Last week I reviewed Alex Tabarrok and Eric Helland’s Why Are The Prices So D*mn High?. On Marginal Revolution, Tabarrok wrote:

SSC does have some lingering doubts and points to certain areas where the data isn’t clear and where we could have been clearer. I think this is inevitable. A lot has happened in the post World War II era. In dealing with very long run trends so much else is going on that answers will never be conclusive. It’s hard to see the signal in the noise. I think of the Baumol effect as something analogous to global warming. The tides come and go but the sea level is slowly rising

I was pretty disappointed by this comment. T&H’s book blames cost disease on rising wages in high-productivity sectors, and consequently in education and medicine. My counter is that wages in high productivity sectors, education, and medicine are not actually rising. This doesn’t seem like an “area where you could have been clearer”. This seems like an existential challenge to your theory! Come on!

Since we’re not getting an iota of help from the authors, we’re going to have to figure this out ourselves. The points below are based on some comments from the original post and some conversations I had with people afterwards.

1. Median wages, including wages in high-productivty sectors like manufacturing, are not rising

I originally used this chart to demonstrate:

Some people protested this was was a misleading portrayal, and that there are structural factors that disguise rising wages. I’ve written about this before in Wage Stagnation: Much More Than You Wanted To Know. The short answer is – no, it’s not about increasing benefits, those only explain about 10% of the wage-productivity difference.

It is partially about how you calculate inflation, which explains around 35% of the problem depending on who you believe. But we’re comparing wages to the cost of education/medicine. As long as you’re using the same deflator for both of them, you’re fine. As far as I know, T&H and everyone who talks about rising education/medical costs has been using the normal consumer deflator. So if you want to argue wages are underestimated, you also have to argue education/medical costs have gone up even more than people think. This doesn’t help at all!

(or see these numbers, which show that nominal college tuition has gone up as a percent of nominal median wage, and so should be immune to inflation shenanigans)

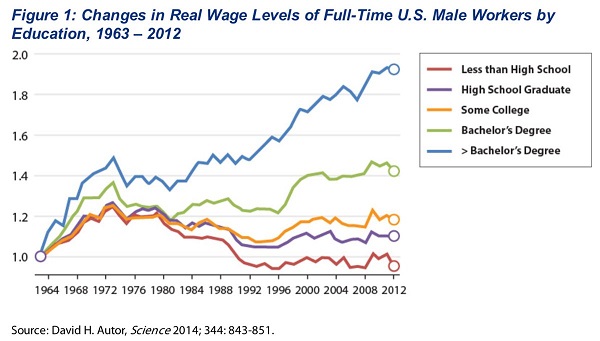

Other people protested against looking at the median wage, arguing that the wages of college graduates are more relevant. After all, teachers, professors, doctors, and nurses are all college grads. If their opportunity cost goes up, that could still drive a Baumol effect. And:

Surely doctors and professors are in that top blue line; I think nurses and teachers are in the lower green one. Plausibly these professions’ opportunity costs have gone up 50 – 100% during this period. This is a start to explaining why education/medicine have gone up 200 – 300% during the same time. On the other hand, the period of fastest wage growth was 1965 – 1975, which as per T&H’s graph (page 2) was the period of slowest cost growth.

2. Wages for doctors and teachers have not risen

Let’s start with teachers. T&H use NCES’ “instructional expenditures” category to show teacher wages have tripled since the 1950s; I cited NCES’ actual teacher salary data to show it’s stayed about the same. What’s going on?

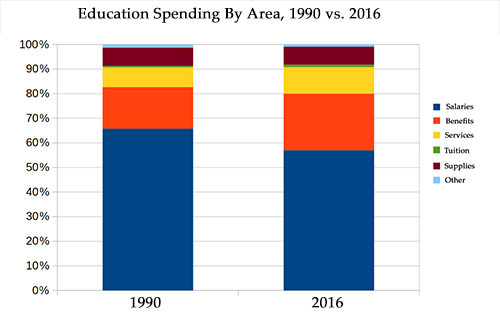

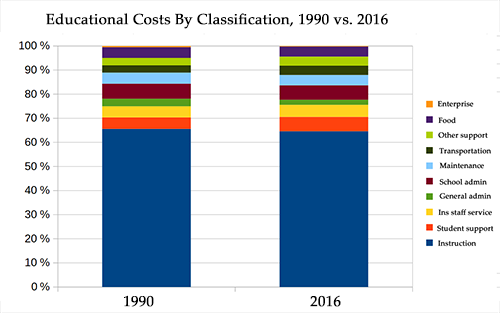

NCES only has good data after 1990. Their data says education has become about 30% more expensive in real terms since that time – T&H’s data (page 2) suggests it has become twice as expensive, but their data on page 5 agrees with NCES (huh?). Here’s how various fields have changed, using two different classification systems:

Pay attention especially to the first one. From 1990 to 2016, employee salaries as a percent of educational expenditures have gone down! Employee benefits have gone up a bit, but not enough: salary + benefits is still a smaller part of the education budget in 2016 than in 1990. How do you look at these data and say “We’ve figured out why education costs are rising and it’s definitely salaries”?

I think I miscalculated my tone when criticizing T&H’s presentation of data in their book. Tabarrok says I complained about areas “where [he] could have been clearer”. But my actual concern was that the presentation of this section misleads the reader. Whenever T&H talk about something other than salary, they emphasize that its share of the pie has not increased, but don’t mention that it increased a lot in absolute terms. Then when talking about salary, they emphasize that it increased a lot in absolute terms, but don’t mention that its share of the pie hasn’t increased. You’re left with the impression that salaries are the culprit for the price increases, when in fact salaries increased least of all the major categories in the data. “The data could have been clearer” is never just a minor gripe! Unclear data means you can prove whatever you want!

How are salary costs per pupil rising (even in proportion to other costs) if salaries are not? My guess is it’s all about decreasing class sizes, which T&H also highlight.

Moving on to doctors, I don’t have any equally clear sources. But I’ll at least try to explain more about the ones I already have.

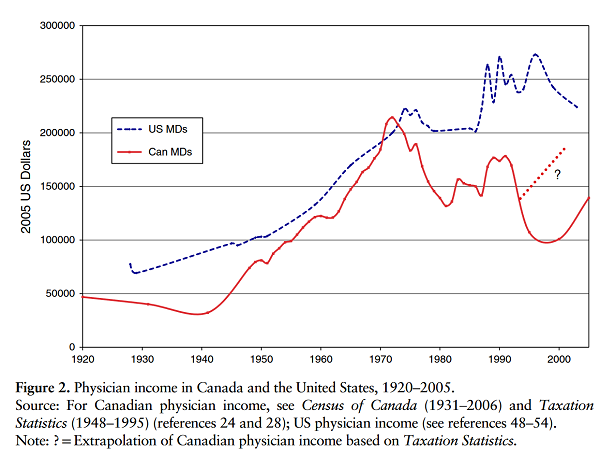

This paper from Health Economics, Policy, and Law shows on page 15:

They cite their source as “references 48 – 54”, but their reference section isn’t numbered, and is in alphabetical order, which would make it a pretty big coincidence if reference 48 through 54 were all about the same thing. I think a wire got crossed somewhere. But taking it at face value, I eyeball US doctor salaries in 1960 as 130K and in 2005 as about 210K, for an increase of 60% (not the 200% T&H claim). Doctor salaries have been about stable since 1975, even as (according to T&H’s graph on page 2), healthcare costs have about doubled.

The Last Psychiatrist posts this image:

I can’t trace the source beyond him, but read his post, where he notes that “There is the reality that doctor salaries (with notable exceptions) have been fairly static since 1969, even as the cost of living, price of homes, college, etc have gone up. And medical school debt.”

