that, holding everything else equal. Isn’t the techno-utopian ideal a world where almost everyone is a “rentier”?

Sounds like we need to figure out how to get back to the gilded age, and then figure out how to turn that 1% of rentiers into 2% and keep trying to expand that number.

This could maybe make sense around number of rentiers, but amount of money per rentier could work the opposite direction, and Piketty’s numbers awkwardly combine both.

Paul Christiano on some of Piketty’s other statistics:

The extrapolation in figure 10.11 looks pretty wild. It takes a special something to draw a graph that’s been pretty smooth/predictable historically, then insert a stark+unprecedented regime change exactly at the current moment for no apparent reason. Does he give some justification for the sharp discontinuity?

Claiming that economic growth is always 1-1.5% also seems pretty dubious. According to Maddison’s estimates, which I don’t think are under dispute, worldwide per capita growth first reached 1% around 1900, continued increasing to 2-3% by 1960, and then fell back down to 1% in the great stagnation. You could say “A century is a long time, that’s basically always, the mid-century spike was just a deviation” but elsewhere Pikkety seems willing to write off that same chunk of history as an aberration. Or maybe his argument is supposed to apply only to the US? (Or maybe he includes Europe and then can cite steady growth for 150 years instead of 100? I don’t even think that’s true though, in 1875 I think that per capita GDP growth in Europe was not yet 1%?)

I’m not sure in what sense rentiers can be said to be winning. We can just look directly and see that rents are significantly smaller than wages, the capital share of income is staying around 1/3, it’s grown but only a tiny bit. If 1/3 of GDP is rents that get allocated inequitably then maybe you can increase median income by 25% with perfect redistribution, but that just doesn’t seem that promising compared to efficiency effects, unless you are super concerned about inequality per se (rather than regarding it as an opportunity to benefit poorer people). Even that benefit would shrink as savings rates fall.

If in fact the rentiers grow their fortunes at r, then they will get wealthier and wealthier until r = g, that’s basically an accounting identity. That seems to basically be a reductio of the concern that r>>g can continue indefinitely + rentiers can have their wealth grow at the rate r.

From an efficiency standpoint it seems like the main implication of r>>g is that we could spend 1% of GDP today to make our descendants several percent richer, which sounds like a good deal and suggests that we ought to invest more. It’s pretty wild to respond to r>>g by considering massively disincentivizing investment. If you want to push for equality and think that r>>g, maybe support a sovereign wealth fund? Or else we’d need to decide collectively whether the problem with inequality is that some people are rich, or that other people are poor—I can see how a wealth tax (vs a similarly large consumption or income tax) would help with one of those problems, but not the other. I think it’s just a really bad policy for a lot of reasons with very little to recommend it other than leveling down.

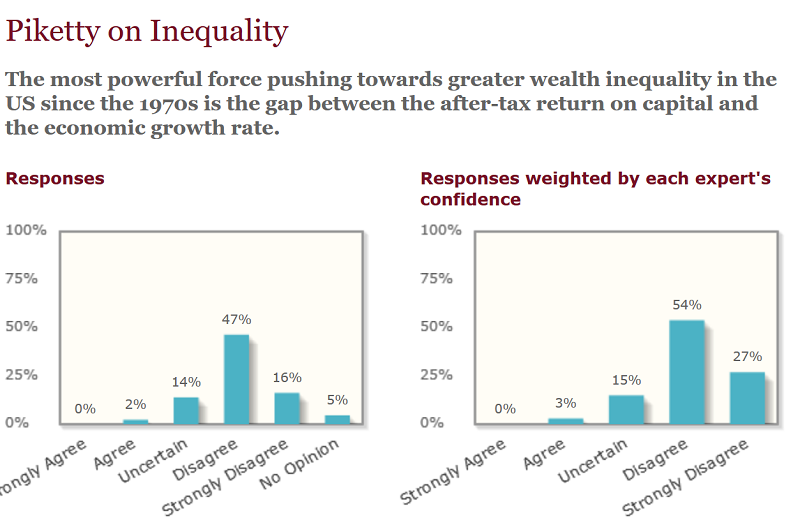

Swami brings up an IGM poll of economists on r>>g:

Overall, it looks like the claim that the super-rich get much better returns on investment than everyone else doesn’t really hold up, except in obvious predictable ways, eg they can take more risks.

The claim that there is a rising rentier class who will dominate the 21st century doesn’t really hold up.

I’m not qualified to say whether Piketty’s empirical data holds up, but there seems to be significant academic debate over it.

And although Piketty’s rules of thumb for growth (g = 1 – 1.5%, r = 4-5%) hold up more than I would have expected before reading him, they still don’t hold up that well.

Now taking recommendations about if anything from Piketty is still worth keeping.

My own takeaway from Phillip Magness’s paper (which also contains a “[..]would discredit a high school history paper[…]” quote in a footnote), is that Piketty is regrettably very political.

For example, he makes basic errors in simple matters like when the U.S. minimum wage was raise, by how much and under which president, and he makes them in a way that shifts the raises from republicans to democrats.

Though Magness doesn’t offer many of these cases, he shows a few, and even one makes it hard for me to take on faith anything else Piketty claims or believe he simply got different results from others using legitimate reasoning.

The Sutch paper mostly contests Piketty’s 19th century data but in the 20th he finds that Piketty actually downplayed rising inequality : “The other remarkable contrast between the alternative series and the trend Piketty presented is that the new series presents a picture of sharply rising inequality over the last 35 years. Twenty-four percent of US wealth was in the hands of the richest 1 percent at the end of the 1970s. By 2012 their share had risen to 42 percent. By contrast the Piketty trend hardly increases from 1990 to 2010. There is an irony here.While intending to demonstrate that inequality has been growing recently, Piketty underestimated the trend.” (p. 603)

Regarding Magness’s claim about the tax code, this vox article gives a summary of the debate and provides a link to the Piketty & Saez response : https://www.vox.com/policy-and-politics/2018/1/10/16850050/inequality-tax-return-data-saez-piketty.

Notice how civil and charitable the debate is and contrast with the tone of libertarians.

