[Epistemic status: I am not an economist. Many people who are economists have reviewed this book already. I review it only because if I had to slog through reading this thing I at least want to get a blog post out of it. If anything in my review contradicts that of real economists, trust them instead of me.]

I.

Thomas Piketty’s Capital In The Twenty-First Century isn’t just a book on inequality. It’s a book about quantitative macroeconomic history. This is much more interesting than it sounds.

Piketty spent decades combing through primary sources trying to get good statistics for what the economies of various Western countries have been doing over the past 250 years. Armed with these data, he tries to put together a theory of the very-long-term forces at work in economic change. His results touch on almost every big question in politics and economics, and are able to propose sweeping theories where other people resort to parochial speculation. While more knowledgeable people than I are probably already familiar with much of this, I used him as an Econ History 101 textbook and was not at all disappointed in the results.

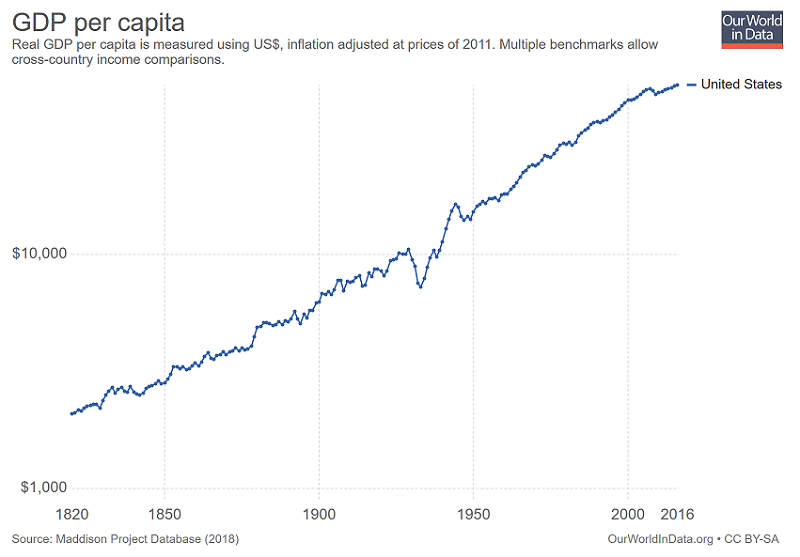

The most important thing I learned from Piketty is that since the Industrial Revolution, normal economic growth has always been (and maybe always will be) between 1% and 1.5% per year. This came as news to me, since I often hear about countries and eras with much higher growth rates. But Piketty says all such situations are abnormal in one of a few ways.

First, they can have high population growth. Population growth will increase GDP, and it will look like a high economic growth rate. But it doesn’t increase GDP per capita and it shouldn’t be considered the same as normal economic growth, which is always between 1% and 1.5% per year.

Second, they can have temporary bubbles. This definitely happens, but after the inevitable bust, the whole period will eventually average out to 1% to 1.5% per year.

Third, they can have “catch-up growth”. This is a broad category covering any period when a country that was previously underperforming its fundamentals gets a chance to catch up. This can happen after a long war in which a devastated country gets a chance to rebuild. Or it can happen after dropping communism or some other inefficient economic system, as the country transitions to a more practical form of production. Or it can happen when a Third World country globalizes and gets the benefits of First World technology and organization. But if a country is at peace and on the “technological frontier” (ie one of the highest-tech countries that has to invent its own advances and can’t get them by osmosis from somewhere else), it will always have growth of 1% to 1.5% per year.

For most of the 20th century, one or another of those conditions has been true in most places. Whether it was the Baby Boom in the US causing high population growth, or the dot-com boom, or Germany and Japan’s decades of miraculous economic recovery after World War II, or China’s catch-up growth after Deng Xiaoping’s liberalization, people have gotten growth of more than 1% to 1.5% per year and learned to expect it. In the Third World, which continues to experience good catch-up growth, their expectations will probably be met. In developed countries, they are bound to be disappointed.

Piketty uses this point to construct a super-ambitious zoomed-out version of 20th century history. Everything was going normally until the two World Wars, which devastated Europe and Japan, but set the US back only slightly. The US and Britain had the Baby Boom and minor catch-up growth, meaning a pretty great 1950s. Continental Europe had the whole process of rebuilding their economy from the (sometimes literal) ashes, a period the French called the Trente Glorieuses (Thirty Glorious Years) of near-constant economic boom. Around the 1970s, the US and Britain realized that Continental Europe and Japan were doing much better than they were, what with their near-constant economic boom, freaked out, and decided their economies were somehow rotten; this led to Thatcher and Reagan getting elected on a platform of cleaning up the economy. Around the same time, Europe recovered fully from its devastation and went back to normal economic growth; Japan, which had been a bit more devastated, took another few years but then had its own bust and went back to normal (or subnormal) growth. The US and Britain, seeing that they were now “caught up” to their Continental and Japanese competitors, declared “mission accomplished” and gave Thatcher and Reagan the credit. Since then it’s mostly been smooth sailing, with the normal 1%-1.5% + population growth (which works out to a little bit more in the US and a little bit less in Japan, given these countries’ high and low fertility rates respectively).

I don’t fully understand this theory. It proposes a very long time for Europe to get over World War II, which doesn’t really match graphs that show the GDP rebounding basically immediately even in the hardest-hit countries (maybe it would be more revealing if I had a log graph like the US one above, so I could do more than try to eyeball the trend). It also suggests that Americans judge the state of their economy by comparing it to Europe (or at least did in the 1970s), which doesn’t really match how most people I know think. In particular, in 1990 they would have had to have said “Our economy is now equal or better to the Europeans, we’re happy now” when this was entirely a function of Europe cooling down and didn’t involve any improvement in the US economy at all. Still, this is a persuasive model and one of the only ones I know that makes sense of the straight line graph above.

II.

All this is just exposition. Piketty’s main focus is inequality between labor and capital, and he starts with the idea of the rentier.

A rentier – an old word I’m surprised we don’t have a better-known modern equivalent for – is something like the strict sense of “capitalist”: a person who lives off the interest on savings instead of working. Trust-fund kids who live off dividends from investments, landlords who live off literal rents from their properties, and aristocrats who lived off the profits from their estates are all rentiers.

It’s fitting that Piketty uses an old word, because rentiers were more common and more important in the old world than they are today. Although he presents tables of statistics proving this is the case, Piketty also urges us to consider Jane Austen novels for a more intuitive sense of the situation. Few of her characters work honest jobs besides occasionally some sort of vague “managing investments”. They’re all obsessed with their dowries and their families’ endowments. That’s because they live off the interest of their principal, which usually stays the same throughout their life and which often comes from a dowry. Some of these people are titled aristocrats, others are “gentry”, others might not have qualified for either role – but they all live off interest.

Piketty (himself a Frenchman) also cites this passage on 19th-century French novelist Honore de Balzac’s Pere Goriot:

The darkest moment in the novel, when the social and moral dilemmas [Eugène de] Rastignac faces are rawest and clearest, comes at the midpoint, when the shady character Vautrin offers him a lesson about his future prospects. Vautrin, who resides in the same shabby boardinghouse as Rastignac and Goriot, is a glib talker and seducer who is concealing a dark past as a convict, much like Edmond Dantès in Le Comte de Monte-Cristo or Jean Valjean in Les Misérables. In contrast to those two characters, who are on the whole worthy fellows, Vautrin is deeply wicked and cynical. He attempts to lure Rastignac into committing a murder in order to lay hands on a large legacy. Before that, Vautrin offers Rastignac an extremely lurid, detailed lesson about the different fates that might befall a young man in the French society of the day.