The last source I was able to find was this 1985 paper on doctor pay. It states that “In 1973, the median annual physician income was $45,000…by 1982, the median physician income was $85,000.” According to the inflation calculator, those numbers are $260,000 and $225,000 in current dollars, respectively. Estimates for average doctor salary today range from $209,000 to $299,000. I’m surprised how hard this is to measure, but it doesn’t seem to have doubled or tripled the way T&H claim (or the way it would have to in order to drive Baumol effects).

Also, the Baumol effect only works if the market sets your salary in the first place! Right now the supply of doctors is limited by licensing issues and bottlenecks in the medical education process; that keeps salaries high. Why would the Baumol effect drive that even higher? If doctors’ salaries didn’t increase in keeping with the highest-productivity industries, would medical schools sit empty? Given that the people setting salaries for doctors (hospitals, clinics) are not the people who determine the supply of doctors (bureaucrats, medical school deans), why should supply and salary be related in a way that obeys normal economic laws? I’m not really sure how to model this, but I’m pretty sure it doesn’t end with doctors leaving medicine to play violin concertos instead.

3. The Baumol effect cannot make things genuinely less affordable, but things are genuinely less affordable

I think I screwed up here.

The Baumol effect cannot make things genuinely less affordable for society, because society is more productive and can afford more stuff.

However, it can make things genuinely less affordable for individuals, if those individuals aren’t sharing in the increased productivity of society.

Suppose that in 1960, widgets cost $1, a worker could produce ten widgets an hour (and made $10 in wages), and violin concerts cost $10. Also, you are a farmer and make $10 per hour. You can listen to one violin concert per hour.

In 2010, widgets cost $0.50, a worker can make a hundred widgets an hour (and makes $50 in wages), and violin concerts have risen to $50. But you, still a farmer, still only make $10 per hour. The Baumol effect has driven up the cost of violin concerts for you.

This shouldn’t happen in real life, because if you work in the high-productivity-gain industries, you should make more because of your increased productivity, and if you work in the low-productivity-gain industries, you should make more because of the Baumol effect. But if it did happen, you’d be screwed.

And in fact, as mentioned above, wages have not increased in keeping with productivity, either in the high-productivity-gain industries like manufacturing, or in the low-productivity-gain industries like teaching. So if you work in one of those industries, it’s totally possible for you to be screwed, ie for college etc to become much less affordable for you.

If wages had grown in keeping with productivity, median yearly salary would be something like $100,000. Someone making $100,000 per year shouldn’t have that hard a time affording health insurance and college tuition for their kids; this would be the Baumol effect working in its normal, rising-tide-lifts-all-boats way. Since this hasn’t happened, Baumol-applicable industries have become harder to afford.

Again, this is all theoretical, because wages in high-productivity industries haven’t risen, so it’s hard to see how a Baumol effect could be happening at all. But if it was, it would be a good explanation for cost disease.

So I retract this third objection. I think the first objection mostly still stands, though it is a little weaker if we limit ourselves to college-educated workers compared to all workers. I think the second objection absolutely still stands, and it’s hard for me to see how T&H’s case could survive it.

I feel like changing standards of practice does not get mentioned enough in healthcare. I’m a chemotherapy nurse, 40 years ago our nurses used to smoke as they mixed chemos themselves without gloves on with splatter everywhere, it was fast, efficient and unsafe, and now we have specialized technicians wearing expensive PPE who are not allowed to mix chemo at all if the ventilation hood was even slightly below regulation airflow speed, so it’s amazingly safe and we can’t get drugs on about 20% of days, resulting in major inefficiency. Years ago a TPN bag that got punctured would get a band-aid taped over the hole, and ran on gravity. Now the slightest hint that the central-line might not be working perfectly and you need CT scans and expensive de-clogging medications before you can use it at all. I believe that these changes in practice results in only modest improvements in safety because the staff are good at adjusting behaviour to compensate for risk, but now the system is built with assumption that a) any staff might be an idiot and b) no amount of risk is acceptable. We are throwing vasts amounts of money to prevent problems that are very serious but also very rare. Overall the effect is greatly increased cost with moderate benefit to patients.

Nybbler,

My point is that using CPI adjustment is wrong, it’s an arbitrary convention and it distorts what is going on physically in the real world. I am saying the ‘real wage’ plot you reference is not ‘real’ it is made-up and refers to nothing concrete. But, yes, the fault in my eyes is with professional economists, not you.

The original selection of a CPI basket of goods generated using evolving technologies requiring progressively less work (& thus consequently easily glutting and saturating their market) ensures that the thing you are scaling by is a shrinking portion of the economy, thus the wages have to seem to be rising.

If the price of electricity, for instance, had been used instead as the dominant component of the CPI basket, the ‘real’ wage plot you linked would have been level like mine. But if “Mr Fusion” from Back to the Future ever becomes a reality, electricity would become as bad standard of comparison across time as food and manufactured goods are.

What is real and constant in all eras is people’s experience of time and effort and what that indicates to us about how much they value what they buy with its earned proxy, money.

The thing to look at is not our valuation of what they were buying, but how much they valued it.

Forget the effort for now, just take people’s valuation of time: would you spend an hour, say in jail, in return for a dozen eggs? Then the next hour for a pound of pork chops, the next for a pound of butter,…and so on for every item on your grocery list?,

At some point you need your time for something else!

But the average person in 1935 had to work about that long for each of those items, while in 2019 the average person trades only 2 or 3 minutes for each. Can’t you see that makes a bigger difference than the hedonic quality of the product as assessed by economic statisticians?

If there is a potato blight in 19th century Ireland, the amount paid for an intact potato cannot be used to value the currency of the time by comparing it with our present potato pricing!

On a future moon colony people would need a large fraction of their money earned just to afford water and air, for which we pay almost nothing. Does that mean moon colonist’s work is worth nearly zero and they have no GDP?

Time is the substance of life, stop devaluing past generations’ lives.

on what I used for calculations:

An “Absolute Inflation” index based on comparing “pay per hour worked of average worker” can be obtained to a decent approximation in many ways (even just using GDP/person is infinitely more informative than expert selected CPI baskets with hedonic adjustments), For instance, I’ve done it starting from average nominal wage plus compensation

(but it’s a little harder to find historical records of the benefit fraction than to divide ‘services’ fraction of GDP by the ‘services’ fraction of employment)

But as far as I know we have to calculate this stuff ourselves one way or another starting from each year’s nominal GDP, current population, fraction of population in labor pool, fraction of these presently unemployed, hours worked, etc.

find calculate it ourselves from nominal statistics for GDP, fractional employment, percent unemployment…

Any physicist who has worked in a University has received their share of ‘crackpot’ missives explaining someone’s new unified theory, or why Einstein’s relativity theory is provably wrong. Some are by obviously intelligent people who just don’t know the huge background body of math and observations and how tightly things have to hold together. Usually their ideas seem more metaphysical than physical, not something one can tie down for testing.

Now, apparently I, with my repeated insistence above on using work/hr equivalent inflation, am in he crackpot shoes vis economics. But, I feel I have explored the logical consequences of my assumptions, as well as those of the conventional economic inflation definitions, and mine seemed to be the ones giving sensible ‘physical’ answers while theirs seemed supportable only through rote metaphysical definitions. “Hedonic adjustment?”, really?

For all its high mathematics, economics, like most social sciences, has never gone through the “predict-test-falsify” positive feed-back driven evolution and firming up the physical sciences have. So, it’s about time to start.

I propose the following physical test as a challenge:

The BLS CPI says that a dollar in 1935 was worth the equivalent of about $18.23 in “real” 2019 dollars

My “constant value for average work/hr” index says that it is worth about $92 “real” 2019 dollars.

To find out whose conversion better deserves the moniker of “REAL” we should set up a REAL-ality situation such as in old reality shows of the “1800 house” or “pioneer house” ilk.