For a defense of Piketty I can recommend the several short posts Matt Bruenig wrote when the book came out:

http://www.demos.org/blog/5/25/14/piketty-has-two-separate-income-inequality-theories

http://mattbruenig.com/2014/10/16/how-much-do-economists-understand-piketty/

http://www.demos.org/blog/5/29/14/piketty-and-growth

For a good critique of Piketty coming from the left I like J.W Mason at crooked timber : http://crookedtimber.org/2015/12/15/its-bargaining-power-all-the-way-down/

The issue of competing data findings is very much an open discussion at the moment. I’d urge people to read the Auten-Splinter paper on income inequality measurements since 1962 (http://davidsplinter.com/AutenSplinter-Tax_Data_and_Inequality.pdf), which goes through the differences in their findings and the related tax reporting issues detail.

The related debate over wealth inequality measurements is addressed in my paper as well as Sutch’s paper. Sutch does point to another study by Saez and Zucman (2016) that shows higher inequality than Piketty, but he accepts their findings at face value and does not wade into the mechanics behind them. It’s little more than a “see also”-type citation. The Saez-Zucman paper was only out as a preliminary draft form when my paper (coauthored with Bob Murphy) came out, although we did discuss its strengths and weaknesses when compared to other means of measurement. In the time since then, Wojciech Kopczuk has published a very helpful discussion of the different approaches and the strengths/weaknesses of each here: http://www.columbia.edu/~wk2110/bin/PikettyNYU.pdf

One thing I’d note about Saez-Zucman (2016)’s wealth estimates (as well as an even newer Piketty-Saez-Zucman study of income) is that they’re heavily reliant upon the data series original Piketty-Saez (2003) paper on income inequality. Large parts of both of these later studies are essentially calibrated to the Piketty-Saez (2003) numbers, meaning that they accept its accuracy as a given. That’s an issue itself because the accuracy of Piketty-Saez (2003) is still in question. The Auten-Splinter study is a response to some of the problems with it in the years 1962-present, when data quality is better and alternative measures exist as baselines for comparison.

I’d go one step further though, and argue that Piketty-Saez (2003) is on substantially weaker empirical footing the further one goes back in time. Post-1962 trends are debatable, but pre-1962 trends are marred by all sorts of data problems deriving from both the inadequacy of records and the way that its authors attempt to adjust for internal issues in their series. I’m working on an alternative set of calculations at the moment that covers 1917-1948, correcting for some problems in the way Piketty and Saez handled their source data in the 2003 paper. These amount to differences in the way they handle income from itemized tax deductions, but also their apparant unawareness of two sizable tax exemptions that existed during this part of the series: (1) a broad federal income tax exemption that applied to most state and local government employees prior to 1939, and (2) the Combat Zone Tax Exclusion that exempted most deployed military income during World War II. If you combine the effects of these corrections together it reduces the estimated income share of the top 10% by about five or six percentage points on average for most years until the end of WWII.

If one accepts the validity of these corrections, that translates into substantial differences in shape and magnitude in the early 20th century U-curve. And since the aforementioned later studies are dependent upon the 2003 paper’s data, those differences filter through into almost everything they have written since then.

What exactly is “everything else” that is to be kept equal here? Everything else won’t include the income/wealth distribution. If it includes GDP per capita, then the move from 0.1% to 1% means that the rest have less. If “everything else” is the income/wealth of the 99%, then it seems that gdp growth has only been to the benefit of very few people, which is Pareto superior but debatable regarding fairness.

If you believe all incomes should be equal, then the situation was unfair before, is slightly more unfair after. If you don’t believe that, you need some theory of what a fair distribution is–a theory precise enough to say whether the higher income people before were getting more or less than their fair share. If less, than the change is an increase in fairness, if more a decrease. I don’t think there is such a theory that is generally shared.

Insofar as the attitude is common, it may reflect a conservative bias–whatever is has a special status, so changes are presumptively bad. Or, alternatively, an egalitarian bias–more unequal is automatically more unfair.

I don’t understand which “attitude” you mean to be “common”. My point was mainly to point out that you cannot just say “holding everything else equal” when that doesn’t work. A “theory of what a fair distribution is” would not be applicable in the abstract to the hypothetical example. There is not enough data.

The attitude I was commenting on was “if the income distribution changes in a way that makes incomes more unequal, that is unfair.”

Suppose only one thing changes–someone writes a novel that is a best seller, millions of people buy and greatly enjoy it, and he makes ten million dollars. The income distribution is now a little less equal than it was, but I see no reason to believe that the change is “debatable regarding fairness.”

Which is why you need to start from individual cases, and only then generalize. More successful authors is good, more successful crimelords is not.

The first set of individuals produce something of value, and get money and status in return. The second set take something produced by others, and lay claim to it by force or power. Both have similar numeric affects on simplistic distribution statistics.

To the extent you can classify similar individuals in that way, you have social classes. Then you can talk about how they operate, and how things could be different. And then one you understand that, you can apply moral judgements, or preferences.

Whereas trying to characterize anything useful about a society with 2 or 3 statistical aggregates is not going to get you any further than it would with a physical system that has comparable internal structure.

It occurred to me that the increase in French, etc, baseline might have been due to decreased defense spending with NATO providing more collective defense but quickly eyeballing some graphs they seem to have averaged around 5% before and after WW II.

About letting rich people controlling investment to achieve higher growth:

Higher investment returns only translate to higher aggregate growth if the investments are in value creating endeavors that wouldn’t readily have happened otherwise if the specific investors hadn’t been there.

If the investors were only a tiny bit early compared to others, they may reap high returns without creating much more growth.

More importantly, if the high return investments were not in things that create much value, but instead in things that are good at _capturing_ value, that have moats and network effects that make them natural (or artificial) monopolies then they may actually reduce overall growth (while enriching those that hold all that market power).

It’s possible that many investors who are good at getting returns, are merely good at finding moats and are extractive rather than growth producing. It’s possible that Facebooks returns are mostly based on having positioned itself to be able to extract ad revenues from hundreds of thousands of businesses without having to compete much for their ad dollars. The businesses that need to buy ads would be better off and grow more if there was more competition in the social network advertising space.

A lot of companies seem to be about getting big enough to be able to restrict choices nowadays. They are not always about creating value.

Isn’t the claim that rich people invest better in contradiction with the efficient market hypothesis since it means they would consistently beat the market?