In substance, Vautrin explains to Rastignac that it is illusory to think that social success can be achieved through study, talent, and effort. He paints a detailed portrait of the various possible careers that await his young friend if he pursues studies in law or medicine, fields in which professional competence counts more than inherited wealth. In particular, Vautrin explains very clearly to Rastignac what yearly income he can aspire to in each of these professions. The verdict is clear: even if he ranks at the top of his class and quickly achieves a brilliant career in law, which will require many compromises, he will still have to get by on a mediocre income and give up all hope of becoming truly wealthy:

“By the age of thirty, you will be a judge making 1,200 francs a year, if you haven’t yet tossed away your robes. When you reach forty, you will marry a miller’s daughter with an income of around 6,000 livres. Thank you very much. If you’re lucky enough to find a patron, you will become a royal prosecutor at thirty, with compensation of a thousand écus [5,000 francs], and you will marry the mayor’s daughter. If you’re willing to do a little political dirty work, you will be a prosecutor-general by the time you’re forty.… It is my privilege to point out to you, however, that there are only twenty prosecutors-general in France, while 20,000 of you aspire to the position, and among them are a few clowns who would sell their families to move up a rung. If this profession disgusts you, consider another. Would Baron de Rastignac like to be a lawyer? Very well then! You will need to suffer ten years of misery, spend a thousand francs a month, acquire a library and an office, frequent society, kiss the hem of a clerk to get cases, and lick the courthouse floor with your tongue. If the profession led anywhere, I wouldn’t advise you against it. But can you name five lawyers in Paris who earn more than 50,000 francs a year at the age of fifty?”

By contrast, the strategy for social success that Vautrin proposes to Rastignac is quite a bit more efficient. By marrying Mademoiselle Victorine, a shy young woman who lives in the boardinghouse and has eyes only for the handsome Eugène, he will immediately lay hands on a fortune of a million francs. This will enable him to draw at age twenty an annual income of 50,000 francs (5 percent of the capital) and thus immediately achieve ten times the level of comfort to which he could hope to aspire only years later on a royal prosecutor’s salary (and as much as the most prosperous Parisian lawyers of the day earned at age fifty after years of effort and intrigue).

The conclusion is clear: he must lose no time in marrying young Victorine, ignoring the fact that she is neither very pretty nor very appealing. Eugène eagerly heeds Vautrin’s lesson right up to the ultimate coup de grâce: if the illegitimate child Victorine is to be recognized by her wealthy father and become the heiress of the million francs Vautrin has mentioned, her brother must first be killed. The ex-convict is ready to take on this task in exchange for a commission. This is too much for Rastignac: although he is quite amenable to Vautrin’s arguments concerning the merits of inheritance over study, he is not prepared to commit murder.

What is most frightening about Vautrin’s lecture is that his brisk portrait of Restoration society contains such precise figures. As I will soon show, the structure of the income and wealth hierarchies in nineteenth-century France was such that the standard of living the wealthiest French people could attain greatly exceeded that to which one could aspire on the basis of income from labor alone. Under such conditions, why work? And why behave morally at all? Since social inequality was in itself immoral and unjustified, why not be thoroughly immoral and appropriate capital by whatever means are available?

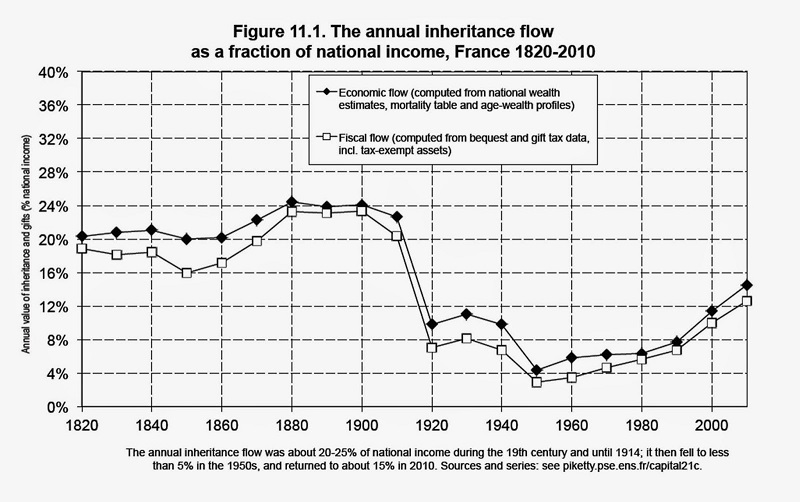

Piketty’s figures show that rentiers became more and more powerful from the 1700s all the way until the Belle Epoque (early 1900s), then declined precipitously around the period of the World Wars. What happened?

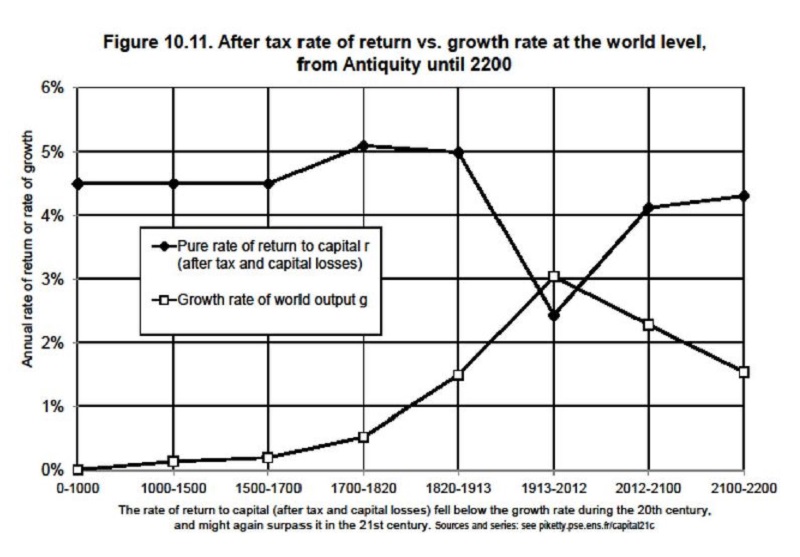

This is where he brings in his famous inequality (no pun intended) r > g – that is, the rate of return from capital is greater than the growth rate.

Rentiers’ money grows with the rate of return on capital. As they get profits/dividends/rent/interest on their capital, they consume some fixed fraction of it and add the rest back to their principal. As their principal grows, so does their yearly income. If they have enough money (and most of them do), the amount they consume even in a very luxurious lifestyle will be trivial, so we can approximate this by saying their income grows at the rate of return.

(One of the few checks on this process is population growth among the rentier class – if a rentier has five children, he may have to consider splitting his fortune five ways, which would mean that the fortune of each individual rentier decreases by a factor of five each generation. This means the growth of rentier power is strongly influenced by population growth, which will become important later.)

Laborers are assumed to have few savings and live a hand-to-mouth existence. Their income grows whenever they get a raise. So the growth of their income is approximated by the GDP per capita growth rate.

In ordinary times, the rate of return on capital always averages about 4% – 5% per year, and the GDP per capita growth rate always averages about 1% to 1.5% per year. So in ordinary times, rentiers’ yearly incomes should always be pushing further and further ahead of laborers’, and inequality should always increase. This is exactly what happened between the 1700s and 1914.

During crises – especially wars and economic busts – the situation reverses. If a rentier invests all his money in a factory, and the enemy bombs that factory, the rentier is broke. The laborers in the factory are also pretty unhappy, but they have the opportunity to get a job in a new factory when the war ends, in a way that the rentier – whose family might have spent several generations accumulating their capital – might not. The same is true of hyperinflation: laborers will get paid hyperinflated wages to spend on hyperinflated goods – but rentiers, who might have their money in currency-denominated investments like government bonds, can lose decades of careful fortune-gathering. Finally, if the government decides to respond to the crisis with confiscation of resources, or wealth taxes, or any interference in the economy, it’s likely to be the rentiers who are hardest-hit. Because rentiers’ wealth takes decades or generations to accumulate, but laborers live hand-to-mouth, a crisis lasting five years will give laborers a bad five years (after which they’re in the same position as pre-crisis), but can ruin rentiers completely. The period 1914 to 1945 – containing two World Wars and the Great Depression – was an unprecedented prolonged multi-crisis that caused “the collapse of the rentier world”.

On the other hand, since World War II the First World has had fifty-plus years of relative peace and prosperity. The last few decades have seen decreasing population growth and tax cuts for the upper class. These are the perfect conditions for the rentier class to make a return, and this is exactly what the data show.

…sort of. If you measure in capital/income ratio, rentiers are doing pretty well. If you look at inequality, it’s pretty high. If you look at various comparisons of share given to capital vs. labor, capital is coming out on top. But then where are the rentiers? Aside from occasional jokes about trust-fund kids, you rarely hear about them. And Piketty’s own data confirm that only the top 0.1% of the population makes most of their income from capital, compared to the entire top 1% back during the Belle Epoque.