Call it “1930’s Farm”

Give a team of economists a typical 1930 farmer’s cash reserves (and monthly payments on loans) scaled by CPI to modern $2019 money, plus a typical allotment of land and equipment. They then have to use the authentic 1930’s methods on pre-rural-electrification style farms which required 20 times as many farm workers per consumer served, one finicky old gasoline hungry tractor per 40 farm workers, horses, primitive plows, ineffective insecticides such as powdered lead of arsenic or sprayed kerosene, pre “green revolution” fertilizers, etc., etc. … in order to grow enough food to feed and pay the farm workers and cover all costs. They have to transport their produce to markets in small trucks lacking refrigeration (with maybe some packing ice) absorbing all spoilage costs.

The question is whether they can break-even or make any profit selling to 2019 customers at the official CPI version of the converted 1930 prices, and if not, what price would!

We can guarantee the purchase of what food gets to market unspoiled at any price, the question is to find what level reaches break-even for the farm in real 2019 dollars in 2019. The CPI scales the 1935 food in city markets to around today’s Whole Foods prices (though bacon is cheaper than at any 2019 normal average supermarket (guess they made a lot of it in 1935, having no refrigeration). CPI also claims farm workers got $7,000 a year in real 2019 equivalent. Note, the prices for food make sense for our experience of actual 2019, but not the farm worker’s salaries.

If the test farm can not break even trying to sell at what economists say were the actual 1935 prices in 2019 equivalent (as I predict), then in what sense can they label those 2019? I predict that the break-even prices would need to be $30 for a dozen eggs, $25 for a pound of pork chops, etc. Shockingly high for today’s supermarkets (but the real experience of 1930’s shoppers, and the reason people looked so gaunt in the old photos)

This is real compensation per hour for the “business sector” — the entire economy less government, nonprofits, and private households. That is, it’s average compensation per hour deflated by the conventional index of inflation. Note that it’s going up. I gather that you used “Personal Consumption Expenditure: Services” to create your “constant value for average work/hr” deflator; this is simply wrong, as consumer spending on services is not at all the same thing as wages.

Also, using a farm is probably the absolute worst way to do things. The usual CPI used is the consumer price index for all urban consumers, and many measures of the economy either exclude or treat farms differently.

Couple thought.

1. Glad you got point #3. This is, I think, too unappreciated when it comes to cost disease. Even though more absolute buying power remains in hand after paying for things like education and healthcare, that is only true across society and not for a given individual. I think the literature has failed to grapple with the meaning of this. If healthcare and education become 70% of GDP and the median pay is, say, 70% of the average productivity per worker, then half of society will only be able to pay for education and healthcare.

The social implications are enormous…as that happens, it is unlikely that a larger and larger slice of society will be able to afford these critical services, and that means taxes as a percentage of GDP will go up, much much higher (or people will be starved of essential services). There will be enough surplus in absolute terms, but will taxes in relative terms cause serious class conflict?

2. I haven’t read this book, but at a quick glance I think the analysis is too wage focused. Real wages tracking with productivity growth doesn’t seem to be the linchpin of Baumol’s argument. The long term effect of productivity increases is falling prices for the outputs of that industry. If demand for less fast growing industries is inelastic, this means their prices will rise relative to the slower sectors. Whether wages rise will be more complicated: does the increased productivity benefit holders of capital or the workers (depends on politics, and what drives the increased productivity). Does consumer demand rise as fast as the prices fall? If not, employment I’m that industry will fall/wages will decline. (If the price falls by half and demand only increases by 10%, employment falls).

I suspect wages are flat and service prices are relatively high because productivity per worker has increased while demand for eg heathcare has been stable (or growing!), which would create the cost disease effect. But politics has decreased labor’s bargaining power, the role that technology (and that capital) has played in productivity increases is high, and the real benefit to workers has been in fast deflating prices in areas where productivity growth is high (e.g., computer chips). Interestingly, these tend to be the most difficult areas to think about when we look at inflation.

The Baumol effect has TWO parts as T&H emphasize repeatedly in the book. Part 1 is that the relative price between two sectors increases, Part 2 is that we can still get more of everything, just with higher tradeoff costs.

As active agents, Medical Schools can set the level of undersupply to keep doctor salaries at a fixed ratio above the free market rate. As Baumol effect Part 2 causes society to demand more resources on doctors, medical schools can provide more doctors without providing enough doctors.

So we get more heathcare in absolute terms, doctors make more than they would in a free market, and we feel that doctors are very expensive when priced in cars and hamburgers.

US physicians per capita rising over time:

https://data.worldbank.org/indicator/SH.MED.PHYS.ZS?locations=US&name_desc=true

What happened to the explanation I heard a lot around the time of the ACA that healthcare costs have increased simply because we consume more and use more expensive medical technology? Cost per service has increased because input costs have gone up (more expensive machines), and total number of treatments have gone up because our mongrel system doesn’t really have an way to effectively ration healthcare. Is this hypothesis one that didn’t stand up to scrutiny?

This is part of it. USA has high living standards and thus the population consumes more healthcare, which drives up costs.

Scott has linked this

https://randomcriticalanalysis.com/2018/11/19/why-everything-you-know-about-healthcare-is-wrong-in-one-million-charts-a-response-to-noah-smith/#rcatoc-substantial-reverse-causation-is-not-likely

which is a long, but good read on the subject.

I’d like to see somebody collect a lot of examples of trends in compensation for jobs that are relatively homogeneous over the years, such as starting salaries for associate lawyers at Cravath Swaine, starting salary for a Dallas public school teacher, minimum salary for a Major League Baseball player, and minimum salary for a Chicago Symphony Orchestra musician. And then put them in rank order of change over time. Would the rank order fit what is predicted by the Baumol Effect? Or is something else going on?

I often find that putting things in rank order quickly generates better hypotheses about what are the driving factors than does theorizing from abstract models.

I’d recommend using other examples than medical care (in the US) and college (in the US). Those two industries have been the most distorted away from being simple markets by various features. Some of those features are explicitly designed to decouple the choice to consume from the price of the resources that will be expended. Another is that the measure of the product is constantly changing. We demand medical treatments as a right that simply didn’t exist when I was a boy. Similarly, my alma mater (which is an excellent college that in theory shouldn’t have any marketing problems) finds it necessary to ramp up its student amenities and add many more specialties to its academic program in order to remain competitive.

A better choice for studying Baumol, I think, is public primary and secondary education in the US since maybe 1950. The product that is delivered hasn’t changed greatly and the business structure of the industry basically hasn’t changed at all.

There’s also the complexity that the US hasn’t been a closed economic system for decades. Looking at wage statistics for the US is like looking at wage statistics for California — you don’t expect them to be the only, or perhaps even the major, driver of prices or consumption for any good or service that is tradable. Better would be to take everybody in the globalized countries (especially including China), and comparing them now with their parents in 1990 or their grandparents in 1960. The media US wage hasn’t changed much, but the median wage of the larger population has increased a lot. The elites of other countries are making a lot more — and they now form a significant part of the demand for US colleges. Conversely, manufacturing hasn’t so much become more productive as simply replaced an expensive set of workers with a cheaper one.

Instead of focusing on e.g. manufacturing workers, who used to be elite with respect to the world and now are not, it might be interesting to look at the wages of Ph.D.s or M.D.s or some other occupation which hasn’t been much subject to foreign competition. If you use their wages as a baseline, do the prices in different industries show the Baulmol pattern?

I have this somewhat silly urge to say that looking at average pay rates in the US over the past 50 years is like lookat at average pay rates in Flint, Michgan over the past 50 years, and saying “Have string quartets gotten more or less expensive?” Flint used to have a lot of well-paid unionized GM workers. Then it didn’t. String quartets got a lot more expensive relative to Flint wages. But since all of that auto work went elsewhere in the same economy, Flint is anti-representative of the entire economy.

So, I don’t know if someone has posted this before, I haven’t read all the comments.

But doesn’t the Baumol effect work just as well on the “investor” side as the wage side? I.E productivity in other sectors rise, increasing the relative rate of profit of those industries. In order for anyone to ever invest in education or healthcare, they would have to increase their profit margins to match. But increasing their profit margins without increasing productivity means raising the price (/lowering the quality or wages).