I’m not an expert but I don’t think so. Even the efficient market hypothesis allows for above average returns to those who have unique knowledge, information and expertise compared to others. The EMH only says that as the knowledge spreads, the extra returns should vanish. It also says that the knowledge only needs to spread to a rather small amount of people that compete with each other for the extra returns to vanish.

Edit: to clarify further. My point was not about the market being inefficient in an EMH way. It’s about the case where even if it is efficient, it might be efficient at things that are not growth inducing to the aggregate.

For example, if some of the best returning investments are in groups of organised pick pockets, it will be overall very detrimental to direct more ressources into these types of organizations.

Depends which version of the EMH you believe is true. The weak version allows for fundamental analysis (that is, in-depth understanding of a given investment opportunity, but not statistical analysis of past prices) to make excess returns. It and the semi-strong version both allow for inside information to result in excess returns.

I am by no means an economist. That being said, it looks a lot like the 20th Century is still the reshuffle from the pre-WWI equilibrium to whatever the Clinton boom was.

I’d describe the pre-WWI equilibrium as hybridized colonial mercantilism and capitalism, with various princes and semi-heriditary pseudo-monarchs still running things in places. Differentials in governance accounted for differences in growth between nation-states.

I’ve never seen it written, but (I beleive that) stocks are anathema to flows. “We” saw stocks of physical objects and human capital destroyed in record quantity in the two wars. That is, in a hydraulic macro sense, like building a dam to create a “desert”. Ending the destruction is like releasing the dam. Putting things on a war footing cohered production into laser-like effectiveness.

It just doesn’t last.

“Now taking recommendations about if anything from Piketty is still worth keeping.”

I read Capital in the 21st century not long after it came out, and followed at least some of the subsequent discussion at the time. My two major take a ways may not be necessarily unique to piketty but I think still hold up, which are that:

1) income will tend to concentrate in the hands of relatively fewer individuals at least in some periods (r>g at least sometimes) which will have significant societal implications if this continues for a protracted period. Piketty is more interested in looking at this hypothesis in the form of a universal law, but the subsequent discussion around the book reveals that it is probably not a universal.

2) Events that destroy the value of existing physical capital tend to decrease inequality. in Piketty’s writing war is favored heavily, but I would also think of a smaller version of this happening vis-a-vis technological change.

Housing markets are very important, and as a millennial living in the metropolitan area of a major east coast city, I am sympathetic to the importance of housing’s share of pseudo income (net value added?) having quadrupled since the 1940’s. It is absolutely worth pointing out that just because housing has been the major driver of capital income growth, this does not imply that anything egalitarian is going on. According to some quick googling only about 19.9% of “housing units” are owner occupied without a mortgage. (https://fivethirtyeight.com/features/how-many-homeowners-have-paid-off-their-mortgages/) For those that are mortgaged, my suspicion is much of the income value of the property is captured by the mortgage holder, which in the olden days would have been bankers, but in the modern era of banks following an originate to sell model and mortgage payments being chopped up into mortgage soup (securitized) and sold on to asset managers who in turn pass on that stream of payments to their investors it is these investors who are effectively the mortgage holder. This mechanism sounds to me pretty much like the traditional sort of capital accumulation Piketty is describing, which puts me solidly in the “yes it’s housing but it doesn’t matter” camp.

Instead of landlords directly owning large swaths of property in the old days, effectively something like housing sharecropping is going on where some of the capital value from rising housing prices is captured by owners, and some is captured by after being run through a complex financial funneling system for mortgage payments. This is a better system for the end recipients of the mortgage payments than owning the property directly, because it gives owners an incentive to maintain their property, a burden that would traditionally fall to landlords.

The securitization/originate to sell model for mortgages is actually *quite good* for a mortgage payer that has good intentions for the debt they take on. Almost all significant advances in wealth for a W-2 employee (laborer) come from leveraged investment. A mortgage (for a payer) is effectly a 5 to 1 leveraged investment of the value of the property. Without securitization/financialization of these mortgages, lending criteria would be much stricter. Stricter lending criteria would limit access to homebuying, and considering that if you pay attention to the FIRE community (who are effectively a group of people dedicated to “becoming a rentier as quickly and efficiently as possible”), buying homes is one of the most efficient options available for growing personal wealth.

To give you an example, I am in the process of performing a refinance on my current home – I was offered 3.25% with $38,000 cash-out. (My original interest rate was 3.66 percent, I will vehemently attack government subsidy at every opportunity, but Veterans Administration loans are quite amazing for those who can get them.) After the math is done, I pay approximately $18,000 more in interest over the 30 year loan term. Shoving just $10,000 of those dollars into a FIRE-approved investment fund yields $76,000 or so. This is almost the same thing as saying “I am conducting rate-of-return arbitrage using my home as collateral”, but without securitization, government subsidy (thanks, Taxpayers!), etc I wouldn’t even have ACCESS to this sort of investment.

Now there’s also the common case, which is people take out Home Equity Lines of Credit or Cash-out Refinances and then spend them on pricey vacations, big screen tvs, new cars, etc. However I am not sure people making bad decisions with cheap debt leaves them so much more worse off than removing the ability of people making optimal (or at least decent) decisions with the same cheap debt.

I agree with you that securitization may in fact benefit home buyers, thinking this over a little while I was at the dentist this morning, it’s arguable that a well securitized system may in fact be at least close to a Pareto improvement over the traditional originate to hold style banking.

I think this distracts from my main point though, which is that under both models a significant amount of real-estate income is captured not by home owners but by institutional/wealthy investors, either because the institutional/wealthy investors own shares or have made loans to a bank which owns significant mortgage income under the traditional model, or because they own some kind of mortgage backed security which makes them the beneficiary of mortgage payments under the new model.

Increases in home value are captured by the home owner, not the mortgage holder

I would argue that increases in home buyership increases both parties’ total income and doesn’t affect the distribution. Mortgagers get more total “mortgage debt” to buy, and more home buyers are able to obtain that leverage for cheaper. The real winner is home *builders*.

Correct, but I’m not really interested in who captures changes in the asset value of real-estate, but instead who captures most of the capital income generated by said real-estate. The interest income from a mortgage is captured by investors, changes in the asset value between the point of purchase and the point of future sale are captured by the homeowner.