I’m not sure about this, and for a point which is kind of the center of his entire argument, Piketty doesn’t seem too sure either:

We need to understand the reasons for this long-term change, which are not obvious at first glance, since I showed in Part Two that the capital / income ratio has lately returned to Belle Epoque levels. The collapse of the rentier between 1914 and 1945 is the obvious part of the story. Exactly why rentiers have not come back is the more complex and in some ways more important and interesting part. Among the structural factors that may have limited the concentration of wealth since World War II and to to this day have helped prevent the resurrection of a society of rentiers as extreme as that which existed on the eve of World War I, we can obviously cite the creation of highly progressive taxes on income and inheritances (which for the most part did not exist prior to 1920). But other factors may also have played a significant and important role.

If I understand Piketty right – and reading a bit between the lines – I think there are at least three things going on.

First, there’s more of a middle class these days. The middle class doesn’t entirely live off capital, but they have some savings and investment. Instead of 1% of people making all their money off capital, we have 30% of people saving for retirement and living off the profits of their nest egg.

Second, there are more super-rich “laborers”, for a broad definition of laborer that includes CEOs of big corporations. If we’re talking about how far in the income distribution you have to go before you get to rentiers, having a bunch of super-rich laborers screws up that statistic. I don’t think Piketty presents the more interesting statistic of what percent of people are rentiers, and I’m not sure why not. These people not only muddle the statistics, they also get much more media attention. When we talk about rich people, we talk about Bill Gates and Jeff Bezos, not the nth-generation scion of the Rockefeller family.

Third, capital is increasingly owned by institutions. There are hundreds of billions of dollars tied up in the endowments of top universities, and trillions tied up in the sovereign wealth funds of oil countries like Norway and Saudi Arabia. These don’t look like a particular individual walking around in a top hat and monocle, but they still distort the flow of money away from people who work for it and toward the people lucky enough to be part of the relevant institutions.

But if Piketty is right, if there’s no crisis then rentiers’ share of the pie will continue to increase. Either it will eventually overwhelm these considerations, and we’ll wake up one morning and notice we have an idle hereditary nobility again. Or it won’t overwhelm these considerations, and more and more of the pie will go invisibly to people other than average laborers, without any conspicuous signs of what’s happening.

III.

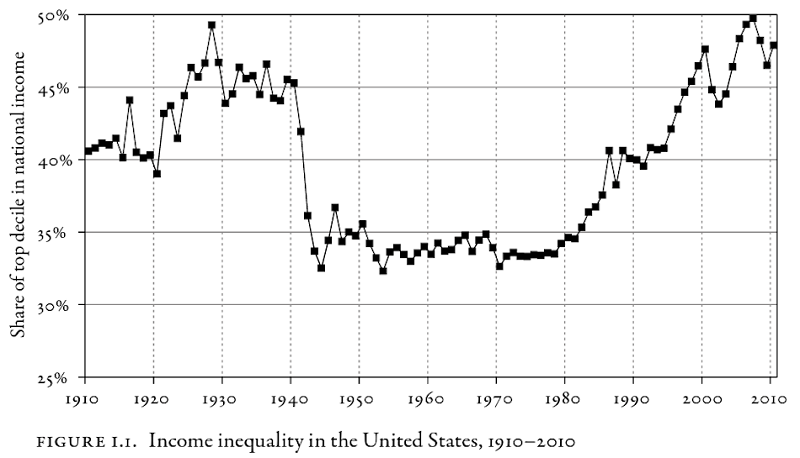

Along with rentier-vs-laborer inequality, Piketty touches on income inequality among labor (remember, “labor” includes anyone who works a job, including CEOs).

He confirms what everyone already knows: the share of the top 10% (especially top 1%) has been increasing for decades now. This is most pronounced in the Anglosphere, but still happening somewhat in Continental Europe and Japan.

He addresses an argument made by supporters of high CEO salaries: might there not be a good economic justification for paying these people a lot? Suppose that having the best candidate (rather than the second-best candidate) as CEO increases your company’s profits by 1% – surely a plausible number. And suppose your company makes $10 billion/year. Then having the best CEO would increase your profits by $100 million. So two companies in a bidding war for the best CEO ought to be willing to offer them a salary of up to $100 million/year to join.

Piketty isn’t buying it. This isn’t really his area of interest, so he doesn’t throw the same overwhelming level of statistical artillery at it that he does at some other things, and I don’t consider him to have proven it beyond doubt in the same way as some of his other conclusions – but he makes a few strong arguments. First, there are no signs that this situation is more true in the past few decades or in the Anglophone world, but these are the only places where CEOs get paid so much. Second, with appropriate caveats and controls there are no signs that good CEOs get paid more than bad CEOs. Third, CEO pay seems to clearly increase because of some factors outside of CEOs’ control, for example in an economic boom (though wouldn’t this increase company profits, and so be consistent with the 1% scenario above?)

He thinks that executive salaries have increased because – basically – corporate governance isn’t good enough to prevent executives from giving themselves very high salaries. Why didn’t executives give themselves such high salaries before? Because before the 1980s the US had a top tax rate of 80% to 90%. As theory predicts, people become less interested in making money when the government’s going to take 90% of it, so executives didn’t bother pulling the strings it would take to have stratospheric salaries. Once the top tax rate was decreased, it became worth executives’ time to figure out how to game the system, so they did. This is less common outside the Anglosphere because other countries have different forms of corporate governance and taxation that discourage this kind of thing.

This matters not just because it produces income inequality, but because today’s income inequality is tomorrow’s rentier-vs-laborer inequality. A CEO who earns $5 million per year can make $50 million, retire, invest the money, and pass the fortune on to their children. The more giant fortunes like this are around, the more rentiers there are in the next generation and the more inequality perpetuates itself.

Piketty is especially afraid of very large fortunes because of his fascinating data showing that these grow more quickly than other fortunes. Using the Forbes rich list, he calculates that Bill Gates et al must have grown their fortunes at rates approaching 8% – 10% per year – far higher than the 4% – 5% rate of return on capital Piketty usually uses. Forbes is a pretty sketchy data set, but he finds the same thing with the largest college endowments. The richest colleges, like Harvard and Yale, see their endowments grow at 10.2% yearly. Somewhat rich colleges (= $1 billion) grow at 8.8%, medium-rich colleges (= $500 million) at 7.8%, middling colleges (= $100 million) at 7.1%, and the poorest colleges (= $100 million) at 6.2%. And all of these do better than the average person saving for retirement, who – again – gets about 4% to 5%.

Piketty suggests this is because the richer you are, the more economy of scale you have in hiring really good financial planners. I am a little confused how this interacts with the conventional wisdom that experts are crap and you should invest in index funds, but I think the financial planners Piketty talks about aren’t people who are very good at picking which stocks will go up, but more like people who know a guy who knows a guy in Singapore who can use your money to fund an unlisted Burmese mining project nobody else in the West has ever heard of.

I’m still confused why there isn’t a mutual fund that lets retirees pool together their money to give it to one of these people. Part of the answer must be “there are only so many unlisted Burmese mining projects”, but then how do economies of scale help exactly? Piketty doesn’t answer, almost as if he is more interested in explaining the dynamics of inequality than in providing me personally with investment advice.

IV.

Taken together, all of this suggests a gloomy conclusion.

Income inequality can be expected to remain high. This will produce further rentier-vs-labor inequality, which conditions are already right to exacerbate. Not only will rich people separate from poor people, but the super-rich will separate much faster from poor people and even from other rich people. As more and more fortunes accumulate, we will get either the sort of rentier society typical of Europe in the 19th century, or a covert version of the same where the profits of rent go invisibly to various people connected to rentier institutions.

Piketty suggests the obvious direct solution: a global tax on wealth. He is okay with having this be merely nominal on fortunes up to hundreds of thousands of dollars, but he wants it to be significant on larger fortunes, and punitive on the largest fortunes. This will help prevent these from growing exponentially at the rate of return and prevent the rebirth of rentier society.

He is pessimistic about this ever working, because if any country does it unilaterally, rentiers can just move their wealth to another country. He suggest an EU-wide tax, but I do not entirely understand his reasoning for why Europeans wouldn’t then just move their wealth to the Cayman Islands or one of the many other perfectly good banking systems that are not in Europe.

He does give measured praise to the US system, including the FATCA laws, which place penalties on any country that don’t report the details the US needs to tax American citizens’ holdings in those countries. I think he hopes Europe could pass a law like this, but stronger.