This would explain how a Baumol-like effect can happen even if wages don’t increase, although presumably this would cause some other measurable change, and would probably already have been noticed by now.

I have actually have a hard time buying that physician productivity has not increased.

For one thing, doctors simply do more today. Back in 1960, we had basically no treatments for heart attacks, few medications to prevent them, and not a whole lot to mitigate symptoms afterwards. Today we have the miracles of the cath lab. We can use thrombolytics. We can do coronary artery bypass grafts. We can drop in an LVAD if things are dire enough and possibly even implant a second heart in series to the first. All of these interventions require specialists who simply did not exist in 1960. So yeah we have more cardiologists per capita, but Americans now rarely die in their 50s from heart attacks.

Nor is this unique to heart attacks. Whole specialized fields of medicine have arisen since 1960. Emergency, critical care, interventional radiology, and many sub-specialties basically did not really exist in 1960. So again you need more physicians to provide additional services.

Then on the flip side “healthcare” is one of those terrible to metricate concepts. What do we really want from the doctor; we want to become healthier than if we did not spend resources on medical care. What we, properly, should be measuring is for a given a patient how much mortality and morbidity have our physicians prevented?

I would submit that our whole healthcare system is preventing massively more mortality and morbidity than in 1960. In 1960 ~10% of the adult population was obese or worse; today about ~40% is bad. In 1960 the average American married in their early 20s and stayed married. This is associated with vastly better health outcomes and cheaper healthcare (having a spouse who can change bandages can save you a very expensive stay at a skilled nursing facility for instance); today average age of first marriage is approaching 30 and record numbers of people are single throughout life. In terms of mental health, Americans’ baselines have never been worse. We have ever increasing rates of depression, anxiety, and everything else. Maybe these are just changes in diagnosis standards, but somehow we have a very rapidly rising suicide rate. Mental health is an independent risk factor for basically causes of death. We have moved the needle on smoking but otherwise the bell curve for social determinants of health has shifted in the wrong direction.

A physician from 1960 seeing today’s average patients would wonder why he is treating all the hard cases. I expect that he would quickly alienate well over half of them (who would stop taking medications or listening to his advice) and we see a steady rise in morbidity and mortality for his patients. If you put a doc from today back in 1960, she would save countless lives with small practice changes (let alone introducing new technology) and be amazed that all her patients are basically healthy.

Physicians (and nurses and all the rest) simply accomplish more today. If nothing else, everyone who does not die of the things that killed people in their 50s and 60s back then becomes much more resource intensive to treat. Bypass surgery, for instance, has created a lot more people surviving their heart attacks who need various degrees of cardiac follow-up. Dead patients just need a quick visit to the pathologist.

The other major thing that makes me wonder is how much the cost of becoming a physician has changed. In 1960, the median medical school charged ~$1050 per year at the expensive private schools. Using CPI adjustment we are looking at around ~$9200 per year in 2019 dollars. Median public medical school tuition is now north of $32,000 per year. Doing a true apples to apples for a private school is north of $50,000. Ignoring increases in housing costs, we are looking at the capital input required to become a physician basically quintupling.

Except, of course, that things are worse than this. Back in 1960, many states allowed one to begin practicing medicine after a single intern year and then start making a reasonably high percentage of the average physician’s income. Today, you need three years of residency even for the most basic family med or internist options. This means that physicians today not only have massively more debt, but that it takes them longer to pay it down. We measure the inputs, we should expect physicians to be much more expensive as they tie up much more time and capital in their training. And lest we forget, it is becoming vastly more common for medical students to need a year or two of research or work experience before medical school and another year or two after residency for fellowships. Once you include changes in retirement patterns, you end up with sizeably shortened career span.

Paying off a quintupled price tag with fewer years of earning seems like a pretty straightforward way to raise prices.

Seems odd that we are talking about price while ignoring both quality of services and the capital inputs required to train the service providers.

“I have actually have a hard time buying that physician productivity has not increased.”

I’m impressed with the steady increase in quantity and quality of minor medical techniques I witness in periodic doctor’s appointments or, especially, visits to the emergency room.

My dentist is about the same age as me (60) and grew up in the same neighborhood in a then middle class and now upper middle class part of the San Fernando Valley. I figure it cost his parents about $6k total out of pocket for his education all the way through UCLA dental school.

Being Catholic, I went more private school until B-School. My parents probably paid in tuition a total of $3k for 8 years of parochial elementary school, $3k for 4 years of Notre Dame HS, $12k for 4 years of Rice U. (Rice charged a low tuition due to its prosperous endowment), and $3k for 2 years of UCLA MBA school.

Back then Jewish people like my dentist eschewed private schools as sort of un-American. The turning point was the imposition of racial school busing in 1978. Local Jewish politicians like Alan Robbins and Bobbi Fiedler led the fight against busing, but when they were defeated, Jews white flighted from the LA public school system. These days, the San Fernando Valley is full of very low profile Jewish private schools, although the very public struggle of 4 decades ago has been memoryholed.

I think you’re wrong about your interpretation for 2.

Let’s say I spent $100 on education in 1990. Since salaries plus benefits were ~82%, that means I spent $82 on salaries.

Now let’s say my education budget has doubled to $200 (constant dollars). Since salaries are ~80%, I’m now spending $160 on salaries.

Of the extra $100 I’m spending now, $78 are going to salaries. So in my example 78% of the increase in price was due to rising wages.

Ie more than 3/4 of the increase in price is due to wage increases. If we’d held wages constant, we might expect the price increase to be about 1/4 of what it really was.

This seems to confirm their claim – the majority of the price increase in education is due to wage increases.

I am not an economist, but this does not strike me as being correct. The difference in inflation rate occurs when you switch from CPI to PCE. And PCE reflects that people adjust to variations in prices by changing their choices of what to buy. Thus the price of medicine can go up by 50% using the CPI, but the salary involves a human making trade offs and thus would use the PCE. So, as I understand it, we would not use the same inflator for them both, and arguably should not be.

A real economist should feel free to correct me or clarify, though….

An interesting data point since you highlighted physician pay 1973 to today, is military enlisted pay. The numbers are easy to find and coincidentally 1973 was the year the draft ended. Looking at your physician pay example, today they make 5.64x what they made in 1973. An E4 with 10 years of service made $5,556 a year in 1973 and $31,967 today for an increase of 5.75x. An E5 over 10 was $6336 then and $40,510.32 today for a 6.39x increase. An E6 over 10 was $6693.6 then to $43,874.76 today for a 6.55x increase.

It doesn’t look like physician pay kept pace with the pay raises for military enlisted people.

Good point.

The military are not poorly paid anymore.

On the other hand, they tend to do more tours in war zones than in the past.

And the benefits are the best! Free housing, free food, no copays or deductibles for healthcare that includes all the motrin and foot powder you can ask for.

Still, framing matters, they aren’t poorly paid on an annual basis compared to median wages, but hourly wages are still below the legal minimum much of the time.

I just thought it was a good comparison for people who think that doctor pay is the reason health care is expensive.

Also I classify the military as the ultimate service industry (it’s right there in the name), and the destructivity of the mark one model zero grunt hasn’t changed since the 70s (they use the same rifles even).

Eh, only for the really junior enlisted, and even then only, as you say, when you conspicuously don’t include all of the benefits (many of which go well above and beyond the standard sort of “benefits” one is used to thinking of in the private sector)

Suppose we live in a world with no inflation (or it’s adjusted for, as most of the analyses assume). We have a worker bee and an artist butterfly. Both make 20 dollars per month and buy 10 dollars worth of art and 10 dollars worth of goods.

The productivity of the worker bee skyrockets and she can make 10 widgets instead of 1 in the same amount of time. Due to competition between manufacturers the price of a widget drops to 1 dollar. Should the wages of a bee increase in this world? Given a robust competition, no. The profit margin of the factory stays the same, the price of the output drops by a factor of 10, the bee makes the same 20 dollars a month.