An increase in the asset price of a home is good for the current home-owner, bad for the potential home buyer (e.g. me, middle income millennial) in almost a zero sum way, and good for investors in that they now able to lend out a larger amount of money against the buyer’s (my) future labor income to cover my now larger financing needs. Which is really the point, that capital income is very slowly crowding out labor income, and this is almost entirely vis-a-vis housing, which means that home owners (especially younger homeowners) are paying more of their income either in rent or traditional mortgage payments. At best the asset mechanism is simply another transfer of wealth from the young to the old in select localities that are popular with the young. By contrast the stream of interest payments is a transfer from workers to investors, and the size of the stream of payments is going up on a per-capita basis.

I’m not sure where to put this for formatting, but I want to point out that failing to take into consideration that discounting “appreciation of a capital asset” as a valid form of capital income doesn’t seem right to me. To give you an example – assuming your home appreciates at 4% (probably higher than that depending on the area) and you take out a loan for $300,000 to buy it at an interest rate of 3.5%, you will have generated (over a 30 year term) $976,000 or so while paying $189,000 in interest (I personally think there is a limit to how much land can appreciate, but given increases in population over time I have no reason to believe that is a universal law of nature).

Now, on the same terms, a homebuyer buying the same house for $500,000 will pay $308,000 for the loan but also generate $1.67m instead of $976,000.

So subtracting the purchase price from those figures: $300,000 yields $676,000 or just more than 200%, by the same token $500,000 yields $1.17m, or just more than 200%. So even as the disadvantaged millenial homebuyer – you would still be winning if you could take that risk. The problem is not that it is a worse deal because it is expensive, it is that access to the good deal is more restrictive due to price constraints on labor income. (The solution to that particular problem is to ressurect my own personal McCarthy on the topic of zoning laws, but my opinion is unpoopular in city planning circles).

This is an excellent point, but I want bring up a few counters that are important.

I buy a house for $300,000 over a thirty year term. After 30 years I am faced with a hypothetical decision, do I wish to sell? If I die in my home the change in the asset price is irrelevant. if I choose to buy another $300,000 home that has also appreciated at 4%/year for thirty years then I’m still no better off as a result of the price appreciation, even though I’m worth much more on paper.

The counter argument I can think of here is: if I am interested /need to go into a nursing home, then selling the house and paying for expensive care (labor costs) may be important down the line, so I don’t want to make it sound like I wouldn’t benefit from appreciation at all, but at some point for that appreciation to be beneficial to me I do have to exit the housing market in some substantial way and I think the benefits will occur only in the very late stages of life over a very long time horizon.

The other point, and this is the one I worry more about is the one you brought up indirectly. House price appreciation forces more and more of my wealth to be tied up in a single very large asset. I can’t diversify away this risk in the same sense as a stock portfolio, so my on paper wealth is very much bound up with housing conditions in my local area. Nationally new household formation is trending downward, and as the baby boomer generation starts to exit the housing market, my suspicion is that further growth in housing prices will slow or potentially reverse, so this kind of growth cannot necessarily be counted on. In a hypothetical steady state of new household formation I could imagine the real value of housing staying flat, at which point I’m still on the hook for the interest without having benefitted from the asset side (though this would also mean that the growth in housing’s share of national income would slow or reverse, which is what I was originally concerned about)

I don’t see anybody mentioning maintenance costs when considering the value of houses. Rough googling gives me an expected life time for a house of forty years, a bit more for apartment buildings. Any home owner knows owning a house is considerably more expensive than having money in the bank. Many places also tax houses specially.

Is it just so obvious that it goes without saying?

What you need is r(1-c)>g, where c is the fraction of the income from capital that is consumed. For someone living entirely on capital income, that is likely to be substantial, whether in mansions and yachts, donations to favored politicians, or charitable contributions.

I’m not much qualified to talk about anything else in this, but I will say that I question your intuition that the US and Europe were about equally rich before WW2. The US had vast wealth and output head and shoulders above Europe in the 1930’s, producing something like half the world’s oil and a huge chunk of its steel. Europe was about as populated but it’s much smaller, has fewer natural resources and was overall less industrially productive.

My gut feeling for this is that you’re correct. I recall reading somewhere that one of the US’s advantages in the war was that we had greater mechanization available to the populace than most of the populace of Europe. It’s easier to teach a guy to drive a tank when he’s been driving a tractor his whole life, and we had more of those guys. Likewise your army can find better mechanics and your platoon can keep its trucks running better if your army has 2-3 times the personal automobile ownership. Of course, you only have more cars, tractors, etc if you are more wealthy. My memory is that US and Germany had around parity in cars / person, and France and the UK were close, but it dropped of pretty steeply after that in most of Europe. The salient anecdote was that some units in the Soviet army would have to abandon trucks that weren’t properly maintained because the men didn’t know how to do it.

This seems relevant:

https://history.stackexchange.com/questions/8510/gdp-per-capita-of-major-combatants-before-and-after-wwii

That’s a WWII anecdote, not really a WWI anecdote. Pre-war means 1913 or earlier.

But even so, USA was well ahead of all but a small fraction of Europe, and ahead of everywhere bar maybe the UK (the exact date that the USA passed the UK depends on your dataset, but it’s either just before WWI or 1914/15 – the economic cost of the first full year of the war definitely put UK behind USA).

Europe’s industrialisation and modernisation was very varied from country to country.

I think your objection is better directed at Futhington, who made the shift in time frame to which you refer.

I’m just agreeing that, pre-WWII, the US was probably wealthier than most of Europe.

But in your (Scott) plot showing increased capital shares, the y-axis is represents capital *income* shares, not “the amount of capital”. So someone merely living in a house and not earning income would not get counted in this plot (i.e. unless they earn rent, or appreciation, etc). So it doesn’t seem to contradict Picketty in the sense you’re suggesting (since there has been a rising share of income from capital over time).

They may be “imputing” income in the form of the rent you would have paid if you didn’t own the house?

That would be standard practice for this kind of data.

Interesting, I did’t realize it would likely include imputed rent.

As you say, the economic history and big-picture thinking of Piketty is worth keeping. The data and models are limited and probably suggest incorrect conclusions, but that’s the drawback of pretty much all data and models. He should have written the book without the math.