I agree with his pessimism. Absent a World War level crisis that would make for a cure worse than the disease, it’s hard to imagine everyone coming together to solve the sorts of problems Piketty brings up. I believe his predictions are likely to come true, with little chance of governments having the will to push a solution.

If a wealth tax itself is impossible, there are other things that might help a little. I can’t help but note that solving the housing crisis would be a big help here. Rents go directly out of the pockets of laborers and into the pockets of landlords, and are probably the biggest such transfer in today’s economy. Anything that lowers them has a big effect on the rentier-vs-laborer balance.

College is another big way that laborers get into debt. Although much of the debt is low-interest and government-owned, not all of it is, and even when it is this is scant consolation to the people who have to pay it.

Finally, one of the historically most important ways to decrease the power of rentiers is to increase birth rates, so they are forced to split their fortunes many ways every generation. Right now the birth rate of the rich is at historic lows. This might offer a point of agreement between rentier-fighting liberals and conservatives, who are already concerned about declining birth rates. Unfortunately, the main proposed solution to low population growth – giving workers better maternity leave – is likely to miss the rentier class entirely. I’m not sure what kind of policies might better target them.

So as not to end on a completely pessimistic note, I want to mention three causes for optimism I found in Piketty.

First, if we believe Piketty’s data, there is no Great Stagnation, at least not in economic growth. Piketty argues that (outside of special circumstances) economies always grow at 1% – 1.5% per year, and First World economies are currently growing at 1% – 1.5% per year. If we expected them to grow more, it’s because we’re not adjusting for falling birth rates, or getting too excited by passing booms and busts, or comparing them to catch-up-growth like in China. Whatever our sins in terms of decreased innovation and efficiency, they have not yet hit the economic growth rate.

Second, catch-up growth provides a powerful force for reducing inequality between nations. Given enough time, the US economy will keep growing at 1% to 1.5% per year, and sub-Saharan African economies will keep growing at 3% to 8% per year. Will this continue until the latter have caught up entirely? Unclear. Reviewers of this post have mentioned Acemoglu’s theory of entrenched inequality due to poor institutions, Sachs’ theory of entrenched inequality due to disease burden, and Jones’ theory of “hive mind” style entrenched inequality, as reasons why full catch-up might be hard. But all of these factors can potentially be improved with a growing economy, so they are not causes for total defeatism. Capital In The Twenty-First Century has overall made me more optimistic about the prospects for Third World catch-up.

The third thing that impressed me about the book is that we can talk about these kinds of things at all. Reading Piketty feels closer to reading real science – the type where there are universal laws that make clear predictions – than most economics or social science I’ve read. Marx liked to say he had discovered the universal laws that govern history; Piketty’s claims are only slightly more modest, but much more believable. They make the actions of individuals seem very small – one recurring theme is some faction taking credit for improving the economy or fighting inequality when economic fundamentals meant things had to change then regardless of what anybody did.

But they also suggest points of leverage. I don’t know if good economists knew all this stuff already. But I didn’t, and learning it makes me more optimistic that we might one day find a way to solve the problems Piketty talks about. Even if his wealth tax doesn’t work, he has good explanations of all the other factors that contribute to inequality and what would happen if we changed each. Now it’s just a matter of political will.

And although that’s a pretty big “just”, I hope that maybe the move to a society of rentiers will change the political calculus enough to make people take these problems more seriously. I complain about attacks on “meritocracy”; maybe we can see how much people like hereditary rent-seeking, and whether getting rid of that makes a better rallying cry. Maybe “everyone productive vs the idle rich” will make for less toxic politics than “people who earn more vs. people who earn less”. I can always dream.

It’s important to note the major statistical corrections that have been made to Piketty. The first one – which more or less kills Piketty’s thesis – is that the primary driver of r > g is housing wealth. The big problem here is middle class NIMBYs, not upper class rentiers.

http://mattrognlie.com/piketty_diminishing_returns.pdf

Strangely, on a few occasions, Piketty explicitly supports middle class rent seekers (such as taxi drivers and occupational licensing).

It’s also worth reflecting on a point which Piketty makes mathematically, but literally never says in words. If rich people are the best investors, then the best way to create economic growth is to ensure that rich people are the ones controlling investment decisions. Intuitively this makes a lot of sense; Travis Kalanick (and now Dara “the D” Khosrowshahi) are a lot better at transportation than the average autowale. Bezos is a lot better at logistics than my local cell phone store.

The conclusion of this is that if we take Piketty’s suggestions, we will all be poorer.

I can’t figure out why he never spells this out in words that reporters could understand.

Does he claim rich people are the best investors? I thought he claimed there were economies of scale to investment which rich people (who have large-scale money) take advantage of. As I mentioned above, I’m very confused how this could be, and I can’t have an opinion on it until I figure it out.

Thanks for the link; do you know if Piketty accepts the criticism?

I did hear something about the criticism and that Piketty had some kind of answer to it, i.e. he didn’t accept the conclusion. I don’t remember having a sense of who was right. I’m not an economist either so what do I know anyway.

It doesn’t matter. Whether it’s due to intrinsic skill on the part of rich people or merely due to economies of scale, the best way to grow the economy (according to Piketty) is to have wealthy individuals controlling large investments.

The only other way one might gain the economic growth without large inequality is if there existed a “mutual fund that lets retirees pool together their money to give it to one of these people [the guys with secret mines in Burma]”. But if such a fund existed, then most of the concerns Piketty raises would be mitigated – middle class people would be the people receiving capital income.

(As a person who’s peripherally connected to the financial sector, I can tell you the main reason this mutual fund doesn’t exist. A fund manager who can do this would prefer to invest as much of their own money as possible and as little of others. This fund manager then becomes a wealthy person who’s intrinsically good at directing investments.)

I don’t know of any response by Piketty.

Another good critique is by Nassim Taleb: https://medium.com/incerto/inequality-and-skin-in-the-game-d8f00bc0cb46

Piketty seems to have captured the Zeitgeist very well. But it’s unclear to me which specific claims of his I should take seriously. Everyone says this work is super important. But I kind of wish the people saying this would state specifically which claims they find important, and which specific claims must be refuted in order to make Piketty unimportant.

R > g seems to be caused mostly by housing wealth accruing to the middle class, so Piketty’s claims that this drives inequality must be false. His narrative about Jane Austen style rentiers is refuted by examining the Forbes 400. Taleb also has solid critiques of his stats correctness.

As an American living in India, I also consider Milanovic (the guy who created the “Elephant graph”) far more relevant on the topic of inequality than Piketty. Words like “China”, “India” and “immigration” seem far more relevant to the topic of inequality than “Balzac” and “Jane Austen”. Milanovic shows in various works that the primary driver of inequality is location (compare an upper middle class professional Indian to an American non-worker, the latter is far wealthier), and that global inequality has gone down drastically.

I very much wish some proponents of Piketty’s narrative would tell me exactly what I’m supposed to take away from it.

“It doesn’t matter. Whether it’s due to intrinsic skill on the part of rich people or merely due to economies of scale, the best way to grow the economy (according to Piketty) is to have wealthy individuals controlling large investments.”

Or there are a fixed number of good investments, everyone competes for access to them, and rich people win. I don’t have any reason to prefer this model to yours, but I don’t have any reason to disprefer it either.

The most important things I took away from Piketty are that economic growth is always 1% – 1.5%, rate of return on capital is usually always 4% to 5% but higher for the richest, there used to be a rentier society that was destroyed by the World Wars, inequality (both income and labor-vs-rentier) is increasing, and conditions are good for them to continue increasing.

I think most of these (though possibly not the last) survive Ronglie’s criticism, though I haven’t gotten a chance to read it fully yet.

If there are a fixed number of good investments then inequality is self limiting. As you note:

This is the more standard economic theory, which claims that a few very good investors might beat the market and go from $1M to $1B, but someone with $100B will not be able to do the same.

(Unless of course they are Jeff Bezos and create $100B by building things that have never been built before.)

This claim is tautologically true – to become rich you need to achieve a high rate of return. As a result, rich people consist of a) people with a high rate of return or b) people who started rich. Poor people consist of a) people who started rich but had a negative rate of return and b) people with a low rate of return. This latter group tautologically has a lower rate of return.