But now the insects consume 10 dollars worth of art and 1 dollar worth of goods, all things being equal. Baumol disease strikes again, except it doesn’t really. Relative price of art increased, compared to the goods, but the absolute art price didn’t have to go up in this toy example.

The salary of the more productive worker also doesn’t have to increase with the productivity. Why? Well, because in dollar terms the worker did not become more productive. That gives an insight of how the productivity can be (and is) easily mismeasured in the real word – it has to be decomposed into the price inflation component and the actual extra dollar output that was created by the bee. Arguably the extra dollar output is imaginary in most cases, simply because the competition drives the output price to the level which keeps the owner’s profit margins and the worker salaries constant.

The main reason none of these charts hang together is because they are adjusting for inflation, as if one price or wage inflation rate exists to describe all sectors of the economy. Due to friction in the economic system, you can’t instantly compete away elevated salaries, profit margins, or cost of goods. Some anomalies persist, and they are sector-specific. Yet we assume that we can average apples, oranges, and grapes, and get a meaningful result of inflation which applies to every economic actor, entity, and sector.

When studying complex phenomena, I learned to slice and dice, decompose into pieces and not compare the incomparable, pull on the various ends of strings tangled into a ball, but never to yield to the temptation to produce a single number. Economics is not the same as finance. Implied volatility of an option is very useful when comparing different securities with different prices and expiration dates, but the real economic system is not a basket of options.

Talking to Mrs. JohnBuridan this morning she pointed out some increased efficiency in teaching over the past 75 years. Thanks to calculators more students can reach Algebra 2 and beyond, so now Algebra 2 is an expectation for all students: even the GED equivalent tests have some Algebra 2 on them. The entire system has been trying to move complex math concepts to lower and lower grades for years and has been astonishingly successful – at least for some students (data forthcoming?).

Schools have become much more efficient at working with developmentally challenged students (perhaps), which for decades was an ignored issue – some students need a lot of additional help. Various student services are now offered…

On a different note, I wonder how government subsidy rates changing over time affected education. AFAIK, before Reagan’s tax cuts gifted education in America was large, then it shrivelled up. But expenditure on the left tail stayed the same or grew. Ahg! I see why Scott is obsessed with this problem. It feels like the puzzle pieces are there but we can’t figure out how it all goes together!

I used a calculator in algebra class, but I don’t remember it being good for anything besides 80085. I do however remember y=mx +b and (-b \pm sqrt(b^2-4ac))/2a. Do they teach those in algebra anymore?

Could you ask Mrs JohnBuridan to clarify?

I sought clarification: calculators have helped more students get into higher level math than they would otherwise be able to get to because mastery of math facts can take many more years for some students, especially ADD and dyslexic students. This makes lots of problem solving – especially problem solving in a timely manner difficult. Throughout high school there is a lot of math that is easy for students who understand the integers to intuit and solve quickly, but slower students are not be able to solve those same problems in a timely manner and so never learn to enjoy the beauty of math.

I am reminded of this story about a student who randomly did great with math when she didn’t have to work with integers and this paper about numberless word problems.

The formulas you mentioned are of course necessary to solve problems and students still learn them, but hopefully they learn why they are true, and so by understanding the concept know when to implement the procedure. The AoPS curriculum is motivated by this thinking: calculators can calculate, students can problem solve. Consider this humorous story in which Richards gets mocked for having lots of formulas at a Math competition.

Thanks. That didn’t occur to me. I guess I’m an old geezer, because my algebra teacher kept the calculators in his desk and only took them out for special activities.

It’s an empirical question whether there are

students who are more or less incapable of

fluency in integer arithmetic, but otherwise can do math. If there are, then I can imagine letting them use the calculator could be helpful.

In his reminiscences about Stanislaw Ulam, Gian-Carlo Rota writes about Ulam’s extreme laziness, which seems to have been an in-born trait, as well as his relatively short attention span, which came about after having his encephalitic brain sprayed with anti-biotics. This gave Ulam rather peculiar intellectual qualities that allowed him to fill an important niche. I suppose Ulam would have been happy to use a calculator.

I once worked as a tutor in a program “JUMP” that took the opposite assumption to that of the “problem solvers”: many difficulties with mathematics are psychological, “hard'” arithmetic can be learned in tiny steps, and that doing so can boost confidence and remove psychological obstacles. Here’s the link to https://jumpmath.org/jump/en/jump_home.

Of course, everyone agrees that at the end of the day, manipulation of symbols without understanding is useless, except for some signalling purposes. The question is how best to achieve understanding. Did one side win the “Math wars”?

Ultimately, I suspect part of the problem is the focus on how to teach rather than on how to learn.

So I’m really confused. The Baumol effect says that while Widget productivity over time goes from 5 widgets/hour to 500 widgets/hour, string quartet productivity doesn’t change at all. To my mind, this means that widgets are “high productivity” while quartets are “low productivity.”

The analog to string quartets are professors–as one of my colleagues once joked: “I’m going to increase productivity this semester by talking 15% faster.” Joke notwithstanding, a 50 minute lecture still takes 50 minutes, even after all these years. College professors are low productivity (compared to widgets), which is why they might be subject to the Baumol effect.

Yet throughout his piece, Mr. Alexander refers to “education” and “healthcare” as “high productivity.” Yet they (or at least education) are precisely not–at least the way I understand it. So I found the piece very confusing–I don’t understand what he means.

Please explain.

I think there is a coma, but it indicates that he is listing stuff so

Means “high productivity sectors, AND ALSO education and medicine”, implying those are not high productivity.

If you check the previous article on this

So yeah, education and medicine are not high productivity, the opening to this article is just a little confusing.

I’m not sure if ‘rising wages’ here means rising wages vs. productivity, but I DO remember Tyler Cowen saying that he thinks the problem is on the Productivity side: He thinks the rises in productivity aren’t Real.

This issue has to be considered at the margin. The marginal increase in salary for the marginal worker is the source of rising costs, not the average salary. An employee is pulled into the sector when the wage exceeds the wage in a comparable sector after subtracting whatever transaction costs exist in changing sectors. The wage difference could be quite small or large for the marginal worker depending on the transaction costs involved. The total difference for society is the share of workers employed in those sectors times the wages in those sectors. If the wage increase isn’t in doctors salaries but we pull in lots of additional nurses that have lower transaction costs to change sectors, then the average wage doesn’t need to rise much or at all. It could even fall as the people drawn in earn less than average but more than they would elsewhere.

If we look at the total labor resources dedicated to these sectors, those in fact have risen dramatically. Over the last 50 years or so, the share of total US employment in education and health services has risen from roughly 6% to 16%. This is the baumol effect in action. Low productivity sectors take much more labor input to increase output than high productivity sectors. Measured average wages within the sector have almost no explanatory power.

This is not the Baumol effect, the Baumol effect does not claim that we are going to demand more violin concerts, only that those we do demand will cost more.

I am providing a link to a google document I made (in response to Scott’s last “Baumol” post) showing some plots of historical data relevant to what I am convinced is the underlying explanation Scott is looking for (without knowing it).

These include some plots regarding declining median wage vs college costs, but I will have do some more to address doctor salaries and such in the new post. But my first concern is to elucidate what is going on.

https://docs.google.com/document/d/16rNp087cIPbiG6TlT5Lo4Xek-h8d-FV5ZtlVtGaahco/edit

The Baumol effect was intended to explain, using just the interplay of natural economic forces, why all service wages rise in lockstep relative to that remainder of the economy which is using technology to increase output per worker.

Scott liked the universality of this attempt, but seemed to recognize an absence of any sort of transparent incentive/reward pricing-feedback signaling that could be regulating it.