If criticism of Piketty has a political upshot, it’s not that “inequality isn’t a problem” but rather “inequality is a solvable problem, not a law of history”. It’s the social market rejoinder to Marxist accelerationism. Tax the wealthy a little more, use it to make average people’s lives a little better, and it’s amazing what you can do.

What, if true, would cause you to believe that taxing the wealthy more and redistributing it to average people was not amazing or good?

What I’m hearing here is, “An intellectual pillar supporting my conclusions is wrong, but the big picture conclusions themselves are still 100% correct.” This is a defensible, possibly correct belief (to claim otherwise is the fallacy fallacy, a false argument does not disprove the conclusion). But putting it like that makes it seem like you’re rotating arguments around the conclusion you want. So I’m curious if that belief is falsifiable to you, or if it’s an unfalsifiable article of faith.

I’m not the person you put the question to, but there are at least two obvious answers:

1. If I was convinced that the wealthy were entitled to their wealth, in the sense Nozick uses in distinguishing entitlement from desert. A possible example would be an author who writes a book that millions of people greatly enjoy. He gets only part of the value he has created, he has violated nobody else’s rights in getting it, so by some views, including Nozick’s, he is entitled to his money, so giving it to someone else is bad.

2. If I were convinced that taxing the wealthy would end up making most people, including the poor, worse off. Reasons why that could be true are pretty obvious.

Certainly. I’m not saying such an argument couldn’t be levied. But I’m a big believer in falsifiability, that an unfalsifiable belief is an article of faith.

My exercise here is to ask someone who has shown a great deal of resilience in the face of contrary evidence what evidence would cause them to change their mind. If it exists, it reveals a great deal about their methods of inquiry and values. If it does not, then it is their faith, and that is to be respected insofar as it goes.

The modern social market economy has proven to my satisfaction that some level of redistribution can eliminate most of the moral atrocities of capitalism while retaining the underlying incentive structure and information transmission mechanisms. It did not have to be the case that Sweden is a nicer place to live than the United States during the Gilded Age. But since it happens to BE the case, that affects my priors pretty substantially.

Alright. I’m not interested in arguing that Sweden is terrible. Sweden is a fine society. My question is what evidence could I bring to you that would make you believe that redistribution and social programs were not good? Would it be that an unfettered capitalist society has to be ‘nicer’ (however you want to define that)? Then what is nicer?

That’s a misleading comparison, because Sweden today is much richer than the United States during the Gilded Age, and it is richer in large part because for much of the intervening period it was a relatively laissez-faire society–more so than most of the rest of Europe.

A better comparison would be between Bismarck’s Prussia, which invented a good deal of the modern mixed economy/welfare state, and England or the U.S. at the same time.

“Chris Stucchio has a different perspective on rich people making higher rates of return:

It’s also worth reflecting on a point which Piketty makes mathematically, but literally never says in words. If rich people are the best investors, then the best way to create economic growth is to ensure that rich people are the ones controlling investment decisions. Intuitively this makes a lot of sense; Travis Kalanick (and now Dara “the D” Khosrowshahi) are a lot better at transportation than the average autowale. Bezos is a lot better at logistics than my local cell phone store.

See also Paul’s answer to one of my objections to this. Right now it looks like (assuming Piketty is right about this at all), Chris has a point. Does anyone want to try to convince me otherwise?”

Seems like the obvious objection to this is that there’s not much correlation between how well people invest and economic growth. Presumably the theory is that “better” investing entails more efficient allocation of resources – startups that would not have gotten funded otherwise do get funded and produce a lot of value maybe. But the problem is that almost all investing is just trading already existing assets around in a way that doesn’t really effect real capital investment. Capital is very cheap these days, and is not really the constraint on corporate investment decisions. Bidding up the price of a stock in this environment at most means larger dividends being paid out to shareholders.

People keep saying this, but… Don’t you see that the market for trading existing assets is a vital part of what you call “real capital investment”? The incentive to invest in an equity share of a new venture would be much smaller if the only possible return was a lifetime of dividends from it, and there were no chance of your investment being sellable to somebody else after it has grown in value.

That seems to obvious to me that I may be missing your point.

A part of the answer to this is almost certainly that if you start a trendline in 1870 it is going to be screwy thanks to the Long Depression. This is what the wikipedia article says about France during that period

This is one of the undersold criticisms of approaches like what Piketty uses- there is no “normal”. If you count war, recovery from war, depressions, recovery from depressions, financial panics and recovery from financial panics there are 30+ year stretches with few or no “normal” years for some countries.

“From an efficiency standpoint it seems like the main implication of r>>g is that we could spend 1% of GDP today to make our descendants several percent richer, which sounds like a good deal and suggests that we ought to invest more. It’s pretty wild to respond to r>>g by considering massively disincentivizing investment. If you want to push for equality and think that r>>g, maybe support a sovereign wealth fund? Or else we’d need to decide collectively whether the problem with inequality is that some people are rich, or that other people are poor—I can see how a wealth tax (vs a similarly large consumption or income tax) would help with one of those problems, but not the other. I think it’s just a really bad policy for a lot of reasons with very little to recommend it other than leveling down.”

This gets at two separate problems. What Piketty is focusing on is the long run pro-inequality effect of r > g. A second point that may be even more important that he doesn’t get into is that r being greater than g implies that we are not investing nearly enough – as you say it would be sensible to keep increasing investment diminishing marginal returns get us to r = g. This is basically the MMT argument – have the government make up for that investment shortfall via money printing and bond issues and thus get the economy to actually run at full capacity rather than based on the amount of investment the private sector randomly happens to produce in any given year.

I hadn’t realised that equivalence between r=g and MMT. Thank you for pointing that out

I don’t see the match between MMT and r=g, so someone else needs to fill in the gap here.

Short-term recession comes from “too little investment” because the economy equilibrates to equate desired savings and desired investments, unemployment be damned. If you have unemployed resources, the government can theoretically step up in and deficit-spend to soak up the desired savings, and the unemployed resources will then be employed.

Long-term shortage of capital is because your people are spend-thrifts. You do not have unemployed resources, so just printing money leads to straight inflation. If you want to increase capital, you need to engage in a totally different set of policies to boost the capital spend, like forced savings schemes. These are typically coupled with financial repression to prevent people from earning a fair share on their savings, to give below markert rate loans to businesses and government.