(Similarly, if you backtest a trading algo over 10 years, you need to include companies that existing in 2008 but no longer exist today. Otherwise your algo will appear to beat the market simply because it uses hindsight to exclude Bear Stearns and WaMu.)

This claim is tautologically true

Your claim of tautology breaks at two points. Firstly, you can be rich without a high ROR and secondly because your typification is incomplete. You are missing poor people who have a (theoretically) high ROR but stay poor because they are missing the assets to make (meaningful) investements.

The “fixed number of good investments” model doesn’t really make sense.

Suppose I’m a company trying to borrow money. If people are competing to lend me money, then I just lower the interest rate. Now I get a better deal, and the market clears.

Similarly, if rich people are competing for access to hedge funds, then those funds take a larger cut. If the hedge funds give deals to rich people because they like them, then that’s not return on capital, it’s “hedge fund managers effectively have more income then it looks like on paper, and they choose to sacrifice some of that income to benefit rich people.” This might then be offset by reciprocal favors from rich people, with informal trade replacing explicit trade for tax reasons, but that still doesn’t change the basic problem with your proposed model.

Yes, but the point is that Picketty’s number that capital is always outperforming the normal growth rate (aka R>g) has been pretty rigorously debunked.

What makes you trust his numbers? Other sources I’ve read claim that historically the rate of return on capital was highly variable (see this graph, for example, which shows the nominal interest rates). Moreover, when the risk of bankruptcy is taken into account the real rate of return before XIXth century was close to zero. If “4% to 5% but higher for the richest” rate of return were the real thing would not everything on our planet be now owned by Fuggers or Medicis?

Sure you do. It’s obviously possible to make bad investments–spend capital on something not worth spending it on. So if people who are good at spotting good investments are the ones controlling the capital, less of it will get wasted. Why would one assume that what investments get made is independent of the people allocating the capital–which is what you seem to be suggesting.

Not always. According to figure 10.11, it didn’t reach 1% until the 19th century and it was 2-3% through most of the 20th century. His scientific law looks distinctly fragile–the result of taking a limited time period and then explaining away all the deviations.

As I already commented, I don’t believe that’s true. Historically speaking, 4% is unusually high for the real interest rate.

This is a super common problem with hedge fund size. On the one hand, there are a lot of economies of scale like any company – more people pick up your phone, you need compliance people, big endowments prefer larger funds, it costs money to build systems and set up legal entities. But there is a natural push and pull on size at the portfolio level.

Bigger size means that when you find a good idea you can max out the benefit by buying as much of the asset as possible. However, fund managers only have so many good ideas a year. If you’re too big, it becomes difficult to scale your good ideas. So either a bunch of money doesn’t get put to work (dragging down returns) or they chase bad trades/push their good trades until they are unprofitable.

You can see this with different hedge fund sizes. Those with big macro themes (like interest rates around the globe, or stocks vs bonds) tend to be much larger. Those are deep, liquid markets, and if you think of a good idea you can put it on in massive size. However, if your fund is oriented towards deep credit analysis they tend to be much smaller because each trade is smaller. Credit markets are thinner, less liquid, and more difficult to trade in, although good ideas tend to be more consistently profitable, even if in smaller size.

This, by the way, is a natural result you’d expect from Grossman-Stiglitz . In more liquid markets you can put on bigger trades for smaller alpha, or in illiquid markets you put on smaller trades for bigger alpha. Either way the (marginal) returns to producing information about financial assets is about the same.

If that were true that the rich getting better investment returns actually increased the total level of economic growth, then you would expect to see much higher growth rate in time periods when the rentier class controlled a lot more of the wealth, and much lower growth rates in time periods (like the 1950’s) when they controlled much less of the wealth.

I don’t see evidence for that that in the data at all.

If that is the case, then Piketty’s claims about wealthy people being better investors must be incorrect. I agree that this theory is likely wrong.

I personally subscribe to the more standard theory, that it’s harder to invest $1B than $1M.

“Wealthy people tend to on average get better personal return on investment” doesn’t necessarally imply “if wealthy people make more investments then the average rate of return will improve”, and it certainly doesn’t imply that “if wealthy people make more investments that will drive faster economic growth.” It’s just as possible that either there are a limited number of really good investment opportunities that someone would invest in in any society (but that in a more stratified society the rich get access to most of the best them), or even that the wealthy are better at rent-seeking or monopolizing behavior that improves their own personal investment returns while reducing overall economic growth.

The total amount of money controlled by the very wealthy people is low enough, and other sources of variation in growth rates are large enough, that there is no way you could detect this in the data.

According to the one chart Scott posted here, in 1900 the “inheritance flow” was 24% of France’s national income in 1900 and only about 5% in 1950, and it sounds like there was a similar pattern in most first world countries and by most other measures. That should be more then enough of a change to see it in the national growth rates, if in fact it is true that the rich investing more of the money actually produces more faster economic growth.

This is the standard theory, and in contradiction to Piketty’s math. If this is true, then it directly implies that you’ll get a lower return on $1B than on $1M.

Proof: Suppose I’m the richest person and because of my preferential investing powers I can perfectly choose investment opportunities before anyone else.

Let r[i] be the rate of return on the i’th investment opportunity, and c[i] be the amount of capital that this opportunity can take. Lets reorder these so that r[0] > r[1] > etc. (I’m also clubbing together opportunities with equal rates of return.)

Suppose I’ve invested Sum(c[0:N]) dollars in the first N opportunities, and epsilon < c[N+1] in the N+1'th. My rate of return is:

(dot(c[0:N], r[0:N] + epsilon r[N+1]) / (Sum(c[0:N] + epsilon)

The derivative of this is (Sum(C[0:N])(r[N+1] – mean(r[0:N])) / (Sum(c[0:N])+epsilon)^2.

Since r[N+1] – mean(r[0:N]) < 0, this is strictly decreasing. If you want to see a graph of why this happens, take a look at the “diminishing returns” section of this blog post: https://www.chrisstucchio.com/blog/2017/cobbs_douglas.html

In this world the best possible investor has a rate of return which diminishes with his wealth.

In the real world, most of the richest people have become rich by putting all their wealth and human capital into investment i=0 (where i=0 represents Facebook, Google, Amazon, etc) and close to nothing into i=1, i=2, etc.

This is theoretically possible. The only explicit examples of rent seeking Piketty gives are by the middle class (occupational licensing, taxi guilds). And the most important rent seeking activities I can think of (NIMBYs, occupational licensing, educational credentialing, the regulatory state) are again mostly middle class people harming each other.

Rognlie has shown that the main driver of r > g is again middle class rent seeking NIMBYs rather than wealthy people.

I know Piketty speculates that the rich somehow have secret fortunes and do evil unspecified rent seeking, but I’m not aware of him making any specific allegations.

Investors with large fortunes are playing a different game. They can put enough money into the market to shift the market price. They can do things like buy out entire companies and merge them together to reduce competition, changing the entire nature of the markets.

But also you guys are over-thinking this. It’s easier to play No Limit Texas Hold’em when you have a larger stack of chips. Yet it doesn’t make the game any less zero-sum when the best players have the most chips.

@stuchio I’m not sure what you’re saying about `i=0` when you talk about Facebook. Facebook definitely had the opportunity to buy WhatsApp before anybody else, right?

You sound like you’re implying that these companies don’t buy other companies, yet they spend more money on buying other companies than on anything else.

That’s a disadvantage, not an advantage. It means that if you buy your buying is pushing the price up, which costs you money. If you sell, your selling is pushing the price down, costing you money.

Andrew Cady, my comment about i=0 means that the vast majority of Zuckerberg’s fortune comes from a single high return investment.

Whenever a company builds a portfolio of multiple other investments, they face the diminishing returns issue I’ve described.

This is 100% false. It is way easier to play with a short stack. That is why there are minimum buy-ins and rat-holing (taking chips off the table, taking your money off the table and buying back in at the minimum) is frowned on or prohibited. Early in online poker there were min buy-in bots that were profitable.

For those of us that know little about poker, mind expanding on how the advantage works? I naively would have expected it to be very useful to have a reserve that can sustain losing a high-risk-high-reward hand or three.