Indeed, whatever might have been the case in the 1920’s when mass production was first expanding; at present 90% of US workers are in services while the sectors with improving productivity employ fewer and fewer workers per unit of output in basically saturated markets. Not a recipe for maintaining upward price pressure in order to keep more people in services.

My belief is that the fundamental cause of much such seeming nonsense in economics is that inflation is being grossly miscalculated by the professionals. The true adjustment should keep service pay (and all comparable average-skilled worker pay) constant per hour worked. Human beings trading physically experienced time and effort (either directly, or through its fruits) provide the unvarying standard measure of the cost (and thus valuation) of things in any time. In the new constant average wage reference frame obtained by adjusted for this “absolute inflation,” the high productivity output goods can be seen to be getting cheaper & cheaper in terms of the hours one need work to pay for them as productivity increases.

The document is hastily assembled (and still a work in progress) but I would like to know people’s reactions to my plots showing the “actual” appearance of historical economic trends when one scales all prices to be indicative of how long the average wage earner in each era would have to work to pay them.

At the least, I believe that anybody would find this more of an insight into the way people actually experienced the economy they lived in. How much work-sacrifice does the average new home buyer expend in different times? Apparently, about the same throughout the last century. How about to buy food? It was notably more expensive in the past, for example paying the 2018 work equivalent price of over $20 for a dozen eggs in the 1930’s.

Nice post, and a good place for it.

I clicked the link to your Google Doc, and it said that I didn’t have permission to access the document. There was a button to request permission, but is there maybe a setting on your end to make it automatically public?

D*MN!

Thank you for telling me!

I think it’s fixed now, try again

I have now added the salaries of American physicians from 1928 to 2003 from Scott’s doctor link:

The salaries of doctors have declined in my ‘absolute’ inflation terms!

Down 40% just since 1996.

All these worries Scott and the d*mn book talk about are consistent with being artifacts of false inflation adjustment (CPI usually only 60% of what I recommend per year to keep average work per hour constant)

and as Copernicus would say, mine is the more parsimonious hypothesis

At the very least I hope people recognize that the way the doctors experienced their income in each era is better indicated by how long the average worker in he same era must labor to pay

Is Baumol going to claim that doctor’s salaries stayed in step with other services BECAUSE OTHERWISE they would GO TO WORK in a FACTORY!??

They were earning the equivalent of $550,000 2018 dollars in ratio to average of time, for goodness sake! How can factories make medicine stay in step with the other services over time?

Everything is orderly and sensible this way. More than just services. Not just one cost trend fits, they all do: houses, colleges, spending per student, income of doctors, whatever I look at!

How is this not considered significant?

Why am I the only person analyzing things this way?

How is that 40% possible, when real hourly wages have only increased 15% since 1996?

Because NOMINAL wages increased 130% since 1996!

My entire thesis is that what economists are calling “real” inflation adjustment (based on what a basket of consumer items cost) is not as ‘real’ as scaling by the ratio of nominal wages per hour. The things in the basket are being produced using progressively less work time and occupy a progressively shrinking share of economic activity.

But it is true that healthcare itself is rising in cost massively.

That is evident from the increasing share of GDP pie (18% of GDP means the average worker spends 18% of his time working to pay for health care, in 1960 it was 5%). That’s the sign of something that is becoming more expensive in absolute terms–the reverse of agriculture going from 30% to 1% in a century)

https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata/nationalhealthaccountshistorical.html

I don’t know where the money winds up, not in doctor’s salaries obviously, but this is not equivalent to the Baumol effect!

Everything normally attributed to Baumol rises at the rate of what I’d call “false inflation” (the percent at which CPI fails to correctly compensate the real inflation created using monetary policy)

I have finally found a mention of someone else looking at the problem in terms of time worked to afford things:

https://www.forbes.com/sites/chrisconover/2012/12/22/the-cost-of-health-care-1958-vs-2012/#2589c10e4910

Mark Perry has essentially found that what I would call the the work-absolute price of healthcare in 1958 was only 1/4 what it became in 2012. that agrees decently well with the ratio of 5% GDP to 17% GDP (1960 to 2012) i.e. 1/3.4

My absolute inflation index using the nominal prices from Mark Perry translate to $4,000 (2018 equiv) per person for health care in 1958 and $10,400 (2018 equiv) in 2012, so 1/2.6

(Perry gave a slightly high wage for 1958)

Report commentReport

Click to Edit – 59 minutes and 18 seconds

Reply Hide

The total spending isn’t a measure of the price of a given amount of healthcare. The “unit price” of healthcare would be the total spending divided by the “amount” of healthcare we buy, however that could be defined. We aren’t buying the same amount and quality of healthcare as in 1960.

agreed

I wonder why countries like Singapore have a much smaller fraction of GDP used for healthcare though. They have good results. What are we “buying” that isn’t necessary?

@Charles Engelke As far as I understand,

• Americans buy unnecessary doctor’s visits and unnecessarily expensive drugs as a result of low-copay insurance policies. Countries with public healthcare tend to ration these or discourage the• m through long waiting times etc., while other countries with private health insurance tend to discourage them with higher out-of-pocket expenses.

• Americans tend to get private hospital rooms, which are not standard elsewhere.

• Even if doctors’ salaries haven’t become higher in America over time, they are higher than in many other countries. Equivalents of the Baumol effect exist over space rather than time.

• Singapore has a younger population.

So definitionally in your system average-skilled workers never experience a change in real pay rates. So how can we explore if they are better off today or 50 years ago or in another country?

Blumenko, you compare how many units of the things getting cheaper they can buy!

how much less they need to work in a day to meet the necessaries

how many more things they can buy beside food and fuel (which used to take 90% of average people’s work time, now it’s 15% or so)

these things differ in other countries and times

for that matter, how do conventional economists explore if people are better off:

they look at the same ratio of how much the people can buy at a given time, but they freeze the value of the things getting cheaper in terms of work/time and rescale everything else, claiming that more money has magically appeared for the people to use allowing them to buy more of the things I say are getting cheaper and they say are constant. But that was too confusing.

Maybe it’s more illustrative to push the extrapolation “ad absurdum” two ways,

using the conventional, and then my own viewpoints:

Conventional economics says that GDP per person increases with progress, so eventually, if progress continues indefinitely, the GDP per person will rise beyond Bill Gates’ fortune, and continue increasing toward infinity. The belief that somehow all wages should be coupled to productivity increase means the day will come when the lowest quintile earns hundreds of billions per year. What does that mean for the nature of an economy? What jobs are they working in that pay so much? Do average people actually use any significant portion of their income? I can’t imagine the situation.

In my model, money only represents the uncompensated work someone has already contributed to another and is now waiting to have redeemed from society at large. There is a maximum potential amount of work per person that can be generated to trade in this way which we can think of as a ‘pie’.

As labor productivity progressively increases, everyone needs work less and less to get necessary things because fewer people need to be compensated for their work making things one buys.

There is so much potential human work time left over after a while, new sectors with desirable offerings spring up to induce people to exert themselves again and fill in more of the empty part of the pie. Eventually a rich diversity of desirable devices and entertainments are available, but the empty pie still wins out and leisure grows nevertheless to dominate.

The infinite end point of my extrapolation is best thought of as an approximation of the Star Trek future: a veritable apocalypse of wage/productivity decoupling: something analogous to the Star Trek Replicator! Virtually an economy without money.

In Star Trek, Replicators, using transporter materialization technology driven by inexhaustible dilithium crystal power, provide for free, any food, object or known device that any citizen of the federation requests in their own home. Here is the ultimate in “outcome equalization” at last!

But is there a problem that wages haven’t “kept pace with infinite productivity?” (Actually, wages would still be necessary to employ other people directly or to rent a room or buy land: those will still go for the equivalent hourly rate as today, they have no deep connection to the source of “productivity”)

Is the GDP of the Federation infinite? Or is it zero? Do you care? How would a billion dollars help you more than free stuff ala “Big Rock Candy Mountain” or Aladdin’s lamp?