How is people being sprendthrifts associated with lack of investment. Your savings are the banks’ investments. The problem of lack of investment would be the same as the time-value-of-money. People irrationally value today’s dollars far more than tomorrows dollars, thus spending on nonsense is too high and investment too low (because you dont get your investment dollars till tomorrow).

The demand and supply of investment, like the demand and the supply of other things, are equilibrated by a price–in that case the interest rate paid on investments.

Right, but it’s not an identity that this equilibrium is full employment for the economy. So a “shortage” of investment demand in an economy NOT at full employment is a different kind of “shortage” than what the commenter is referencing (an economy at full employment that he feels is not investing enough).

So you can’t just MMT your way out of it.

With the proviso that I am a loooooong way from being an expert about any of this, my interpretation of this was that they are solving different equations. As you pointed out, the current situation is that the economy balances desired saving and investments, unemployment be damned. MMT proposes that the fundamental equation should be something like production (regardless of the price the goods produced find). It proposes instead balancing capital goods with productive capacity, and the desire for return/investment be damned.

Which now that I put it in those terms sounds kind of … bad? A sort of a work around with lots of unintended consequences that you would only propose when the current system’s ability to distribute wealth is badly malfunctioning.

Can someone expand the MMT acronym? The “MT” seems to clearly be “monetary theory”, but that doesn’t actually help me understand what’s being discussed…

MMT = Modern Monetary Theory.

From the wiki: “The key insight of MMT is that sovereign governments that are the sole supplier of national currency can issue currency of any denomination, and in physical or non-physical forms. Consequently, these governments have an unlimited ability to pay for the things they wish to purchase and to fulfill promised future payments. These government also have an unlimited ability to provide funds to other sectors. Because of this, it is not possible for a government that issues its own currency to be bankrupt.”

It is not a widely accepted idea. Even a person who is an extreme Keynesian like Krugman does not accept it: https://www.webcitation.org/60FIKbbn1

More pithily – Government spending is not limited by, nor should it be accounted in, money, but instead by the real productivity of their economy.

A government can never fail to build any number of bridges, hospitals or powerplants due to money shortages, but only because there are no more concrete or builders to be found, and the point of government cut-backs or expansions are entirely about the supply of labor – You should fire government workers when the private sector needs them, and never, ever allow any significant unemployment, but instead just build things when the private sector fails to provide enough jobs.

Inflation is what happens when you try to push the economy above its actual productive capacity, and until you hit that point, you can just conjure money out of thin air with no down-side because doing so creates an equal amount of tangible wealth.

If you have 4000 unemployed workers, you can pay them with money with the ink still wet to build a nuclear powerplant and that money will not create inflation, because the nation got richer to the tune of one power-station.

The secondary point is that this also works if you are less dirigiste and just send every citizen a check with the total amount equaling the price tag of the power plant – people will spend the money, and employ those workers, still not creating any inflation.

As long as there are workers to mobilize, that is. MMT does not say the government can spend without limit – Once the economy is running full tilt, any further spending translates directly into inflation, and draws workers away from their optimal job allocations, which is bad for the economy – It does not matter that the government is a less efficient employer than the market if it is employing people that would otherwise be idle, but it matters a very great deal if new firms going into buisness during a roaring boom cant find workers for love nor money because the government has 20000 people painting murals on the high-way noise barriers.

– One interesting point: The implication of MMT reasoning is that the inflation of the 70s was simply the direct expression of oil price rises – The oil producing nations went from receiving a very small share of economic output of their customers in return for their raw materials to receiving a much larger one, and that real output came out of everyones pockets in the form of inflation.

Another key thing to remember in all these statistics is that the top end of “labor income” should really be put in the “capital income” category. CEOs make so much money not based on anything to do with the labor market, but because corporate governance is too inadequate to stop them from looting.

I think that is far from settled, and as little as “corporate looting” may have to do with labor, it seemingly has even less to do with capital?

Maybe not the war, but didn’t Western Europe receive a bunch of investment from the US right after the war to help prevent the spread of Communism?

Probably more important was the increase in freedom of trade and movement. For example, https://en.wikipedia.org/wiki/European_Coal_and_Steel_Community https://en.wikipedia.org/wiki/European_Economic_Community seem to have eliminated a lot of trade barriers as early as the 1950s.

There was a lot of capital investment going on, because the kinds of things in which one invests capital had gotten largely destroyed in the war. I think the decrease in trade barriers supported this, as did the Marshall Plan and less-formal investments by private investors who saw market potential.

There was also an efficiency component because much of the old, inefficient means of production had gotten bombed into tiny pieces so this was an unusual period in which virtually every factory was producing with the most modern and efficient technologies.

I’d assume there was also a component of what happened with the U.S. after the war, where we saw benefits from more workforce participation among people who previously had been shut out of many professions (women, ethnic minorities, “lower classes,” etc.)

I’d be interested to see a similar graph for Japan. (And the USSR, but I can’t imagine the existence of a dataset there that would bear any relationship to reality.)

I’ve also seen this as an explanation why the US hasn’t managed to switch to metric: we still have a bunch of machines designed for Imperial, it’s too expensive to replace them all at once, and defection from standards has outsize costs. Everyone else had to start from ~0 anyway, so they might as well go with the new hotness.

I think Mancur Olsen argues somewhere that the war destroyed a lot of institutions that were holding back progress. Consider things such as professional licensing or captured regulation, where over time the ins become better and better at protecting themselves from competition by the outs.

Another thought: being a rentier still generally requires some work. For example, the landlord of an apartment complex is supposed to be responsible for things like maintenance, various property tax things, etc. You can hire other people to do that for you, of course (like a building superintendent), but that eats into your rental profits. And what should rental profits be? Well, if being a rentier pays above-market wages, you should expect people to try to become rentiers, driving down the wage of doing so until its the same as any similar job.

Now, at one point owning and renting land was probably legally barred for anyone but nobility, and our modern system of loans and banking didn’t exist anyway. But these days, if owning an apartment building is economically profitable, someone should be able to get a loan to build more housing and drive down the profit of apartment-owning. It’s only in places with fucked-up markets like the Bay where the people who claim to hate landlords have decided to implement policies which benefit existing landlords at the expense of everyone else that you can’t do that easily.