@Gobbobobble

Part of it is the ability to go all-in as an option. If you and your opponent both have very large stacks, if you bet high to protect your hand, your opponent will have to match that bet if he can. That match may not have positive expected value. If your opponent has very little left, however, he can simply push all-in for less than matching the bet. This obviously has a high variance, as it either works and you double your stack (you can’t ever win more than you put into the pot) or it wipes you out, but it gives you some options to stay in.

Forgive me, I’ve literally never played poker for stakes so I’m a little slow.

I’m not seeing how that is a better situation to be in than having enough chips to not have to go all in? If you go all in and lose, you’re out. If you have to bet higher to stay in and lose, you have a chance to recover. And, if I’m understanding the rules correctly, if I bet $100 and you go all-in at $10, your expected value is still lower than if you had $200?

I suppose with less money there’s less potential loss from continuing to play, but that’s practically tautological.

There are versions of the game where the only winner is the last-man-standing who wipes out all other players. In this case, having a big stack is an obvious advantage, because you can take better risks, or even bluff.

There are also version of the game where you can walk up to the table and walk away at any point. It’s easier to grow a small stack than a large stack, in percentage terms.

@ Gobbo

The advantage of the small stack is that you reduce the number of options to two for every hand. Either fold or go all in, so it is very easy to devise a low mistake strategy. At the same time it complicates strategy for the normal stacks at a table (to a degree, if there are a bunch of small stacks adding one doesn’t matter much). The larger your stack is the more likely you have to make multiple decisions, increasing the number of situations you have to recognize making it harder to play well.

In a tournament, you are obviously more likely to win if you have a larger stack. Nevertheless, it is EASIER to play (correctly) with a short stack because your options are much more limited. Basically, you either go all-in or you don’t. Your stack is small relative to the other players, so they will typically ignore you (to a greater extent the smaller stack you have) in their strategic decisions, making it easy for you to get all your money in when you have a good edge.

In a cash game, where if you bust you can just buy back in, not only are your decisions easier but, all things being equal, you have a better chance of winning money. You have the same edge in getting your money all in when you have an advantage, plus if you bust you can just take more money out and buy a new stack. So it’s quite easy to profit.

Now if you are a really good player, you want to be a deep stack because you have an advantage over everyone else due to your skill and you want to have them covered so that when you crush them, you can take all their money. But it’s MUCH more difficult strategically to play a deep stack. If you have nothing else to go on, at a live poker game, the deepest stack is generally the best player, ESPECIALLY if they’ve just bought in and the depth is not a result of winning hands.

Its also easier to lose! The percentage of stack is (mostly) immaterial as you care about $ per hour not % of your stack for ROI. Short stacking was (and maybe still is) popular in part because it was so simple that you could play 16 tables simultaneously online (and also find a new game easy every time you made it a large enough stack) and the lower return per table was overcome by the larger number of total tables.

The key reason why playing with a short stack is an advantage is that stack size is an important variable in decision making. For example, there are certain starting hands (e.g. low pairs) which offer a low chance of developing into a very strong hand on the flop but a high risk of being duds. Such hands are fairly strong if everyone is playing with a deep stack as there is a big payoff if your hand develops well; if it doesn’t, you’ll find out early and can cut your losses. If everyone is playing with a short stack, such hands are far less valuable since there can’t be a huge payoff due to stack limitations.

Now consider a table with some short stacks and some deep stacks. The short stacks are just playing their short stack game and can value their hands accordingly. They prefer hands that have a high probability of being reasonably strong over hands that have a low probability of being very strong and play accordingly. The deep stacks, on the other hand, have to play the short stack game agains the short stacks and the deep stack game against the other deep stacks, which means they have to compromise and are forced into sub-optimal decisions.

“Whether it’s due to intrinsic skill on the part of rich people or merely due to economies of scale, the best way to grow the economy (according to Piketty) is to have wealthy individuals controlling large investments.”

Uh, does Piketty actually write this, or is this a Bizarro Steelman version of him? It doesn’t seem like anything he’d have actually suggested, seeing as how one of his theses is that wealth gained by capital returns tends to concentrate rather than distribute.

Yes, but the text has different mood affiliation. He explicitly says rich people’s fortunes will grow faster because they have a greater ability to choose good investments.

This does not contradict the former claim. Capital can concentrate and simultaneously increase growth.

Concrete example: Bezos builds Amazon, Glenn Beck buys gold. Capital stock / income has increased (i.e. r > g), since Amazon would take many years worth of income to rebuild.

Wealth has concentrated dramatically, since Bezos is now far richer than Glenn Beck.

The main difference between what I described and what Piketty describes is that Piketty uses math (rather than words) to explain this, and then talks about rentiers in the age of Balzac and drops vague hints that maybe the modern world is like Balzac’s world.

stucchio nails it 100% for me. If, after some historical chart-fitting, Piketty confidently advances as an axiom that real economic growth is “always 1-1.5% per year” (a HUGE range!) no matter what anti-capitalist measures you add (but he has “catch up growth”?) then I guess we should all be pretty unconvinced. Or he should drop the axiom that accusation that rich people reliably produce an investment edge or explain how the edge is somehow parasitic and we won’t miss it when it’s gone (I guess it’s in excess of the growth of the “real” economy so it must be, in his mind? But that’s not a tautology).

Here’s how investing large scale money works. (Source: I’m on the investment committee of a multibillion dollar foundation.)

We have the theory/philosophy that it is possible to beat the market on an ongoing basis, but that very few people can do it. The techniques are easy to understand at an abstract level but hard to replicate: gain an informational edge over the market (I know of one manager that wanted an estimate of how a chain of bakeries was doing, and he noticed that they number their receipts in order starting at 1 every day — so he hired a bunch of minions to go buy something every day at the end of the day at every location, and now he knew how many customers they had every day). This is referred to as “proprietary research”, and most of the best funds do it.

The very few people that can consistently beat the market in a particular domain (us public equities or silicon valley venture or private equity or whatever) command very high fees (typically 1-2.5% of the investment every year plus 10-30% of profits) and are very selective about who they allow to invest. They want a small number of large investors so that they don’t have to deal with too many clients, and want assurances that if they have a down year their investors won’t walk away or pressure them to change their strategy. They also often require long lockups, where you can’t get your money back out for years. Digression: this led some institutions to have real problems during the financial crisis when they had too much money locked up and couldn’t get it back to pay bills.

So investing a large endowment or fortune is really selecting investors (called managers) and paying them to invest in their area of expertise. This is a game you can’t even play if you don’t have enough money, because you aren’t worth spending time on. Investing with a manager is a multidecade relationship and all parties take it very seriously, lots of diligence and reference checking in both directions.

The second piece to the puzzle is diversification. Not in the sense of investing broadly in the stock market, but on the sense of betting on lots of different approaches. Equities, distressed debt, real estate, energy, timber, mining, venture, private equity, all kinds of things. Usually even if something goes down like in a stock market crash, other things will do fine (or even well if capital moves from one place to another).

Aside: one of the things that made the financial crisis so brutal was that everything went down, which is very unusual. Nowhere to hide. However unlike the real economy, several markets bounced back hard, so as usual the competent super rich did just fine.

So there’s your answer about why this is different. You need access to top funds, because the average fund (even the 80th percentile fund) is worse than buying the index. To get access you need money: minimums are often $10-$100M. You need enough money that you aren’t making just one of these bets, because even the best sometimes lose; you need to invest in 50 or 100 of these across different asset classes. And you need someone who can make these investment decisions, because it’s very hard to tell the true experts from the managers who got lucky.

None of this is a secret, though for various reasons it’s hard to pull off. The guy who basically invented the latest incarnation of this approach is named Dave Swenson. He runs the endowment at Yale, and wrote a book in 2000 about exactly to how execute this strategy. Here’s a brief profile of him: http://archive.fortune.com/magazines/fortune/fortune_archive/2005/10/03/8356742/index.htm

And even he thinks that this doesn’t apply to regular folks. He wrote another book about personal investing, which concluded like everyone else that you should buy index funds and avoid fees as much as possible.

One final comment: this is not how Bill Gates or Jeff Bezos do so well. They do that by having a very concentrated position in a company that has become insanely valuable. You can’t do that either.

Hope that clears up some of the mystery about how endowments and billionaires invest.

Agree 100% except for the last part about Gates & Bezos. I thought the claim was that their investments apart from MS/Amazon did better than yours or mine.

That is to say, I understood the claim as saying, “Independent of how you got your money, the more you have the higher return you will receive by investing it”.