Of course, one can still join Star Fleet to explore, or create art, or provide services to others, but no wolf threatens at the door if you don’t.

In the standard economic view, yes everyone in Star Trek has infinite income which they spend on basically free replicator stuff, like Lamborghini-equivalent spacecraft, whatever food they want, etc. which if you add it all up in today’s prices costs a hefty sum. If people still needed real estate or to employ other people directly, then GDP wouldn’t be infinite just very large, and a huge share of people’s incomes would be tied up in those things, and hence inflation would also be high.

Yes, agreed,

and I think that is a nonsensically unphysical claim to be making.

So I am against the standard economic view.

Money is for facilitating the trading of work between people.

At anytime, I believe, it should be tied only to what value people have given to others and not yet been compensated for in kind.

It shouldn’t be tied to an abstract valuation of some intrinsic worth in some totality of things.

We treat water as if it were free (but it was rare and hard to get clean water in the past) If eventually, we do get water for free from taps, does that mean an economist from king Herod’s distant past can legitimately prove we essentially have infinite income?

I’d rather define money in terms of average compensation for work hours, and evaluate economic progress by using something like the hours needed to produce things in a CPI-like basket. This would shrink with productivity, so you might prefer the inverse. Or take the time an average worker had to work to buy the contents of the basket at the reference time (when basket was decided upon), then, in subsequent years, take the new time it takes to buy the basket, and subtract it from the reference time, maybe divide this difference by the original reference work hrs.

When that indicator gets near unity, you know that particular basket is no longer useful (so you don’t get the infinite inome from water problem)

Having “astronomically” high inflation in the Star Trek universe would be a stupid price to pay to keep today’s economic analysis based on price of ‘like’ widgets “standard.”

What is real and constant in all eras is the people’s experience of time and effort, and what that indicates to us about how much they value what they buy with its earned proxy, money.

The thing to look at is not our valuation of what they were buying, but how much they valued it.

For now, just take people’s valuation of time: would you spend an hour, say in jail, in return for a dozen eggs? Then the next hour for a pound of pork chops, the next for a pound of butter,…and so on for every item on your grocery list?,

At some point you need your time for something else!

But the average person in 1935 had to work about that long for each of those items, while in 2019 the average person trades only 2 or 3 minutes for each.

Doesn’t that mean more about the comparative ‘cost’ of eggs then and now than whether they are grade A in our terms?!

If there is a potato blight in 19th century Ireland, the amount paid for an intact potato cannot be used to value the currency of the time by comparing it with our present potato pricing!

the goods are not what we value, its our need or desire for them, in context of our time, and that is revealed by how long we work to get them

blumenko:

But this statement is a description of cost disease and so answers Scott’s original question!

Clearly there is no market competition going on in the Star Trek limit. Nobody can stop giving massages and be better paid working in a replicator!

Just a definitional problem with calculating ‘real’ GDP.

=THE cause of Baumol effect.

(Taking limits is often clarifying)

You can say you just prefer the standard economists’ way of describing things, even though its clearly not the only way, it’s the established convention,

But, then accept the illusions that it creates with open eyes. Don’t run around trying to cure a “cost disease” and make policies in the Star Trek universe to reduce the pay of masseuses progressively to zero thus staying proportional with the stuff that comes out of the replicators.

The same goes with trying to avoid having income concentrating in a small percent of people when the cause of productivity increase is an efficient network (rather than shrinking manufacturing cost per unit): J K Rowling made several billion dollars due to the “Harry Potter” boom while other children’s book author’s income stagnated! What can be going wrong? Does she have too much political influence?

But, perhaps I really should make more of a case for the naturalness and morality of keeping average wage constant when adjusting for inflation, or targeting monetary policy.

I think Frederick Soddy (the 1921 Nobel Prize winner for discovering radioactivity = transmutation of elements with release of ‘atomic energy”) was right, when venturing outside his specialty, he posited that fundamentally, money is a way to allow work specialization through the barter of equal work values within a self-organizing cooperative. As with all cooperation, the key is trust.

When someone has contributed the fruits of work and skill to another and received only a token IOU of equal value redeemable from society at large, he needs confidence that when he does require something concrete himself, the IOU will still equate to the value he trustingly contributed.

Note:

The value of a kind of work is shown by how long the average person would work to get it, this is settled through market forces, not statisticians.

When any inflation occurs relative to average work, it is amoral and destabilizing. Yes, I know average people won’t have an incentive to spend their money quickly.

That is not a problem compared to what happens with the richer people who can collect capital for future investments or emergencies. But their money is made to evaporate by government monetary policy, and their only fully reliable recourse is to buy land which on average retains its intrinsic value relative to work (see figures for average house price in my google doc link).

That means that rich people buy up more of the best land than they otherwise would want, which raises prices and reduces options for the less well off. It also leads to speculative bubbles in the most desirable places where demand for a safe place to store money increases demand and the rising price encourages more buying since the value is actually increasing relative to average wage inflation.

But this is not real value, it is psychological future value.

Humans bind future and past in their planning, but future is not known definitely. The positive feed-back in all evolutionary systems is vital: “this worked — so do more of the same –repeat”, that is what drives real productivity innovations and experience curve effect, and new effective structures for production are invested in quite properly by people with excess capital as their superior future potential shows through success.

But pseudo-success trends, fueled by Ponzi-like structures can induce the same automatic response, even when there is no real source of value increasing.

And nothing can drive such impressions of pseudo-success like inflation induced distortions along with its smothering all sight of the real trends

Wish this had more responses would be interested to see what people think of this.

Here’s a paper about Baumol’s in US post-war history that might address some of your lingering questions: https://preview.tinyurl.com/y4brvvej

Not to overstate, but COLLEGE STICKER PRICES ARE NOT A GOOD INDICATOR OF COLLEGE COSTS.

The “sticker price” of college has risen dramatically, but the AVERAGE price has basically kept pace with inflation. We live in a world in which the rich pay the most, and the poor pay the least. This should be celebrated with bells ringing in the streets. Instead, it’s a constant complaint, and I have no idea why.

https://www.npr.org/sections/money/2015/09/30/444446022/what-youll-actually-pay-at-1-550-colleges

https://www.npr.org/sections/money/2012/05/11/152511771/the-real-price-of-college

Perhaps because when we ask the price of something, we want a number, not “How much is it? Well, how much ya got?”

But what good does that number do when you know that 95% of people won’t be paying that price?

I think pdan is onto something here. College and health care are both where we see the biggest supposed rising costs, but they are also the markets where the overwhelming majority of people are unlikely to actually pay anything close to the “sticker price.”

We could fund universities publicly, and we’d have largely the same result. The rich people would pay a great deal more in taxes, the poor would pay very little. There’d be no incentive for people to assess their true ability, though, so we’d need to introduce a testing system.

The only part of this that bothers me is that the people I hear complaining about the high cost of college (biased sample, but still) are those who have benefitted the most.

We could address the other major shortcoming by tieing the amount of funding a university can get in student loans to their loan repayment rates.

I don’t think it’s the same result since (my limited understanding) there are a lot of people from other countries that pay the full sticker price. I’m not sure how you would keep that dynamic in a public funded system.

Why couldn’t you? The UK does — a British (and for the moment, EU) medical student will pay ~£9k/year, whereas a non-EU international at e.g. Cambridge would pay £55k.

You could have non-citizens pay the full cost just the same.

That is shifting the costs of college from those who benefit the most (college students) to everyone, including those who don’t go to college and don’t benefit. And no outside testing scheme will be as good as charging and thereby weeding out people who it isn’t worth it for. As it stands a rich or poor person who doesn’t plan on sending anyone to college faces no effective marginal tax on earning more, but under your plan they would, and they would reduce output, for a deadweight loss.

Instead, it’s a constant complaint, and I have no idea why.

Because it sucks for the provider of a service to dig through your life to determine exactly what you can afford to pay.

It’s yet one more thing on the list of marginal taxes put onto the lower- and middle-class.

Except, technically speaking, they aren’t doing this in order to raise your price, but rather, to lower it.

As far as I know, you’re free not to fill out a FAFSA. I think most schools won’t rescind your admission if you don’t disclose your family’s finances. You’ll just be required to pay the full sticker price.

they aren’t doing this in order to raise your price, but rather, to lower it.

No. They are doing it to charge people the maximum they can.

They frame it as at giving a discount, but that has no effect on reality. This is the standard for the corporate pricing world.

Thanks for posting this. I made a similar observation on one of the earlier posts. Because of grants,discounts, and tax deductions the actual affordability of college is not rising anywhere near what the sticker prices seem to indicate. And on medical care, I think it is hard to argue that in terms of benefits in terms of outcomes, that we aren’t getting more for our money than we did twenty years ago.

My health care costs are twenty thousand a year for two people, but I would still rather pay today’s prices for today’s care than 1970 prices for 1970 health care.

I can think of two reasons:

1. If “financial aid” in that article includes student loans, then you are paying those costs, just later.

2. If your financial aid comes from the government, whether as a loan or grant, then everyone is paying for it indirectly (although the rich do pay a larger fraction). “The government needs more and more money to give everyone a college education” is not the sort of news that gets people dancing in the street.

Sure, there’s no objection about the Baumol effect not making things more expensive on average. But I think that the real reason anyone would be interested in explaining things with the Baumol effect was to say, as per Scott in the previous post,

If we are left with “the Baumol effect leaves an open door to rising inequality that goes directly into No-Idea-How-To-Fix-It-Land” then I anyway don’t have so many reasons to share the optimism of the authors when they say

(See how happily they switch “Society” and “Individuals” there.)

I’d say that “normal people can’t afford to pay college tuitition or medical bills because capitalists have taken all the money” is slightly more optimistic a take than “normal people can’t afford to pay college tuition or medical bills any more because we forgot how to run schools and hospitals” and much a more optimistic take than “normal people can’t afford to pay college tuition because capitalists took all the money AND we forgot how to run schools.”

I don’t think anyone really has the right tools to analyze economics properly. This is a really big country with really big differences between places. For example, in my zip code the median house costs just under 90K, and the median teacher makes 49K. Using the thumb rule of 3x annual income for a house, a median teacher can afford an above median house. This is probably not true where you live. I don’t think national medians or averages work since they are skewed by more people living in expensive cities than in the rural areas.

Looking at the same place over time doesn’t fix the problems since places don’t stay the same. You could try to compare like places over time, like 10 largest cities average 1970 to 10 largest cities average today, but it’s not easy to find good data like that.

Has anyone tried to get data on this outside the US? That might be revealing – since I would guess western countries are likely to have roughly similar Baumol-style effects while they differ much more in regulatory environment and other factors.

For example here, in Czech Republic, I am quite sure the expenses on health and education are not growing dramatically (could try to dig some sources if anyone’s interested) – part of that is obviously that the state pays for almost all education and health, but it is not markedly increasing as a percent of the budget/GDP/whatever. We are however also having large problems due to government not paying teachers and doctors enough so they leave the profession/move to other countries. Is that something to be predicted if Baumol was the cause of cost disease in the US?

Absolutely. The core of Baumol is that the laborers have an alternative: sectors with increased relative productivity; if compensation in the decreased relative productivity sectors does not keep pace, they’ll switch sectors. The last step (compensation increasing in the decreased relative productivity sectors) is short circuited by government involvement in your example.

It seems to me that a mistake is being made here.

Scott, you are alternating talking about prices and wages. Baumol isn’t about wages, it is about prices. Increased productivity increases supply, which (Econ-101) lowers prices. Any wages are downstream of this effect. Low productivity gains for one product means that prices rise in relation to the high productivity gain product.

For an example of how this can trip one up, consider this post from Kevin Drum about a proposed switch to chained-CPI for measuring the inflation rate. The key point here is that “hedonic adjustment” is a key component of inflation calculations.

Theoretically, the real cost of a car has halved since 1980. But when we look at the inflation adjusted cost of a lowest base price car today vs. in the past, they are basically flat (not halved). But that’s because the productive gains involved in making a car haven’t gone into lowering the price of the out-the-door car, but rather in making “more” car (ABS, air bags, power windows and doors, etc.).

The professor, doctor or nurse’s productivity isn’t rising at the same pace, so relative to the flat price of the base model car, the “base model” healthcare increases. There’s more car available compared to healthcare or education.

The assumed argument is that we should should somehow see this directly reflected in wages. It’s probably an interesting argument to have, but it seems to me it’s a different one.

Yes, this is definitely something I have trouble understanding when it comes to comparing prices and wages from different eras: how exactly do we make sure we’re comparing apples to apples? You can’t even just compare apples, because automation, pesticides, logistics, etc, allow fewer people to more efficiently deliver more apples to more people. And you can’t compare what you could trade those old apples for versus what you trade the new apples for because, like you said, however many apples got you a car in 1980 might get you a car but a completely different quality of car in 2019. We’re not doing the same labor, and we’re not producing the same things.

But it goes the other way too. Some things, like having a servant, have become more expensive. To what extent is the shift to alternatives a deterioration that people feel forced into due to rising costs of certain goods/services?

The short answer is that you track inflation, not the price of apples.

And you track inflation by measuring a whole “basket” of goods that represent the broad economy. There are different ways of doing this, and those different methods come up with subtly different numbers, but they don’t differ wildly from each other.

Hedonic adjustment is included in the calculation of inflation. But that means that sometimes inflation doesn’t capture what prices “feel” like. Remember that, according to inflation calculations, cars have dropped in price (in real dollars).

But it doesn’t feel that way because the average person buying their first car today is buying more car. A whole, whole, whole lot more car.

Or, take something like phone service. From a real dollar perspective people are paying way more for “phone service” today. But from a hedonic perspective they are paying way less!

Yes, and my intuition with this is “basically you can prove anything you want about the economy with numbers by looking at it from a different perspective.”

“Are people working for more or for less than they used to?”

“Yes.”

Just because “90% of all statistics are made up”, it doesn’t follow that statistics are meaningless, though.

Every explanation I have seen is that the Baumol effect is about wages, not prices. Your posited effect doesn’t make sense without a wage picture. The input to a string quartet isn’t really 4 string players, but the wages needed to pay 4 string players, which covers housing, food, mobility etc. If the cost of all those goes down, then the wages (and cost) for the string players should go down as well, as that would keep the real wage the same. The reason it doesn’t because of rising real wages.

Hmmm. I see Wikipedia seems to agree with you. I had always seen it being referred to as “Baumol’s cost disease” and people complaining about the cost of all sorts of things going up.

Thinking further, I believe I am inclined to agree that the basic argument of Baumol works at both the wage and the price level.

However, I still think it’s a mistake to think of wages and prices as fixed relative to each other. Just because these effects result in price increases, it does not necessarily follow that we will see an equivalent rise in wages. It is a mistake to talk about wages and prices as inextricably linked as if in a fixed formula. We know this isn’t the case.

People are complaining about rising prices and Baumol’s disease is a particular explanation that focuses on wages. Whether it applies to a particular case is determined empirically, so it is not a fixed formula. There may be alternative explanations, but the point is to distinguish between them.

My problem with the first two graphs, and I think it’s a serious one is: They are looking at slices of the population without considering the changing size of those slices. Salaries may be kind of stagnant for both high school only and college grads, but a much higher portion of the population are going to college!

That also means the general quality of both groups are lower. Back in the days a lot of people only did high school (or less). Today it’s, to be very crude, only the people are two dumb to get into college. But they are still getting paid about the same as high school grads from back in the day. That is a rising wage per work quality. Likewise, a big portion of 2019 college grads aren’t as bright at 1960 college grads, but they’re still getting paid more.