The only sort of exception would be something where there is no way to increase the supply, like with land, and so a land value tax might be justified. But I’m still confused about how land value works when such disproportionate value is produced on certain small land areas which are pretty much completely interchangeable, and we have more farmable land than we need.

edit: And, if it is the case that housing is responsible for all of the relative increase in capital income, the former effect would be far more important than, say, whoever it is that just happens to own random plots of land under what is now Wall Street, and we can pretty much negate that increase by building more housing.

Economic rent is the payment you receive purely for owning something that produces something, in excess of what it costs to produce that thing. An active landlord is not purely a rentier; some of their income is (in the terms Piketty is using) rent and some is income.

Suppose Alice and Bob own condos and rent them out for $1000/mo, and after paying property taxes they clear $500/mo. If Alice does all the work involved in being a landlord (interviewing tenants, hiring contractors, etc) herself, and Bob pays a property management company $200/mo to do it for him, it might be reasonable* to say that the cost of “producing” a rentable condo is $200/mo, so Alice is receiving $200/mo income from her work as a landlord and $300/mo in economic rent for owning the property. And that’s only true if Alice owns the condo outright; what you’re describing (take out a loan for $X/mo, buy the condo, and rent it out for more than $X) – is mostly labor: income from work exerted converting a less valuable thing (an owner-occupied condo) in to a more valuable thing (a renter-occupied condo).

* but not perfectly accurate, there’re a lot of hairs you could split here, but they’re not very important or interesting because these are supposed to be macroeconomic concepts. At the individual level even the wealthy indolent do a little bit of work, and even McDonald’s cashiers own savings bonds; At the macro level, a rentier lives off the return from invested capital, a laborer lives off wages from hard work, and people in between are in between.

Cost of capital (specifically, normal profit) is also excluded from Economic Rent. If Alice could have made $250/month by investing the cost of building the condo in treasury bonds instead (*), then her Economic Rent is only $50/month.

The idea is that there’s a real opportunity cost for making one investment instead of another, and for investing instead of immediately consuming. And that it makes sense to differentiate between “normal” returns on investment that compensate for risk and opportunity cost and returns in excess of that amount.

(*) Treasury bonds returns actually a floor for normal profit here, used as a proxy for the market’s assessment of risk-free interest rate. A condo is a somewhat riskier investment than treasury bonds, so the “normal profit” rate of return should be higher to compensate for the added risk.

My expectation would be that if that were the case, and there weren’t major impediments to building new condos, then more condos should be built until the price of condos goes down to 700$/month or very close. Is that wrong?

$700/month, plus interest on the cost of buying land and building a condo on it. The return on the cost of the land is still economic rent, since nobody built the land (at least outside the Netherlands), but the condo had to get built by someone.

Most places artificially restrict the supply of housing. A lot. This creates very high rents, but literally and in the economic sense of extracted wealth.

I don’t think that was ever the case in England. Are you thinking of specific examples, and if so when and where?

In Scott’s original article, he mentioned that it was illegal (in some places) for nobility to sell land inherited land (or perhaps it was just a requirement of inheriting it?).

Some land was tied to noble titles – “fee tail” or “entailment”. Other land could be willed or sold exactly the same as now – “fee simple” (the only change in modern law for a freehold fee simple is the requirement to register land ownership)

You could leave land to an heir and create a new entailment, and most entailments had to be renewed periodically (the entailment must vest within 21 years after the death of the creator, ie when it goes to someone born after that, they inherit outright) so it had to be renewed every two or three generations. Usually, each new heir would renew when they inherited, but if one didn’t, then his son could still renew and leave it the entail unbroken.

Some special entailments were created by statute and were permanent and didn’t require renewing.

All fees tail were converted to fees simple in 1925 by Act of Parliament (the general right to a fee tail was created in the same manner in 1285, though some statutory entailments were older than that).

A fee tail doesn’t have to be to a noble title, but it has to use the normal law of inheritance like a noble title (either to heirs male or to heirs general, or to the weird British aristocratic system of eldest son or equal shares to all daughters if there are no sons).

The French system was different – land was attached to a title, but if an aristocrat held more than one title, they could split them between their children so long as the senior title went to the eldest son. There were also various systems that let land be sold but still attached to the title. This was popular because noble land was exempt from property taxes. This was all ended in 1790 in one of the earlier acts of the Revolution.

I think that might explain something that had puzzled me about Ancien Regime French nobility. I’d read that in addition to the “normal” ways of acquiring nobility (inheritance, creation of a title by the monarch, etc), a Frenchman could become Noble by holding an appropriately-sized estate and not paying taxes on it for a certain length of time. I’d assumed that implied tax fraud and thought that noble titles were a peculiar punishment for that, but if “noble land” was exempt from property taxes even if owned by a commoner, the situation makes a lot more sense: instead of being a reward for tax fraud, it’s a recognition of the facts on the ground after a wealthy commoner buys a noble estate from an existing noble.

First, that was one of the commenters, not Scott. And second, the word “nobility” wasn’t used, because it doesn’t apply. People other than nobles could inherit and own land in e.g. Regency England. People other than nobles in fact did inherit and own most private land in Regency England. And they mostly weren’t allowed to sell it.

First, can I only recommend this https://www.youtube.com/watch?v=wNLPO2j9RQ0&t=1744s&frags=pl%2Cwn – note, this is Varoufakis, who’s pretty left-leaning.

Going deeper, there are tons of problems with Piketty’s book and here’s a full critique of a methodology of Piketty by Hendriksson: http://humanevents.com/2015/01/14/assessing-thomas-pikettys-capital-in-the-twenty-first-century/

There are also studies (empirical) on how his inheritance tax and inherited wealth increases inequality https://voxeu.org/article/how-inheritances-influence-wealth-inequality

So:

– he’s been critiqued in regard to the overall essence of points he makes

– he’s methods has been proven “faulty” at best

– there are empirical studies proving conclusions stemming from his theory are wrong

Let’s see… a forty minute Youtube from some guy with an impenetrable accent, a blog pushing Amazon Affiliate links which essentially copy-pastes standard AnaCap/Randian criticisms of anything slightly left of “Absolute Free Market”, and a study whose relevant finding is wedded to the specifics of the tax policy itself (the conclusion of the paper is not “taxes increase inequality”, it’s “the tax Sweden had in place during this study increased inequality” – completely different). The paper even says:

Based on the quality of source #2 and your summary of source #3, I lack the required confidence in your honesty or capabilities to subject myself to forty minutes of a Youtube guy with a thick accent.

The ‘youtube guy’ is Yanis Varoufakis, economist and former Greek finance minister. He even has a wikipedia page https://en.wikipedia.org/wiki/Yanis_Varoufakis

That’s cool. It could be God Himself, I’m still not watching a 40 minute Youtube lecture.

Doesn’t global population growth of 2% during the period throw a serious wrench into Piketty’s calculations? Either the rentier class shrinks in relative size or in relative wealth. It explains most of r-g. Also I am surprised no one has called out Piketty on his ‘rentiers never spend their capital’ statement. Considering the exponential distribution of wealth, this will by definition not be true for for the average rentier.

TBH his whole argument strikes me as deliberately deceptive. To channel Taleb, any taxi driver could tell you that the average person is better off today under capitalism relative to the rich than 500 years ago under feudalism.

I’ve heard claims startlingly often from people who should know better that the working poor (not the average person, but still a claim in the same ballpark) today are as badly off or worse-off than medieval peasants. I think the extreme poverty (by today’s standards) of the past is vastly underappreciated by people who haven’t taken a particular interest in economic history or history of everyday life.

I’ve also had someone try to insist to me that in Victorian England, the “average person” had servants (plural). Even discounting the masses of urban laborers and yeoman or tenant farmers who made the bulk of the population, it’s only possible for the average person to have servants if you don’t count the servants as people, or if you use a very loose definition of “having servants” that allows a cyclical graph of servants serving one another.

That reminds me of my father’s story of a conversation with a Polish economist. The economist said he still believed in socialism, but you needed the right conditions. You needed a society where everyone had a house, and a car, and a maid.

“Including the maids?”

“Including the maids.”

Ha!

In Victorian England, most daughters of working-class families worked as maids from the age of 13 or so until they got married. At least some of them might have employed maids when they were older.

So we’re very close; once we have robot maids, we can make it work (well, assuming the robot maids don’t need maids of their own).

Perhaps they meant the average *household* had servants?

You’ve previously acknowledged that your comment section skews right wing more than your reader base in general. Even if it seems like there’s commenter consensus against Piketty, I’d still be skeptical that that implies general economist consensus. The IGM graph also points that way, but is only about the r>g thesis, and not his data or other analysis.

I’m not an economist and I can’t really speak with authority on the object level arguments here. But on other subjects where I do have some expertise, the right-wing bias feels evident to me.

Taken literally, doesn’t this suggest WWII was long-run good for Europe – that its “recovery” brought it well above trend?

First thing that comes to mind is “rebuilding industry and infrastructure from scratch with newly formed, confident governments without that much baggage” is a great way to get rid of old deadweight and inefficiency compared to pre-war conditions.

(“All the old factories that were competitive enough but not great got blown up or ransacked; the new ones are built to the most modern standard and have brand-new machinery.”)

More likely that “All the old bureaucracies that were competitive enough but not great got blown up.”

One problem of prolonged prosperity and peace is complacency and inertia.

There is a difference between inequality in money and inequality in land/items/time.

If one guy owns 50% of all land and decides to do just leave it empty so that the rest of the world is forced to live on the other 50%, that is a problem.

If one guy owns 7000 sportscars and never uses them, like the sultan of brunei does, that is a problem. Not only can no1 else use these cars but a lot of time has been wasted building them.

But if one guy owns 50% of all the worlds money supply, is that a problem?. Money is just a number in a table, it isnt real. Only when it is traded for time or items it becomes real. Bill Gates keeps the majority of his wealth in stocks. He is rich on paper but in reality the inequality isnt really there. He doesnt own a extreme amount of land or luxury items. All his wealth gives him is the ability to influence how the people that work for the companies he invest in spend their time. If he invests it all in companies that make luxury items or do something wasteful that would be a huge net negative for the world, as the time of the people working there could be spent elsewhere instead. If he invests it all in companies that try to improve the world, it could be a huge net positive. If he decides to give 100% of his wealth to the poor, what happens? Well, those poor people can now suddenly afford to buy stuff they couldnt before, like haircuts. But som1 has to come and give them those haircuts, some1 that used to spent his time in a different way. The time is zero-sum, it has to come from somewhere, so what happens is the haircut guy who used to give haircuts only to the rich now suddenly has more potential customers. This means he will raise his price, so the haircuts will become more expensive. This means the net effect of Bill gates giving all his money away would be that the people receiving it would be a bit better off in the short term, in exchange for the rest of the world being a bit worse off. Innovation would slow down a bit which would also hurt the people of the future.

In the end inequality in money is mostly a problem when the people who have the money make poor decisions. A upper class that wastes time to create and consume a ton of useless items is a problem. A group of ultra-rich that invests all their wealth in stocks is a net positive if they have good intentions. In a sense capitalism works as a filter for intelligence. People first prove themself capable by creating great companies or doing something smart that makes them wealthy, then afterwards get to buy and direct peoples time by investing in stocks, choosing which companies and ideas to supports, which to dismiss, influencing the direction in which humanity goes forward. Sure, if the rich are super selfish and invest all their wealth in low-probability chances to increase their own lifespan by a few years, that would be a huge problem. But I think most of them have reasonably good intentions as of now? Raising the wealth tax means redistributing the decision-making from the smart to the less smart.

How is this

different from this

? If the influence leads to wasted or backwards effort?

Yes if the influence leads to wasted effort its the same, but under capitalism the richests people are usually the ones that are most capable of determining which efforts are wasted and which efforts are beneficial, as this is how they got rich in the first place. Contrast this with the sultan who was born into his wealth and didnt have to proof himself first. So its a game where the most capable people naturally end up in the positions with the most influence, as long as their intentions are good that can be a good thing.

The reason the rich get better rates of return, in part, is that the SEC forbids anybody but the rich to invest in the riskiest (thus potentially highest paying) investments. Not metaphorically, the SEC literally forbids anyone with a net worth or annual income under a certain amount to invest in certain investments, and that is their sole criteria.

https://en.wikipedia.org/wiki/Accredited_investor#United_States