You sure? It’s all TL;DR to me, but it seems B&MG foundation invests mostly in Berkshire Hathaway (Warren Buffets fund), which in turn invests a lot in Microsoft.

https://www.simplysafedividends.com/bill-gates-portfolio-dividend-stocks/

If 80% of hedge funds are worse than investing in index funds (which I understand is true), and if hedge funds are only available to the super rich, what explains the supposed out-performance of rich people? That top 10 or 20% of hedge funds has the majority of all the money?

Hedge funds are available to the merely rich, who invest in them because that’s what the super rich do so successfully.

You can access hedge funds as a qualified or even accredited investor, it’s just that almost all the ones you have access to are worse than index investing.

How do the really rich know whether their money manager is *really* an elite money manager, rather than just someone who got lucky for a while taking risks, or a shyster trying to milk them for fees?

Especially if the top money managers can lose money for years on end and justify it by saying “yeah we know our strategy has risks, you just have to trust us and stick with it. and btw you’re not allowed to take your money out now.”

It seems like you wouldn’t be able to reliably pick the elite money managers without being one yourself- it’s the principal agent problem.

From reading the post you’re replying to, the answer would appear to be “with extreme difficulty, intensive study, and the utmost care taken to exclude manipulative shysters from the process.”

As in, this takes orders of magnitude more effort than any ordinary wage-earner puts into investment management, or picking out an investment manager.

Wally Wage-Earner might spend, at most, tens of hours a year, maybe a few hundred, figuring out where to put his investment income. And consequently, he can’t beat the market.

Bob Billionaire spends several hundreds of hours a year, or even thousands, on this task, starting from a position of greater information through having more contacts and general knowledge of the investment world than Wally Wage-Earner. Moreover, he can delegate even more of this task to a team of high-trustworthiness, high-conscientiousness experts who collectively spend tens of thousands of hours a year on it. He can beat the market.

The conclusion that no one can beat he market is based on the premise that no one can have a strategy better than anyone else, or it’d be duplicated. That is at best a simplification of reality; in reality “the market rate” must be something that someone can beat, because it’s an average of what a bunch of above-average people are doing combined with a bunch of below-average people. The market doesn’t converge on everyone doing literally exactly the same thing, and the margin between high and low performers is still something you can exploit if you work hard enough at picking performers.

The only way that wouldn’t work is if the market were a totally random process comparable to playing slot machines. Which it’s not- or if it was, it wouldn’t optimize anything, any more than we could get economic growth out of having a magic 8-ball make the decisions for wealth-holders.

I don’t see any difference between that and stock picking. A lot of people devote vast amounts of time and effort to pouring over financial data, judging management teams and annual reports, trying to pick out the best stocks. But the general consensus is that most, if not all of those people are wasting their time- they’d do just as well picking the stocks at random. Putting more time and effort into it won’t help.

It might be even worse with respect to picking a financial manager. Stock data is at least *honest* since it’s regulated to hell and back. But plenty of wanna-be hedge fund managers would probably just lie to you. Or bullshit themselves and you, or maybe they once had the touch and lost it, or whatever.

It seems like this basically comes down to “actually the EMH is wrong, you *CAN* beat it if you’re good enough”. The rich elites know that, they know other people who know it, and they all connect with each other to make sure they get access to the best investments but the general public doesn’t.

EMH is wrong, but most people don’t have the time, skill and computational resources to find and exploit an inefficiency before it vanishes. This is consistent with even the average person on Wall Street not being one of those people. Even a successful algorithm might only be profitable for a few months or weeks, e.g. “Berman thinks two or three months might be the limit now, and he expects it to drop.” back in 2007 (https://www.technologyreview.com/s/408854/the-blow-up/).

I always understood EMH to mean that the work required to identify profitable investment strategies will get competed to the point where it’s comparable to similar investments.

In other words, EMH doesn’t say that there aren’t any lost $20 bills to be found on the street, just that once we factor in the time and the risk, we would expect looking for lost money not to be any more profitable on average than getting a similar job.

“Somewhat rich colleges (= $1 billion) grow at 8.8%, medium-rich colleges (= $500 million) at 7.8%, middling colleges (= $100 million) at 7.1%, and the poorest colleges (= $100 million) at 6.2%. And all of these do better than the average person saving for retirement, who – again – gets about 4% to 5%.”

Back before the 2008 crash, I noticed that there was a close correlation between how prestigious is was to have your kid admitted to an Ivy League school (Harvard #1, Cornell #8) and the ROIs on their investments. This might suggest that rich people are trading insider trading information for admission for their scions. E.g., rather than the Kushners donating money, other people could be getting their kids in by mentioning investment opportunities.

But I haven’t checked this in a decade or so, so it could have just been a fluke.

Did you really review this without being aware of the devastating criticisms of his: methodologies, false histories, manipulated/corrupted databases, etc? Criticisms levied even by his defenders?

This is why you should stay away from Econ.

Hey, I think your criticism here isn’t entirely fair; Scott is an extraordinarily prolific and entertaining writer, and writes on a wide variety of topics; the price for that is that he doesn’t have the time to be an expert on all of them. It’s incredible he has the time to write as much as he does at all. He doesn’t hide the fact that he’s no expert at Econ, and he’s diligent about drawing attention to things he may have missed (like this, for example) after the fact. This post will still have taught me a lot about something I didn’t know even if it turns out Piketty’s work has problems that the post didn’t talk about the first time around.

I guess another way of saying it is—I could read econblogs by reputable economists instead of or in addition to Scott’s blog, but the fact is that I don’t do that, for one reason or another. I suspect the reason is that I place a very high value on being entertained by the stuff I write, and Scott’s writing is more entertaining than most econblogs (indeed more entertaining than any other blog I can think of). The fact that I place such a high value on entertainment over edification may not say flattering things about me, but at the end of the day it’s how I seem to work, and I think I would learn fewer things overall if Scott restricted his writing to areas in which he is an expert. I believe Scott is sufficiently diligent about listening to commenters and giving his epistemic status on things that my net learning isn’t negative from reading him, in any case.

If I reviewed a book on psychiatry I would sure as shit make myself aware of any (in this case utterly devastating) criticisms. Seems like a very standard part of a review process for a book that’s years old.

I would do it to save my own time (in the case of criticisms like those leveled at Piketty), to help me understand the work and the context as I read it, and to make sure I don’t mislead the people I’m trying to inform.

You make a fair point, but the book has no thesis when you take out the lies and fudges.

I think when he wrote this review he was intentionally trying to ignore the criticisms to Piketty, and I think this was a good approach for him. Not being an economist, it would be hard for Scott to separate the good criticism from the bad on the spot, so why not to try a trusting reading at first? Assuming the author’s data / methods are good enough allows him to think if the whole thesis makes sense in the first place, and if it does, then go around and look for criticism that undermines it. Or, given his position, he can just wait for the commenters here to bring it, as they indeed are doing.

You don’t understand. It wasn’t like, “Oh, some economists think A model best represents blah, yet others think B; I choose B for reasons…”

No, the criticisms are of the variety: “Piketty claims Republicans are bad because Republican President did X.” Upon further examination, it was a Dem president. Or not missing by a decimal point, but getting the DIRECTION wrong in simple math. Using false, utterly made up data points for regressions. And on.

And every single mistake goes in the direction of his (utterly non-sensical and historically debunked) “theory” that just so happens to be a redux of Marx and advocates for taxing the rich…

So it’s not like there were “criticisms,” there were devastating findings of lies and incompetence.

This is the type of case where “the whole thesis makes sense” because people instinctively want to tax the “rich” and, if you make up data lie about it, you can show that you HAVE to tax the rich or we’ll end up on Elysium.

So sometimes you have to check to see if the work you’re reviewing has been destroyed, and I use that term advisedly. Honestly, if you want to see a true academic takedown, read the reviews. Even read the later reviews by his defenders that went from “What an intuitive theory backed by data!” to “Sure, his theory is wrong, but his data set is amazing!” to “Sure he fudged the data, but screw the rich” to crickets.

What page was that on?

I think the terms “capture” and “vertical integration” point nicely at the sort of thing extremely wealthy rentiers are good at, and what merely wealthy people are not good at.

Any other industry you suspect of achieving regulatory capture has, somewhere behind that capture, an investor or set of investors whose incentives are driving that capture.

E.g., I am not so rich/powerful/devoid-of-empathy/otherwise-insulated-from-the-humans-who-are-hurt-by-corrupt-officials that I can rationalize to myself or my close friends my being corrupt. I am also not so well-placed that I have much incentive to be corrupt–for one, I cannot charge a tax on whole nations for the privilege of doing business with FIFA. For both these reasons, I am not a corrupt FIFA official. If we credit that FIFA has a corruption problem, then somewhere out there is someone who is both these things.

Labor and capital are imperfect complements. When you are in the business of providing something, you want to commoditize its complement. Therefore, at the limit anyway, (and ignoring that you also need to treat your creative professionals well) anyone with a lot of capital will have a very large incentive to commoditize labor.

Tyler Cowen has also made this point. In his book “Stubborn Attachments,” in the chapter called “Should money be redistributed to the rich?”

The same logic would apply if you swap ‘stock market’ with ‘poker game’; the card sharks will take the money of the old ladies. That gives them a high ROI, but doesn’t increase the number of chips on the table.

The distinction between a stock market and a poker game needs to be a bit more obvious before you can start giving credence to the theory that clever investors are pushing growth into the economy.

Poker is a zero or negative sum game where every dollar you make has to be from another player losing it. Investing is a positive sum game where you make money by giving money to businesses that create value.

So you fully buy into the causal chain smarter investors -> more value created?

So like, you take the little old lady, giver her a good course in how to invest, and additional businesses will arise to create the extra value required to reward her for her improved skills?

The first one.

Well, it’s not zero-sum. But see, saying that isn’t enough to conclude that any particular difference in outcomes isn’t zero sum.

It is very obviously possible for someone to make money in the stock market at the expense of someone else. (E.g. you buy some gold from me at $10, and then sell it back to me for only $5.) People talk about how life isn’t a zero sum game as if it disproves the existence of that kind of scenario, but obviously it doesn’t.

@Andrew Cady

The casino can take a percentage from the pot (rake) or charge a fee. That makes it a negative sum game.

Investing is a positive sum game where you make money by giving money to businesses that create value.

This is true for the appropriate definition of “investing”, but unfortunately many people understand “investing” to have a broader meaning, so that it includes trading in the stock market, not based on wanting to get your money into the stock of businesses creating more value, but based on wanting to profit from market trends. Trading stocks, by its very nature, has to be zero sum, because the actual net present value of any given share of stock is the same no matter who owns it. So in any given stock trade, one of the two parties must be making what will turn out to be a bad deal. The parties just don’t know which one of them that is (if they did, the trade wouldn’t happen).

As I understand it, one of the issues that led to the crash in 2008 was that the amount of money involved in stock trading of this sort (and other more creative versions of the same thing, like derivatives) was much larger than the amount of money involved in actual investing by your more correct narrow definition (giving money to businesses that create value).

Andrew Cady,

All the money currently sitting on poker tables around the world is accomplishing absolutely nothing productive. It just sits there and gets shuffled around between people and sometimes drops in a hole.

Money that is invested at least has a chance at being productive because people are using it for things, which is why people will pay you to borrow your money.

The difference is fairly obvious. So much so, that I would believe that Cowen implicitly assumed everyone was on the same page rather than going through the explanation. Unlike poker games, the point of the stock market is to allocate credit efficiently to high-value underlying economic behavior – i.e., produce things that people want. Which is why when you say:

You have the causality backwards. More value created->more money to the smarter investors who correctly allocated credit to said high-value behavior.

Yes, that’s the way it works. The thing is, in order for it to be a good idea for money to be given to the rich, as Tyler Cowen suggests, then it would need to be the other way round.

I may have been a bit hasty. I thought you were going for something else. And in hindsight, the reword I made should have made it obvious. In any event, you actually were right. Smarter investors -> more value created -> more money to the smarter investors who correctly allocated credit to said high-value behavior. (That is, we were both right.) Let’s look at your example.

In a sense, yes. Consider two potential investments, A and B. It turns out that A has higher-value underlying economic behavior. If investors are less skilled, they might pick B. But if they are more skilled, they will pick A. The result of picking A will be that higher-value transactions will occur. Some of that additional value will be captured by consumers; some of that additional value will be captured by the employees of the company; some of that additional value will be captured by the investor.

Now, additional businesses may arise, because folks who gained from those trades may choose to use their gains to create a business. Furthermore, better businesses will arise. Entrepreneurs will learn that if they have a business plan more like B than A, they are less likely to get investment, so they’ll work to create better businesses that are more likely to create value which can be captured. The sum of these effects are new and better businesses which arise to create extra value to reward the next generation of smart investors.

(Of course, there are some bloody stupid investors out there, but most people agree that a fool and his money will soon be parted, and that these ventures aren’t good for anyone. That’s why the incentives to be good are so important.)

The “corrections,” of course, come from arch conservatives

1) You were hoping for dour conservatives?

2) I’d rather test the merits of Piketty vs the arch conservatives. Otherwise, I can dismiss Piketty because he’s liberal and you can dismiss Rognlie because he’s an arch conservative.

3) Is Rognlie an arch conservative? I just spent 15 minutes trying to determine his political affiliation and if he has one, it’s subtle. Would your settle for putative crypto-conservative? A lot of economists seem to take his work seriously though, including Brad Delong.

(I didn’t pick Rognlie specifically – I just looked at the first contra source Scott listed.)

Oh man, I’m totally stealing this.

I don’t know if he would qualify himself as a georgist, but Rognlie’s work has a lot in common with georgist theory (and has definitely been picked up and carried by them).

Anyway, this sort of outlook defies normal categorization as per ideology: it can go hand-in-hand with socialist thought, neoliberalism, or libertarianism.

There are no arch conservative economists. The best you can get is vaguely conservative pseudo-libertarian. Of course that’s way more balanced than any other academic field. Just imagine the consensus opinions of economists if economists were balanced politically like the general public.

And “criticism” to the “corrections”, of course, comes from extreme Lefties. See, two can play this game of stating the obvious in an unfair, reductionist, and mind-killing way.

It would be better, however, if we tried to evaluate the arguments themselves instead of tossing them in the bin because we don’t like the messenger. Or do you think your arch-conservatives could never make a valuable criticism of Piketty?

Would you be comfortable being described as an arch leftist?

I so wish that there was a variant to phrenology, where they measure people’s arch of the foot to determine their political beliefs.

My husband is an arch-conservative with flat feet, and my father was another. (I’m conservative, with arched feet.)

Speaking as a pro-free market economist, I am curious about the defining features of an arch conservative economist. What views would you expect him to hold on:

Immigration

Free trade

Abortion

Military conscription

Foreign policy

Minimum wage

Gay rights

To put it differently, is an arch conservative economist someone who almost always agrees with political conservatives or is he someone who has a conservative view of economics–thinks that Marshall got things mostly right, is skeptical of unorthodox economic ideas, left or right?

Oh wow. An actual, literal, ad-hominem argument. You don’t see that often. Most of the things people call “ad hominem” are just insults without and not attempts at argument, but this here is an actual ad-hominem argument.

Housing wealth is important, but it’s worth remembering that huge chunks of housing wealth are tied up in mortgages or mortgage-backed securities, which are held by some combination of banks, governments, and rentiers. Mortgage liability in the US is 10.14 trillion $; around 40% of that is held by private banks (rather than Fannie/Freddie/Ginnie), making up about 25% of all commercial bank assets in the US.

Mortgage liabilities don’t typically appreciate substantially over their lives. If they appreciate too much, the debtor refinances. Mortgage assets on the other hand can appreciate quite substantially.

The funniest part of Piketty’s book is when he suggests that criticisms of Carlos Slim, the Mexican telecom monopolist, are racist. Piketty is offended by how Slim

“… is often described in the Western press as one who owes his great wealth to monopoly rents obtained through (implicitly corrupt) government favors…

(Actually, Slim, himself, has been proactive about improving his press coverage: in 2008 he financially bailed out the New York Times and later became the newspaper of record’s second-biggest owner. Not surprisingly, Slim, who profits lavishly off long distance calls between illegal immigrants in America and their loved ones in Mexico, doesn’t get mentioned much in the Times’ vociferous denunciations of immigration skeptics.)

Piketty, in his inimitable prose style, explains that criticizing Slim is a mistake, if not downright racist: