[Epistemic status: As always, I am not a statistician, and anything I say should be taken with a grain of salt until confirmed by others]

I.

A while ago, I wrote Beware Summary Statistics, where I talked about all the ways I’ve been misled by things like r-values and so on. I recently found some really interesting cases that brought up a few more some of these issues.

Back in June, Noah Smith blogged about a study on IQ And The Wealth Of States.

Some background: a group including Richard Lynn suggests that IQ is the driving factor behind income differences among countries. They are able to cite statistics on how a very rich country like Singapore has an average IQ of almost 110, and a very poor country like Haiti – well, it’s hard to say, because not too many Haitians take IQ tests and the ones who do might be so confused by this weird new idea of filling out a written multiple choice test that they choke and underperform – but officially Haiti has an IQ of like 70. Since you need smart people to build cool things like highways and power plants, maybe this explains a lot of the development/underdevelopment dichotomy. These people can point to a pretty good correlation between national IQ and national development to support their thesis, but the obvious counterargument is that maybe highly developed nations have good health and good education which raises IQ.

Anyway, the study Noah blogged about tested the application of this theory to US states. Noah sums up the results as follows:

The upper bound for the amount of state income differences that can be explained by population I.Q. differences is about a third. If we assume that achievement scores are a good measure of I.Q. and that school attainment doesn’t improve I.Q. very much, then the number goes down to about one-sixth.

What this really shows is that there is Something Else that is driving state income differences. My personal guess is that this Something Else is mainly “external multipliers” from trade (the Krugman/Fujita theory). Institutions probably play a substantial role as well (the Acemoglu/Robinson theory). That’s certainly relevant for the debate about different models of capitalism, where we often compare the U.S. to Scandinavia and other rich places.

In any case, this result should be sobering for proponents of I.Q. as the Grand Unified Theory of economic development. Average I.Q. is not unimportant for rich countries, and we should definitely try to raise it through better nutrition, education, and (eventually) brain-boosting technologies. And it still might matter a lot for some poor countries. But for rich countries, there are things that matter a lot more.

II.

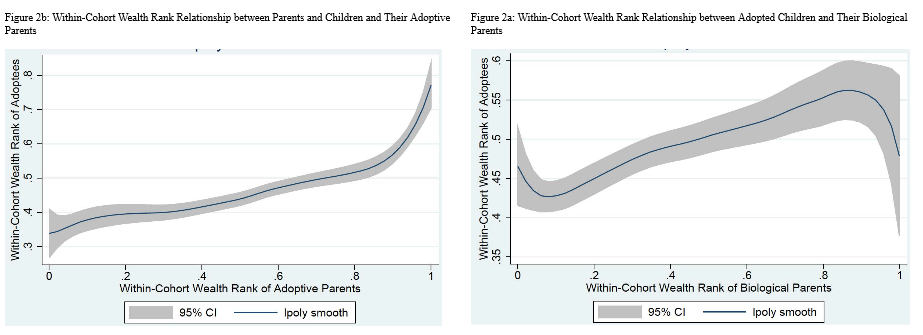

Let’s go to another study. The Atlantic has an article on How Rich People Raise Rich Kids, which is about Black, Devereux, Lundborg, and Majlesi (2015). They look at adopted Swedish kids and determine whether their wealth (not income!) as adults is more correlated with that of their biological parents or their adoptive parents. They find that non-adopted kids’ wealth correlates with that of their non-adopted parents at 0.33, adopted kids with biological parents at 0.13, and adopted kids with adoptive parents at 0.23. This suggests that upbringing is more important than genetics in determining how much wealth you will have.

Part of me wonders if an adoption study is really the best way to deal with this. Giving your children up for adoption is a very unusual choice, which means the biological parents are a very nonrepresentative group – and the study indeed finds that even forty years later, these biological parents have only a third as much money as the average Swede. If the same factors that cause them to give their children up for adoption – illness, relationship problems, trouble with the law – also cause them to fail to live up to their “genetic potential”, then we wouldn’t expect their children (who may lack these issues) to be correlated with them. The extremely odd shape of the graph also gives me pause: after a certain point, the wealthier your biological parents were, the less likely you are to be wealthy. Why? Certainly there’s no such effect for adoptive parents or non-adopted people!

But nitpicks aside, I am pretty willing to believe this. Although other studies have found evidence that biology is more important than upbringing in determining income (not wealth!), wealth seems like a different story. For one thing, you can just give your kids money! As I said last time we talked about GiveDirectly, there is pretty good evidence that giving people money causes them to in fact have the money which you just gave them. The current study reasonably tries to avoid having to deal with inheritances by looking at people whose parents are still alive, but even living parents can give lots of money to their children (for example, I come from a pretty wealthy family and my parents gave me lots of money, which I mostly used to help get through medical school without much debt. This means right now I have more “wealth” than people who took out bigger loans).

The authors write that:

While we have established the relative role of nature versus nurture, the exact mechanisms of wealth transmission are more deifficult to ascertain. Wealthier parents tend to be better educated and earn higher incomes, and these factors could lead to the increased wealth of their children through, for example, teaching them about investment opportunities or providing the right opportunities. However, when we investigate this, we find little evidence that this is the case. It may also be that wealthy parents invest more in their child’s education and career, which could then lead to higher child wealth accumulation. When we examine whether this is the case, however, we find little evidence for education or income as mechanisms. So the pathway through which parental wealth affects child wealth does not appear to be primarily parental schooling and income or child human capital accumulation and greater labor earnings. Taken together, our findings suggest potential roles for intergenerational transmission of preferences (children of wealthier parents may choose to save more or invest in assets that have higher returns) or for financial gifts from parents to children. Unfortunately, we do not have information on savings behavior or on financial gifts so this evidence is only suggestive.

So it seems to be a matter of how much money your parents give you, rather than of you learning deeply important personality traits from them or something. Fair enough.

But I got distracted. I was talking about the Atlantic’s article about the study. What did they have to say?

Even when they’re adopted, the children of the wealthy grow up to be just as well-off as their parents.

Lately, it seems that every new study about social mobility further corrodes the story Americans tell themselves about meritocracy; each one provides more evidence that comfortable lives are reserved for the winners of what sociologists call the birth lottery…What appears to matter—a lot—is environment, and that’s something that can be controlled.

III.

Let’s talk about three things – correlation, percent variance explained, and reality.

(I’m talking a big talk here, but I only got a good feeling for this when I asked various people on Tumblr to explain it to me. But they did a good job, and now I’m explaining it to you.)

Correlation is an r value. Percent variance explained is correlation squared. Reality is best viewed in the form of a graph.

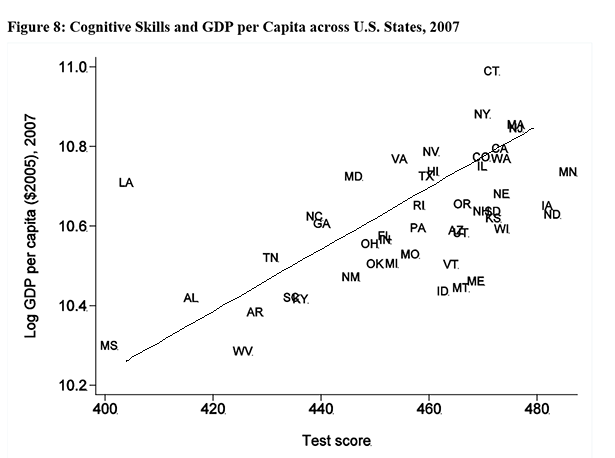

Noah tells us that the IQ-of-states study found that only about 14% of the variation in state GDP was explained by IQ. Since variance = correlation^2, this implies that there’s a correlation of sqrt(0.14) = 0.37 between state IQ and state GDP. The paper itself did some sort of super high-powered nuclear statistics to arrive at this estimate, but I took lists of state average aptitude test scores and state GDP per capita and correlated them together in SPSS and got 0.40, so easy way and hard way agree pretty closely.

Here’s the graph associated with the study (I added the line):

(Proposed new state motto: “Louisiana – Where We Succeed Wildly Out Of Proportion To Our Low Intelligence!”)

Huh! When you hear “…only explained 14% of the variance” it sounds like “go home, this is boring,” but when you hear “correlation of 0.37”, it sounds like “huh, they seem pretty related”, and when you see the graph, it looks like “holy frick, everything is IQ after all”. But all of these are the same finding!

Now. Consider the Swedish study and the Atlantic article about it. They say that although biological parents were correlated at r = 0.13, adoptive parents were correlated at r = 0.23. Therefore, they conclude, nurture wins over biology, meritocracy is a myth, everything depends on the lottery of birth, and wealthy parents are foredoomed to have wealthy children.

But r = 0.23 means the percent of variance explained is 0.23^2 = ~5%. If some Social Darwinist organization were to announce that they had evidence that who your parents were only determined 5% of the variance in wealth, it would sound like such overblown strong evidence for pure meritocracy that everyone would assume they were making it up.

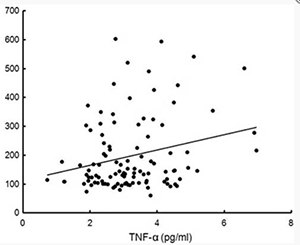

The study didn’t come with a scatter plot, but here’s a plot from a totally different study that got a very similar correlation (0.24) to give you a feel for what it might look like:

The article makes it sound like your position in the birth lottery determines your destiny with impressive finality. The correlation seems unimpressive. The variance seems really unimpressive. The scatter plot looks like someone took random noise and drew a line through it. Once again, all the same finding.

Which of these three ways of presenting the data is most accurate? Um. Hard to say. I asked some people whether correlation (ie r = 0.23) or variance (ie 5%) is a better description of how the world actually works. That is, given that I have a certain “feel” for how much people differ in wealth, and a certain “feel” for what it means to win the birth lottery by getting rich parents, should I feel like the birth lottery thing explains 23% of how much wealth you have, or only 5%?

(I was only a Discordian for like six months, in my freshman year of college, but I still end up with fives and twenty-threes every time I try to do something involving numbers)

The answers I got were that it’s complicated, and both sort of work even though intuitively they should be mutually contradictory. The distribution of wealth is consistent with a story where it is explained by twenty different factors, each of which is just as important as parental wealth, which is sort of like 5%. But parental wealth explains just over a fifth of the standard deviation in wealth, which is sort of like 23%. The best explanation I got, from an anonymous commenter, was this:

About variance: consider the following. Flip 25 coins. Each heads gives you +1 utility point, and each tails gives you -1 utility point. One of these coins is labeled “upbringing”. On average you get 0 utility points. But you can also expect not to get exactly 0: on average, your distance from 0 will be 5 (the stdev is 5). So this is a little similar to a single coinflip that gives you either +5 or -5. Changing your upbringing from -1 to 1 gives you 2 points, out of a typical range of -5 to 5.

There was also a general consensus that if I had to think about this intuitively, which I should try not to do, 5% was probably the number that would lead me less astray, at least in terms of inputs. So fine. Whatever. Five percent it is.

IV.

Stalin once said that “The people who cast the votes decide nothing. The people who count the votes decide everything.”

(I briefly questioned whether Stalin really said that – like, I know he was an evil despot, but I’m not sure he was sufficiently self-aware about being an evil despot to come up with witty evil-despotism-related quotes. But I checked his WikiQuote page, and not only is the saying well-attested, but it seems Stalin was totally all about coming up with the witty self-aware evil-despotism-related quotes. Huh.)

In the same way, the people who conduct a study decide nothing. The people who report on the study decide everything.

I think Noah and the Atlantic were both honest and did a decent job reporting on their individual studies. But taken together, Noah concluded “This shows that IQ doesn’t really matter that much in explaining GDP” and the Atlantic concluded “This shows that who your parents are matters a colossally huge amount in explaining wealth” when in fact if you put both the studies side-by-side the IQ finding is three times as strong as the parents finding.

[EDIT: Some people have been misunderstanding this, so let me say it clearly. These are two studies about two different things! It’s like if I said the percent of weight gain explained by carbohydrates is three times as large as the percent of crime explained by poverty. I can compare these two things statistically, but I’m not trying to combine them into a single meta-study where I say that carbohydrates cause more crime than poverty! Also, some people seem to think I’m saying the Swedish study finds genes/biology/IQ to be more important than nurture. It doesn’t – in fact, it finds the opposite! Nurture is more important than genes but in the grand scheme of things both are tiny and the variance is almost entirely due to other things or randomness.]

In the end, nobody except a handful of researchers is going to remember the exact number. But they might remember “There were a couple interesting studies recently, one of them proved state IQ didn’t matter, the other proved that who your parents are totally determines whether you get ahead in life.” Framed that way, you might actually have gained negative knowledge from your diligent attempt to understand the economic literature.

And if the surrounding culture is pretty united in wanting to push a specific line, by choosing whether to publish r values or percent variance explained or graphs, they can pretty much hijack the intuitions even of people who don’t accept their reporting and try to rely on the numbers themselves.

The antidote is to have a good grasp of what each statistic means. And another antidote is to dial down your expectations. Remember, the study above was only able to correlate state IQ and state GDP at r = 0.4, but almost nothing in social science ever gets above 0.4. Trying to correlate rich parents with kids who become rich only got 0.2! 0.4 is pretty impressive and if you’re holding out for too much more you’re going to be living in a constant state of disappointment. I can think of one exception off the top of my head, and I am proud to say you will only find it here.

It is worse. Even in students textbooks, often size of the effect is no mentioned, so in the end psychology students minds get creeped in with knowledge about some relations that are in minor, but since it is not mentioned, i bet they think the relation is important.

I remember that two decades ago there was quite infamous book, called The Brain Sex or something like that, about Gender/Sex differences. I read it as a very young kid, so missed all the reviews and opinions, and decided, it was cool book.

I mean, it listed a ton of differences, and also mentioned that the only one that is very significant is skin sensitivity (precisely, ability to distinguish between two stimuli on the back, women could do this with the stimuli much closer to each other*). How i was surprised much later on when i read that this book was all about nature, huge and immutable differences and all that stuff that is present in the debate (war, really) about humans. How people got that from that book, well, the post is probably partly about that.

*Its bizarre. I mean, evopsych/sociobiology is funny its the way that it is possible to come with ad-hoc hypothesis for pretty much everything (and often for two contradictory ones, or even opposite), yet i have no idea why such thing would happen. Any takers? 😉

Random hypothesis: women need to be more careful with their bodies because they sometimes have fragile babies inside of them.

But, but, back? Why back of all places, and not, to go along your hypothesis, abdomen, much closer to pregnancy area?

The only thing i can think of is some wierd side effect of something, but it is still bizarre, and a cop-out, to be honest. The other hypothesis (also a cop out) is some sort of laboratory/reporting/documentation fuckup like the iron in spinach one. A bit likely, because it really stands out (basically, in every other thing, the gendered curves of distribution of traits are mostly over each other, but in this example, they dont even come close to each other)

This is completely unrelated to everything:

Well actually your Stalin quote made me think of world readers and quotes.

“the people who conduct a study decide nothing. The people who report on the study decide everything.”

-Alexander the Slate

Okay. Coming to this late again. I think there are all sorts of cultural attitudes also that contribute to wealth in life that are not really discussed by the Atlantic article. Here is how I see it.

1. In large swaths of Anglo-American culture, there seems to be a thing where the kid is out once he or she reaches the age of majority. I’ve known people whose parents have done something along the line of “Happy 18th Birthday!!! Now give me the keys to my house! Goodbye!” This doesn’t necessarily happen in working class families only but I have seen it in more working class families than not.

2. The value for kicking kids out of the house at 18 seems to be independence above all in a sink or swim kind of way. The kids who grow up with such a technique might always be able to find work but it will be more of the job to pay the bills kind of way as opposed to long-term career and income growth kind of stuff. This is a philosophical preference for children though.

3. My general observation is that people think along these lines: “I love/hated how I was raised. I will do exactly/the complete opposite of what my parents did.” This is a bit of hyperbole but generally true. I know someone who was really pushed hard by her parents. Hard enough that she graduated from a very prestigious university in three years instead of the typical American four. Now that she is a parent, she posts lots of stuff on social media about the importance of unstructured play.

4. Related to #1 and #2 is whether your parents raised you with the idea of job or career. I know people who were the first in their family to go to university and all their parents did was pester them about “How is this going to get you a job?” Notice the word. Job as in something that gives you a paycheck on a regular basis. Not something like a career which can take a long time to get via study and apprenticeship, might require to take one step back to eventually take two or three forward, etc. My parents were professionals and wanted me to have a career and they gave me encouragement during some rough patches to move forward instead of taking an easy way out to look for a secure position with job security.

Of course some rich parents can help their kids more than others. Some parents say things like “I think real estate is a good investment so I am going to give you a loan so you can invest in property”, etc.

By Anglo, I mean people whose ancestors came from Britain generally. I have never seen the “You are 18!! Goodbye!!!” thing done in Asian cultures, Italian or Greek families, Jewish families, African-American families, Latino(a) families, etc. There seems to be something very British about the idea of kicking kids out at 18 just because they became adults.

One friend said that her parents asked for the keys back when they dropped her off at college. I find this very strange. I still considered myself a resident of my parent’s house when I was in college even if I lived in the dorms. I graduated college at the typical American age. My acquaintance graduated well into adulthood because she did everything by piecemeal with gaps to work and stuff like that. And I have seen people seriously argue that the way to make college/university more affordable is to put more people on a 10 or 12 year plan and I find that bonkers.

Even at 34, I have keys to my parent’s house and brother’s apartment. This is because we are a family that looks after each other but there seem to be families where this is considered a kind of dependency/weakness.

I think you are right, and while there are a lot of disadvantages (social, emotional, financial) to this kind of attitude, it seems to be very good for the economy to force as many people as possible to become autonomous economic production-consumption units.

At the opposite end of the extreme, I’ve read a partial theory for much of Africa’s perennial economic underperformance: many African societies have such a strong family/clan mindset that as soon as anyone comes into a bit of wealth, he is expected to spread it around his entire extended family/community network. This may inhibit capital accumulation.

Greek culture is similar. Ironically, this is one of the things that has helped Greeks weather the current economic crisis; most people have family to turn to.

I wonder if (within the Christian world) there is a Protestant/Catholic (and Orthodox) divide — related to the “Protestant work ethic,” perhaps? Saul mentioned families with British backgrounds, but I see the same dynamic with families from German backgrounds too.

I am not sure that this hurts Africans and Africa. There are lots of things that hurt Africa like centuries of being taken as slaves by force and colonialization. Wealthy African nations like Kenya still have the strong family/clan structures. So do a lot of Asian nations where it is not uncommon for people to live in multi-generation households for their entire lives and no one considers you odd for living with your parents for a long time.

My parents will always give me a place to stay but I don’t think we want to live with each other either.

I think you need some family/clan support to establish capital though as well unless you are really lucky. My friends who were made completely autonomous at 18 do not seem likely to build up capital. They took longer to graduate from college (if they did at all), they did so with more debt than even someone who just did it in 4-5 years, my acquaintance can always get a job in food service but she seems to spend so much time in that mode that it took her a long time to find a position with career and income growth.

There was an article in the Atlantic about how young people who start companies tend to come from well-to-do families and have personal safety nets. In my experience, this is true. The young people I knew who were able to take career risks and start companies generally come from well-to-do families, their families were able to support them in some ways, and/or introduce them to potential investors, and/or get them into schools/situations where it is easier to meet early investors. You are much more likely to attract capital if you went to Harvard Business School over UT-Austin and UT-Austin has a pretty good Business School.

This might or might not be a problem but I am generally inclined to think it is a problem and a cause of wealth and income opportunity.

as soon as anyone comes into a bit of wealth, he is expected to spread it around his entire extended family/community network. This may inhibit capital accumulation.

While most non-European cultures are far more clannish than NW Europeans, the dynamic among, for example, the Chinese appears to be not quite the same. A Chinese person succeeding in business may be expected to hire his relatives before strangers, but those relatives are expected to pull their weight – one has to be more successful before there’s an obligation to support non-immediate-family members who are incapable of or unwilling to work.

Troy mentions Greece making it through their crisis because of this effect. The expectation that you’ll help out your less-fortunate relatives is reciprocal, and in a society where poverty is widespread and it doesn’t take much to become desperately poor, that expectation is a very useful survival value. Unfortunately, it’s a value which inhibits advancement out of poverty, both individually and societally.

Also look at Jewish-Americans and Asian-Americans, who still tend to have an attitude for their children of “You are going to college and/or going to grad school”. A lot of people found it shocking that my parents had an expectation that I needed to get a graduate degree of some kind.

The whole college is not for everyone argument seems to mainly come from people with Protestant backgrounds as well and usually deeply evangelist ones. Most Jewish-Americans and Asian-Americans seem to prefer their kids become lawyers, doctors, engineers, businesspeople, academics, etc over pride in a story of starting a small business at 18 and building from there without a college degree.

So part of capital accumulation or financial-income success might also revolve around respecting education as a social good and thinking it needs to be done seriously and as quickly as possible. The people I know who like the ten-year plan seem to do so because it is independent, seems to mean paying your own way largely, and doesn’t require government intervention. I think it is better to have people graduate earlier and then have more time to earn money at higher salaries.

Yes, it doesn’t seem to hurt the Chinese, and it is still common for Chinese to have three generations in one house, and for people to borrow money from relatives to buy a car or house sooner than borrow it from a bank. But they also have a very pro-enterprise, pro-education mindset. The pro-education mindset is very old; in pre-modern times the Chinese, like seemingly everyone else, are very anti-merchant in ideology, but they develop a merchant economy anyway pretty early on, so there’s a tradition of that too.

Also, no offense to you personally, but I wish people in general would stop pointing out slavery and imperialism all the time. There is no one who doesn’t already know that slavery and imperialism might be a factor in the underperformance of Africans and African Americans. It gets a little tiresome to always hear, “well, there was a little thing called slavery…” every time one mentions other factors.

It’s called the “absolute nuclear family” and it’s mostly seen in old Anglo-Saxon regions. David Willetts wrote about it in 2010:

“Instead, think of England as being like this for at least 750 years. We live in small families. We buy and sell houses. … Our parents expect us to leave home for paid work …You try to save up some money from your wages so that you can afford to get married. … You can choose your spouse … It takes a long time to build up some savings from your work and find the right person with whom to settle down, so marriage comes quite lately, possibly in your late twenties.”

http://www.vdare.com/articles/david-willetts-the-pinch-uk-cabinet-ministers-discreet-but-devastating-dissent-on-immigrati

R vs. R-squared, my favorite topic … I’ve written a bunch of posts on this topic the past few years. Chris Povirk actually pointed to one of them. Here’s a link to the one that (I think) has been the most popular, with others linked at its end.

Generally:

The correlation coefficient (r) tells you how much of X (in standard deviations) you should expect to see in Y. So, r=0.23 means that for +1 SD of X, expect +0.23 SD of Y. This is usually the one that is most relevant.

The r-squared, on the other hand, tells you what percentage of Y is “explained” by X, in contrast to *every other independent explanation*. So, if r=0.23, that means r-squared = 0.05, approximately, which means that birth order is “one of twenty” real-life explanations of the variation in wealth. This is not usually the one that’s most relevant.

Of course, you can use the one that makes your case stronger. “23 percent of variation in wealth is passed on to the next generation” makes is sound big. “Wealth only explains 5 percent of the variation” makes it sound small. But they’re both correct.

One way to keep it straight is to realize that r-squared is actually a percentage of the total of “square dollars.” It doesn’t mean anything in real life units. So you can’t use it to say anything about wealth — only about EXPLANATIONS.

r=0.23 means “23 percent of a standard deviation of wealth.” r-squared=0.05 means “5 percent of the total explanation.”

I realize it isn’t the point, but I don’t understand this:

Wouldn’t that be better evidence for wealth being almost entirely a matter of pure luck?

“IQ and Statistics” now means “Smoke and Mirrors” . Absolute majority of social studies are poorly constructed agenda driven farce, especially for politically sensitive topics such as IQ, Income, Crime, Race, Gender .

What is to be gained by analyzing them? Do you want to know truth? -but you cannot know it from those studies as they are not designed for it. Do you want political/debate argument ammunition? Don’t we have plenty of those already

Studies such as this state has higher average IQ but has lower overall GDP serve to what purpose? Its not like there is any consideration of doing anything about average IQ anyways, so what the point of that study exactly except further its narrative agenda?

Countering the agenda which says wealth disparity is the result of Evil Conspiracies and not only should we forcibly diminish it, if we do, it will stay dissipated.

As an adoptive parent I very much doubt any study can adjust for certain factors. Adoption requires a mountain of paperwork, vetting by professionals and federal, state and local (and sometimes foreign) officials. Nobody adopts by accident. The determination and consciousness of the adoption process are tough to compare with biology. Even though adoption often involves children who have been abused or have severe medical issues outcomes are often positive. But I don’t think we can generalize findings about wealth or nations from adoptive parents.

As far as IQ/nations there is definitely something to that. I’m not going to start my spacecraft start up in Haiti. And the US state picture looks much like I’d expect it to. Rich people in Mississippi can only hire so many smart tutors. But there is mobility between states especially for the rich. Where are the Romney and Bush and Clinton families from?

I have found this analogy on “equation coefficients” vs. r-squared helpful.

The more important fact is that “variance explained” is NOT a measure of causal importance. Not at all.

I think this example came from somewhere else originally, so I’m not claiming originality, but it should help understand why.

Imagine a bunch of military guys. All of them have two legs, except for the ones who have been in an accident (car bombs, land mines, etc.) and had either one or both legs blown off.

If you do the standard statistical analysis, you’ll find that genetics explains zero of the variance in “number of legs,” and that “accidents” explain 100% of the variance.

So, like any good researcher, you confidently announce to the world, “Genes make zero contribution to legs. No connection at all.” Which would be 100% wrong. *Variance* in number of legs may be caused mostly by land mines, but the fact that there are two legs in the first place has everything to do with genetics.

I agree that a person who had no DNA in their body would not be making an income. But in this case, I think variance in wealth (or GDP, or whatever) is indeed what we’re interested in.

“Nurture is more important than genes but in the grand scheme of things both are tiny and the variance is almost entirely due to other things or randomness.”

Ecclesiastes had this figured out 3000 years ago:

I returned, and saw under the sun, that the race is not to the swift, nor the battle to the strong, neither yet bread to the wise, nor yet riches to men of understanding, nor yet favour to men of skill; but time and chance happeneth to them all.

In terms of gaining intuition, I’d recommend discretizing the data. A way of going about comparisons afterwards is along the line of statements like “in the lowest quintile for IQ the median GDP of US states is X, vs Y for the highest quintile”. To compare two different studies, one could use stuff like (Y-X)/Y. In this example, looking at the medians for the three intermediate quintiles could help convince us that the correlation is there.

Great idea to plot the full graph too. Reminds me of looking some years ago at a blog post that showed the full graph for the violin study that the 10,000 hours meme is based on (sorry for the lack of link : S, looked for a while). And one can of course see that while there is a correlation, it’s far from being a deterministic thing.

Looking more at the “misuse of statistics” side of the post, I mostly just wish that not that many bad decisions are actually taken based on the kind of analysis it identifies (my experiences in situations where powerful people/institutions are involved is that either people don’t care statistics at all, or they know what they’re doing, but I suspect there must be swathes of the world where there is power and that don’t work like that..)

Thank you very much for this post.

I have a suggestion for clarifying one sentence in it. You said, “…If some Social Darwinist organization were to announce that they had evidence that who your parents were only determined 5% of the variance in wealth, it would sound like such overblown strong evidence for their position that everyone would assume they were making it up.”

Shouldn’t that be, “…the environment in which you are raised”, rather than “parents”? It was really confusing for me as written, because I think ‘biological parents’ when I read ‘parents’.

To me the most intuitive way to think about the way different factors “contribute to” some trait is in terms of controlled experiments (or thought-experiments). For example, to really get a sense of the way parental wealth vs. genetics contribute to the wealth of the child, I would imagine one experiment where a bunch of clones are placed in different adoptive families which differ in wealth (but are alike on as many non-economic traits as possible, like education and political views), and then imagine another experiment where a bunch of genetically different kids are placed in families with identical wealth (also alike in as many non-economic traits as possible), and see what the spread in wealth of the children would be in each case.

What I’d really like to see is for someone trained in statistics to put together various mathematical models of different numbers of independent traits (and perhaps also some models involving correlated traits) which are all designed to replicate the observed statistics in a given study, and then see what the models themselves would predict about controlled experiments like the ones I describe. I think this would give me a better intuition of what variance and correlation might tell me conceptually, and also how the answer might be affected by differences in the models such as the number of independent factors assumed.

I can compare these two things statistically, but I’m not trying to combine them into a single meta-study where I say that carbohydrates cause more crime than poverty!

WELL, WHY AREN’T YOU? DON’T YOU WANT TO GET A PAPER PUBLISHED??? 🙂

The news media would eat that up with a spoon. Consider:

(1) Carbs make you fat

(2) Poor people are obese

(3) So poor people are consuming too many carbs and not enough healthy (excuse me, I believe the current American term for that is “healthful”) fruits and veggies

(4) Poor people are criminals

(5) Ergo, carbs = fat, fat = poor, poor = criminal, thence carbs = criminal

(6) Solution: put everyone on a weight-loss regime of carrots and ten mile runs every day, and crime will decrease!

There you go, and I won’t even ask for a mention in the footnotes. (And I bet ten minutes’ Googling would give me studies to back up at least the first four points).

But if carbs only cause crime through causing poverty (step 4), how could they cause more crime than poverty? HUH? HUH?

Besides, I’m already on record saying that the dietary substance which causes crime is omega 6 fats

Scott, Scott, Scott – I’m not saying carbs cause poverty, I’m saying poverty causes carbs!

Poor people are fat. Poor people are criminals. Poor people get fat because they eat too many carbs.

What is the difference between thin rich people and fat poor people? Fatness!

And before you jump in to say “Also, money”, I’ve got that covered.

Rich people can afford to eat all the carbs they want, yet they don’t eat as many carbs as poor people. Rich people are not criminals. So it is obvious that carbohydrates and not money (or the lack thereof) must be the causal factor behind criminality.

You see, my hypothesis is unassailable!

I thought “healthful” was the more correct term, because, technically, most things we eat are already dead, and therefore, not “healthy.” Rather, they are health-promoting, i. e. “healthful.”

But most Americans call that “healthy” too.

“Healthful” seems to be the term used by medical or quasi-medical types; it sounds to my ear like an over-formal correction – “healthy” is too much a layman’s term, to sound like a Proper Nutrition Specialist you have to use the jargon, so “healthful” it is.

It’s no better a term than “healthy”; if a dead plant is not healthy, neither is it full of the mysterious element or quality “health”. What they really mean is “health-inducing” or “contributing towards health”, so they may as well stick with “healthy”.

But then, every profession needs to re-invent the wheel periodically, especially in a field where coming up with the Latest Diet To Make You Live Forever or Magic Supplement or Really Scientific Research is a vital part of the job; anyone can talk about healthy (your granny can tell you what’s healthy to eat) but only a Real Proper Trained Educated Specialist is the only one who can tell you what’s “healthful” 🙂

I believe I was taught the “healthy” vs. “healthful” distinction in high school, thirty years ago, so it’s not a recent grammatical innovation.

Scott, I added an update to my post to make sure everyone understands:

http://noahpinionblog.blogspot.com/2015/06/iq-and-wealth-of-states.html

I actually had no objection at all to the way you reported on that study, and found it interesting, but I needed a foil to the Atlantic saying that r = .23 was a huge effect, and your post fit the bill perfectly. Please don’t take this as criticism.

Oh, no worries. I think the key points in all this are:

1. The modal quality of stats reporting in the media is horrible. This will hopefully improve over time, because data journalism is so new.

2. The results of structural models are really hard to explain, since everyone is so used to OLS.

3. Counterfactuals are the best way to explain structural model results, but these can seem like “magic”, because the result just seems to come out of nowhere – all the interesting stuff is in the guts of the model.

Whether the effects are tiny or not depends on the causal model assumed.

With some more or less reasonable assumptions, the correlation of 0.13 for wealth between biological “mid-parents” and their adopted-away children means that the heritability, or genetic variance, of wealth is 13 percent. You don’t square it because the correlation between biological parents’ wealth (BPW) and adopted-away child’s wealth (ACW) is not due to the former causing the latter but due to both sharing some of their causes (A). The causal model would be like this:

a a

BPW ← A → ACW

A is the “additive genome” which is the same for the mid-parent and the child. Because we know that corr(BPW, ACW)=0.13, we can deduce that the regression weight a=sqrt(0.13)=0.36. The square of this regression weight is the additive heritability of wealth, 0.36^2=0.13. We can also predict that a one standard deviation change in the genetic value A will cause a 0.36 SD change in wealth.

I’m not quite sure how to interpret the correlations between parents’ wealth and that of the children they raised (whether biological or adopted). Some of it should probably be interpreted as above (parents environmentally or genetically transmit wealth accumulation skills), but some it should probably be regarded as a direct effect (and therefore squared). At the maximum, familial effects could explain about a third of wealth differences, so it’s not necessarily a tiny effect.

The fact that there’s much less variation in wealth among those who gave away their children and among the adopted children versus among non-adoptive parents and children, as discussed above, suggests that corr(BPW, ACW) may underestimate heritability in the population at large.

Regarding Stalin’s self-awareness: Just watch him in this video.

https://www.youtube.com/watch?v=fik2-kgOgng

‘It’s not the voting that’s democracy, it’s the counting.’ Tom Stoppard, Jumpers.

It’s studies like those you mention that will get a hyperlink in advocacy articles. Someone will be writing about income inequality or something and link to two to three studies. The writer will briefly mention in one or two sentences, that, e.g., studies show (or he will use the word, “suggest”) that rich parents determine their children’s success, and then move on to possible solutions to the perceived problem. The studies themselves will not be further scrutinized, if they ever were in the first place, but rather accepted as the truth.

I am also not a statistician, so I am wondering if there is any significance to the fact that IQ is being plotted against the logarithm of GDP per capita. If the dependence of GDP per capita on IQ is exponential while the dependence of adopted childrens’ wealth on adoptive parents’ wealth is linear, doesn’t that suggest that the former dependence is stronger even if the quality of fit is the same? The functions we are fitting are not the same.

This depends on what you mean by “stronger.” One way to think about statistical relationships is “I have some uncertainty about what Y is. If I knew X, how much would that reduce my uncertainty?”, which implies that the deepest meaningful units are something like “probability,” but that’s very complicated to discuss. So we typically talk in units of Y divided by units of X (one meter per second, say).

But from the statistical point of view, it doesn’t matter what the units of Y and X are, and depending on what we want to talk about, natural units shift. Whether Y is dollars or log-dollars (whose integer part is the number of digits in your net worth / salary) depends on whether we’re talking about, say, lifestyle (where log-dollars do seem to be natural) or ability to donate to charity (where dollars seem to be natural).

It is not. The Swedish study does not regress wealth on wealth, but wealth rank on wealth rank. Pretty close to taking logarithms, just like GDP. They say that they looked at a bunch and this was the best. They couldn’t just take logarithms because many people have negative wealth.

I think this is an interesting piece, but there are some major errors of reasoning which I think you might commit and I’m sure that some of the commenters have committed after reading.

Some have already been pointed out, but the big one seems to be missing:

https://en.wikipedia.org/wiki/Ecological_fallacy

You cannot simply compare a correlation at state or country level with a inter-individual correlation. Some commenters, e.g. Arthur B., point out a process that can only happen at a state level, namely migration of smart people to wealthy states. That cannot happen inter-individually (which is what you seem to be interested in).

For me and some of my students that I tried this on, the point that best drove home the ecological fallacy (or its more general form, Simpson’s Paradox) was:

1. Across people, average alcohol consumption correlates positively with IQ test performance (at least in Germany).

Now, this surprises many people, and actually we may not really know what the reason for this is (e.g. maybe they have more money to buy alcohol or maybe they need it more to feel sociable at parties). What is clear, is that this doesn’t reflect people’s intuition about the causal role for alcohol on IQ.

Now we can add a regression and control for income, wealth and sociability, but it’s much simpler to simply look what happens intra-individually.

2. The more a given person consumes alcohol, his/her IQ test score (while drunk vs. sober) becomes worse.

That is the result that also holds up experimentally, because that is the true causal effect of alcohol on IQ test performance.

But shouldn’t this negative intra-individual causal effect also have some influence on the inter-individual level? Yes, you can make that inference! However, it’s entirely possible for different unobserved third variables (like wealth) to have a much stronger, positive effect on both IQ and alcohol consumption, leading to the negative association disappearing.

You may have heard all this before, but a lot of the potential inferential errors in this piece follow from this, so maybe it’s worth saying.

So, all you report here matches my expectations: a highly controlled design (adoptees vs. biological children) would usually yield smaller associations than a completely uncontrolled association at a higher level (as shown by the many commenters who are speculating on the various state-level processes involved).

From experience I also know that a lot of the state and country level indicators that people like to look at are highly correlated with one another, to the point that it’s often impossible (due to the small number of countries/states and multicollinearity) to squeeze out the added benefit of having high GDP over having high HDI (human development index), low GINI, low adolescent fertility rate, a smaller gender gap in institutions.

I don’t 100% know why this is, but a likely explanation is that all these things are seen as desirable by countries and their rulers/voters and that getting a high GDP allows you to bring the other things about.

Combine this with the fact that most psychological studies are in WEIRD countries (Western Educated Industrialised Rich Democratic) which are even more similar and correlated on all these indicators (i.e. there is rich, unequal societies, but you usually don’t get much psychological data from Saudi Arabia) and you know why most psychologists are wary of looking at country-level correlations to infer something about psychological processes.

I wouldn’t bet much on the association between adoptees’ wealth and their adoptive parents’ wealth being within +/-0.05 of the ones reported in Sweden in Burkina Faso or even the US.

Hi, Scott! A few comments:

1. Remember that the estimate in the paper is not a causal estimate. Saying “Holy frick, IQ is everything after all” probably implies that IQ is an exogenous variable that causes state GDP variations. But the entirety of the correlation in the paper might run in the opposite direction, meaning that it would be more appropriate to say “Holy frick, state GDP is everything after all”. More realistically, there is probably two-way causation.

2. 17% is actually slightly higher than what the paper finds. Using a bunch of different methodologies, the number they find is actually around 10-14%. Which still implies a correlation above 0.3, so your point is of course still valid, I just thought I should point that out.

3. Graphs can be tricky. You might think this graph shows a very strong linear relationship, but try covering up the small scattering of 8 states in the lower left: MS, LA, AL, WV, AR, TN, SC, and KY. If you cover those 8 points with your thumb, you’ll see that it now looks not much like a line, and a lot more like a fluffy cloud. But you’re still looking at 84% of the data. A small number of outlying points tends to draw the human eye.

4. I think Figure 9 in the paper gives a much better picture of what kind of GDP results we might expect from IQ changes. The light green bars represent the estimated effect of test scores, the black represents things we know we can control (schooling), and the gray – by far the biggest bars and the bars most varied in length – represent “other stuff”. Looking at this graph, as a policymaker, I think raising state IQ might be a priority, but not the highest priority by any means.

Cheers,

Noah

Somewhat confused – I also noticed the bunch of methodologies showing 10-14%, but I figured you would be better at interpreting than I would, and you said “What it shows is that the vast majority of differences in state income are not due to variations in state average I.Q. If we had an I.Q.-boosting device, boosting the average I.Q. of Ohioans by 1% would raise Ohio’s average income by at most around around 0.17%.”

Am I misunderstanding you?

The paper doesn’t do the kind of linear regression you’re imagining. They do something more complicated: they make a model of how they think growth works, and they use that model to infer a linear relationship between growth in IQ (test scores) and growth in GDP. The 17% number comes from that relationship, not from a simple linear regression of GDP on test scores. 10-14% is the percentage of GDP variance accounted for by IQ differences; 0.17 is their estimate at the size of the effect of changes in IQ (measured in percentage points of 1 standard deviation) on GDP growth (measured in percentage points).

(But because they assume GDP doesn’t causally affect IQ, this 0.17 number should be treated as an upper bound.)

A better way to think of this is that according to this model, if you used IQ-boosting technology to boost the IQ of Ohio’s population by 18 points – the commonly cited figure for the difference between the average IQs of Mexico and South Korea – you would increase Ohio’s GDP by about 16 percent, or $5,600 per person. Nothing to sneeze at, but not exactly world-changing.

Noah’s argument:

“What this really shows is that there is Something Else that is driving state income differences. My personal guess is that this Something Else is mainly “external multipliers” from trade (the Krugman/Fujita theory). Institutions probably play a substantial role as well (the Acemoglu/Robinson theory). That’s certainly relevant for the debate about different models of capitalism, where we often compare the U.S. to Scandinavia and other rich places.

“In any case, this result should be sobering for proponents of I.Q. as the Grand Unified Theory of economic development. … But for rich countries, there are things that matter a lot more.”

True, no doubt, but the problem of course is that “external multipliers” and “institutions” are less “things” than IQ is. “External multipliers” and/or “institutions” are likely important, but they are also extremely broad hand-waving conceptual bins in which to lump miscellaneous things that you can’t really measure other than to assign a lot of leftovers to them. We could make up lots of other names for useful catch-all concepts, such as “culture.”

In contrast, here in America we’ve been pretty good at measuring this thing we call IQ for the 99 years since Lewis Terman invented the Stanford-Binet test. We have a convenient method for coming up with a single number metric that turns out, when you create a scatter plot, to be strikingly correlated with all sorts of complex real world numbers like state per capita GDP.

Obviously, the IQ glass is part empty. But it’s much more remarkable that it’s part full.

By the way, it’s probably just a coincidence that the center of the global high tech industry is now the Stanford campus and that the “Father of Silicon Valley” is either Terman’s son Fred or Fred Terman’s pal William Shockley. But, then again, maybe there’s something about the culture of the Santa Clara Valley going back over 100 years that makes a cult of intelligence that, remarkably, has paid off over and over again.

Thanks, I’ve edited the post to reflect the correct statistic.

It’s really more about the fact that the people who wrote the paper are doing something very different than drawing a GDP-IQ scatterplot and then drawing a line through it. So it’s not an apples-to-apples comparison.

If you do draw a GDP-IQ scatterplot and draw a line through it, as you do in this post, the closest correspondence is to use the 14% number as the r-squared. So yes, it’s good to change that number from 17% to 14%. But the most important thing for readers to realize is that the people in the paper aren’t doing the same thing you’re doing.

In economics, many people use “counterfactuals” to summarize the importance of the causal effect of A on B. A counterfactual is when you ask the question “If we forced A to rise by a certain amount, what would happen to B?”. This is what I did with my Ohio example. I think it explains exactly how important population IQ is and isn’t in the model in the paper, without creating the kind of confusion you profess in this post.

In other words, I don’t think there’s any Stalin-esque vote-counting going on here. The size of the effect is very clear and easily explained.

Oh, and I think the caption of the graph should actually be: “Proposed new state motto: Maine – If intelligence were the key to riches, we’d be driving nicer cars!“

Proposed new state motto: “Minnesota — If we weren’t intelligent and cooperative we wouldn’t be here because it’s really cold.”

Actually, if you look at that graph, virtually all of the states with high IQ relative to GDP are far northern, heavily forested, very rural states. Maybe it’s not all that useful to be smart if all you’ve got is trees.

Another possibility is that there you’re seeing the actual effect of high IQ (which is not very impressive) due to low parasite load and/or demographics, and everywhere else you’re seeing a correlation with good education or something.

In my blog post, I gave a hypothesis as to what I think a big chunk of the “something else” might be: location in a geographic pattern of trade networks.

Yeah, but that didn’t look too plausible for me, and I don’t notice a stunning trade route difference in the states above vs. below the trend line – Nevada, Tennessee, and Georgia are above, but Rhode Island, Oregon, and Missouri are below.

I would recommend the work of Krugman and Fujita on this topic:

http://www.amazon.com/Spatial-Economy-Cities-Regions-International/dp/0262561476/ref=sr_1_2?ie=UTF8&qid=1438618031&sr=8-2&keywords=masahisa+fujita

It gets pretty math-heavy, but the first two chapters do a good job of communicating the basic ideas. In a nutshell, small historical differences can easily lead to large, enduring economic differences between regions. But don’t feel bad for the North Dakotans; they probably derive greater than average benefit from living in a wide-open, empty place.

“In a nutshell, small historical differences can easily lead to large, enduring economic differences between regions.”

No doubt. The general principle that past differences have led to present differences pretty much has to be true.

But how informative is it? Notice how much this resembles most tribes’ creation myths for the origin of the universe: small differences in the past lead to today’s large, enduring differences between the sky and and the earth, between day and night, man and woman. Something caused these current differences!

Scott writes:

“Yeah, but that didn’t look too plausible for me, and I don’t notice a stunning trade route difference in the states above vs. below the trend line – Nevada, Tennessee, and Georgia are above, but Rhode Island, Oregon, and Missouri are below.”

You are being overly literal. “Trade networks” to economists attempting to explain the world doesn’t necessarily mean canals or highways, the term today mostly means The Way Things Are. Silicon Valley, for example, is rich because it’s full of things that make Silicon Valley rich.

I wonder if people with high IQ are more likely to value lifestyle over wealth?

Brings Scott Adam’s “world’s smartest garbage man” to mind. 🙂

The cost of living tends to be low in very cold weather states, so the standard of living tends to be higher than it looks. Minnesota, for example, has a high material standard of living, assuming you can stand the climate. Florida, Arizona, California, and Hawaii have lower standards of living than per capita GDP would suggest, but then they have nice weather in winter.

“If we had an I.Q.-boosting device, boosting the average I.Q. of Ohioans by 1% would raise Ohio’s average income by at most around around 0.17%.”

This sounds like a regression coefficient, not the variance explained. Even in a linear regression, the two will be related but they are not the same thing.

Dan: Correct. The amount of the variance explained in their model is around 10% to 14%, while the effect size is 0.17 (actually a little lower). Obviously these don’t have the same relationship to each other that they would in a simple least squares setting.

Btw, Scott also interprets regression coefficients as correlation measures in the adoption study. This only works only if you have one explanatory variable and all the variables are normalized. It’s possible to get very high r^2 with very low coefficients on the explanatory variables if the variance of the explanatory variables are high.

Also, since both biological and adoption parent wealth are included in the same regression, the coefficients are really partial correlations if you want to use that word.

In terms of the variance explained, it’s really the biological and adoption parent wealth taken together that explains 14% of the variation of wealth rank of children.

In terms of explaining the results to a lay person, it’s better to start with the economic impact. e.g. if we increase the wealth rank of the adopted parent by one points holding the rank of the biological parent constant, we’d increase the wealth rank of the children by X points.

Then you can talk about the stastical significance. e.g. 95% confidence interval for the X estimate is Y and Z.

The R^2 generally will tell you very little.

Megan McArdle quoted one of her professors a while back as saying, “If you look at demographics long enough, you will find it accounts for 110% of all social phenomena.”

Really? Because when I take GPD and raw NAEP from table A2 of the paper, I get a correlation of only 0.27. It is only by adjusting for migrants (column 5) that I get a correlation of 0.46. And then it goes back down to 0.41 when adjusting for differential trends in NAEP scores. And back to 0.28 for column 7, using SATs.

(oops…I was supposed to exclude AK, DE, WY. Then all the correlations go up, but the correlation with raw test scores was still only 0.31 and the highest was not 0.54. And maybe I was supposed to weight by population, which I did not do.)

I always assumed that “not having a totally corrupt government” would be the #1 factor in income differences among countries. I don’t know where corruption comes from but I suspect it’s mostly cultural rather than IQ-related.

Aaaaaand what makes you think those aren’t correlated?

I think there’s a tendency to over-emphasize “book smarts” (IQ) in life outcomes among audiences like SSC where education level tends to be post-graduate and profession reflects this. Although above average IQ does seem necessary to work on the sexy, bleeding edge tech of the era (e.g. rockets, selfdriving cars) it would seem that crass day-to-day business is the driver of the wealth of nations; if we were going by achievements in space (or computer hacking skills), Russia should be second wealthiest country to the US.

Some of the profiles I read of Mitt Romney’s family history show an attitude I’d dub “enterprising” where wealth was accumulated in pretty bland ways: ranching, car dealerships, management consulting. This probably gives a more representative example of the population than the iconic Steve Jobs stories. I see this bias to hi-tech even in the discussion of AI, where the computer becomes a physicist and invents a Rearden Steel, as opposed to an online pornographer or property developer. “The only way doctors get really rich is through real estate” -Bill Gates

Book smarts contributes to all these endeavors. Bill Gates plays bridge with Warren Buffett, who got rich in the most boring possible way.

What about personality? That’s more important in business.

but even successful ‘low tech’ entrepreneurs probably have above average IQs. But you don’t hear as much about bland businesses in the news as you do about tech

Higher IQ correlates to greater success in pretty much every job, all else being equal. A smart janitor will get more rooms cleaned in his shift than a dumb one.

The two factors other than intelligence which seem to make the most difference to financial success are conscientiousness and sales ability. (Both of which seem to correlate with intelligence, but are independently valuable.) Bill Gates is really smart, but he’s also both very conscientious *and* has really good sales ability. There are programmers who are smarter than Gates, and many are his equal in conscientiousness, but most aren’t as good at sales. The Romneys who were ranchers (really?) are probably smarter than most other ranchers.

Speaking of bias, there’s also a large bias both here and in most other communities where there are lots of people with advanced degrees against attributing high intelligence to very successful people who don’t have very high academic achievement. Many of the smartest people I know stopped after a bachelor’s degree, often from a second-string university, but have done quite well because they turned their intelligence to making money. Management is an intellectually demanding skill that many otherwise smart people can’t do, and don’t recognize as being intellectually demanding.

For a graph of the most recent PISA scores across a wide number of First and Second World countries, see:

http://isteve.blogspot.com/2013/12/graph-of-2012-pisa-scores-for-65_4.html

It’s kind of weird to repeatedly credit an article to The Atlantic even though it has a listed author. Joe Pinsker’s name ought to be in this post, especially since a lot of your readers are going to conclude that the piece in question is severely incautious in generalizing from the research findings. We should know who to blame.

I don’t like blaming people.

OK, then credit Joe Pinsker for Joe Pinsker’s irresponsible science journalism.

It doesn’t make sense to attribute an article with a byline to an institutional author. You wouldn’t say “The New York Times’ post” when you were talking about something Krugman wrote. Why do it here?

It’s not like the Atlantic respected Joe Pinsker’s expertise so much that they would publish his article no matter its conclusion.

If Pinsker hadn’t messed up, The Atlantic would have found some other idiot whose misunderstanding of the science happened to lead to the conclusions The Atlantic likes.

Therefore, blaming The Atlantic makes sense, because there are way too many idiots doing journalism, but not that many popular publications.

So the bad science journalism is really a function of management wanting to push bad science journalism, for ideological reasons, and Pinsker is just their current mouthpiece? That sounds like attributing to malice what is explicable by incompetence.

I think it’s more likely that the bad science journalism is a function of having hired an incompetent science reporter. That it would be possible for The Atlantic to get better science journalism, by hiring a more competent science reporter.

And I think it’s important they do this because, as you say, there aren’t that many popular publications any more. It’s wasteful to have Pinsker filling the science reporter slot at one of them.

How many good science reporters are there, really? (How many good reporters of any sort are there, for that matter?) Keep in mind that scientists, university public relations people, et al. all have incentives to make their work sound as important and definitive as possible; meanwhile, even if a science reporter wants to be as accurate and truthful as possible, she has incentives to write things that people want to read. (The Cochrane Collaboration can get away with saying “more research is needed” for everything; Buzzfeed can’t.)

Pinsker isn’t a science reporter, he is an editor who covers business.

I think this means that all of his content can be considered editorials, and as such, they represent a point-of-view and are not simply reporting. Much of the content The Atlantic would fall under this rubric, and the publish a number of viewpoints that cover a fair amount of the spectrum. Conor Friedersdorf and Jonah Goldberg are regular contributors, for example.

No, “editor” is meaningless title. Journalists at magazines are often called “contributing editor” even though they do no editing. “Associate editor” is a lower-level title and might mean that he really does grunt-work editing in addition to writing articles like this one.

It is true that magazines are not newspapers and are not simply reporting the news.

@Douglas Knight:

That’s a fair point. I’m not up on the job title conventions in media these days. Still, his beat is business not science, and a brief perusal of some of the other things he writes seems to be sort of a smorgasbord of more or less interesting nuggets (including the two times squirrels stopped stock trading in the U.S.. It seems more of a blog type approach, rather than an attempt to cover the most import things in a topic.

As such, I think it is still fair to characterize his writing in the opinion category. Certainly he ends some of his pieces with opinions that are clearly his, and not simply a reporting of the opinion of someone else.

I think that this paper counts as “business” rather than “science” because it was written by economists.

He just posted another article about a social science paper. This time it’s about appearance and crowdfunding on Kiva with a title that’s not completely supported by the article.

How to Succeed in Crowdfunding: Be Thin, White, and Attractive

The biases of the online marketplace, quantified

http://www.theatlantic.com/business/archive/2015/08/crowdfunding-success-kickstarter-kiva-succeed/400232/

Having complained about Pinsker, I recognize that it’s probably now incumbent on me to go through that one and see how well he does (trying to judge objectively).

I’m not going to do that, because after following links through other news reports to their source it looks like it would be around 10 studies to read, and I have another project today. I acknowledge my dereliction of duty in my recently self-assigned role as Judge of Pinsker’s Reporting. Sorry.

ETA: The very fact that he’s reported a piece that eventually sources to 10 different studies is points in Pinsker’s favor though.

Usually, the publication writes the headline and not the writer. If the headline is the problem, then we should be blaming The Atlantic.

Reporters/journalists/columnists don’t write the headlines, as has already been pointed out; that’s editors/sub-editors. And they go for an attention-grabbing line that may or may not be borne out by the body of the article, e.g. if there’s a piece about general nutrition and healthy eating that includes the sentence “Turnips turn out to be good as one vegetable to boost fibre in your diet”, the headline will scream “Turnips – nature’s miracle weight loss food!”

It’s even worse for online pieces, where they live and die by getting readers to stop and click on that particular article so they need something that will make you go “What?”

I really don’t think he was that bad. I think he stressed a certain aspect of the study, maybe a little more than seemed proper, but he didn’t misrepresent findings or lie about anything. If we grade science journalism on a curve, that’s solid B+ territory.

I agree that this is about the Atlantic’s institutional biases, and the Atlantic can’t feel bad if I yell at them, so I continue to be satisfied with blaming the Atlantic. Hounding a poor not-so-bad journalist out of the profession changes nothing; getting the Atlantic to change the way they do things changes a lot.

If you are interested in test scores by state, Audacious Epigone is the place to go. For example, here are federal NAEP test scores by state for just white kids:

http://anepigone.blogspot.com/2015/02/state-iq-estimates-whites-only-2013.html

Most states’ white students are pretty average on average, but the gap in average white scores between Massachusetts and West Virginia is close to 2/3rd of a standard deviation.

I actually double-checked with a state IQ dataset you posted somewhere, and it correlated with this study’s at 0.96.

All cognitive tests correlate fairly well.

“Stalin was totally all about coming up with the witty self-aware evil-despotism-related quotes. Huh.”

Stalin was a funny guy. Seriously. He apparently modeled his prose style on the sarcastic prose of the letters of Ivan the Terrible, who was also a funny guy.

Also, Germans apparently found Hitler hilarious, but Stalin’s mordant black humor strikes me as funnier.

Well, past a certain wealth level, maybe the motivations for giving a kid up for adoption change? i.e., “oh god the kid’s gonna be retarded” instead of “oh god I can’t afford it”?

I think scatter plots are generally the best way to convey this kind of data. I don’t think the State-IQ graph makes it look like IQ explains everything, at least not if you’ve spent a lot of time looking at graphs; there is a lot of variance between the states. Similarly, the most interesting thing to me about the Swedish wealth graph is how there is much less variance w/r/t to adopted parents and wealth vs the biological parents. The confidence interval for the first graph (adoptive parents) seems really tight.

Something helpful I wish more studies did would be to provide series of graphs for a variety of factors, as it is very easy to selectively cite data to tell the story you want. It’s a lot more work, but if you can back up your hypothesis with a dozen different measurements it’s much more convincing, and often it reveals a much weirder reality than what can be shoved into a five hundred word article.

I wrote about cancer rates in US states compared to smoking. The correlation coefficient was .248. But if you looked at cancer death rates r=.891. I’m sure this has been studied to death, but it was new to me. In this case we know how bad smoking is for you (and dang, r=.891!), but if the empirical research was murkier and the numbers not quite so divergent you could plausibly tell whichever story you wanted. Really what we need in cases like what you’re writing about is better data, as statistical tools can only take you so far.

Your link back to your post on the Leslie et al study reminded me: Leslie and Cimpian have responded to a similar criticism of their paper in a discussion note.

The critical comment:

http://www.sciencemag.org/content/349/6246/391.2.full

Leslie et al. (Reports, 16 January 2015, p. 262) concluded that “expectations of brilliance” explained the gender makeup of academic disciplines. We reestimated their models after adding measures of disaggregated Graduate Record Examination scores by field. Our results indicated that female representation among Ph.D. recipients is associated with the field’s mathematical content and that faculty beliefs about innate ability were irrelevant.

Their response:

http://www.sciencemag.org/content/349/6246/391.3.full

Ginther and Kahn claim that academics’ beliefs about the importance of brilliance do not predict gender gaps in Ph.D. attainment beyond mathematics and verbal test scores. However, Ginther and Kahn’s analyses are problematic, exhibiting more than 100 times the recommended collinearity thresholds. Multiple analyses that avoid this problem suggest that academics’ beliefs are in fact uniquely predictive of gender gaps across academia.

Do you have further thoughts about this issue?

I think my analysis is immune to the colinearity argument since I only look at one thing.

OOOOPS, you’re right, that part doesn’t have anything to do with your argument.

They do say something that seems potentially relevant in their reply:

“The results displayed in Table 1 make it clear that academics’ ability beliefs are a significant predictor of female representation above and beyond whether a discipline (i) requires mathematical ability (as indicated by the quantitative GRE score) and (ii) privileges this ability relative to verbal ability (as indicated by the quantitative:verbal ratio or the quantitative−verbal difference) (see, e.g., models 7, 8, 9, 20, and 21).”

“Privileges” is an interesting choice of word. Tells you something about the authors’ view of the world, I think.

What is the x-axis in figure 8? It is called “Test Scores,” but it does not seem to correspond to any of the columns in Table A2. In particular Louisiana has a score just over 400 in the graph, but not in any of the columns.

I find that the correlation between the GDP listed in Table A2 and the Test Scores in the same table are: 0.27, 0.26, 0.46, 0.41, 0.28. After excluding AK, DE, WY: 0.31, 0.30, 0.54, 0.52, 0.37. The scatterplot from column 6 looks most like the scatterplot in the paper, but the x-axis has shifted by 20 points. (regression line does not exclude the 3 states) CSV.

(I probably should have weighted these by population. But that is irrelevant to the question of the x-axis.)

Statistical analysis is a horribly abused field of applied mathematics and your post highlights why this is so. It’s original efficacy was essentially to inform decision-making and hopefully achieve better (or desired) outcomes. It later was applied as an aid to interpretation of experimental data, and used to improve understanding of physical phenomena. In neither of these endeavors was there any expectation of certitude or revealing a definitive truth.

During the past half-century, however, the field of journalism has co-opted statistical science in service to sensationalism and selling a media version of “knowledge” that implied the revelation of a higher truth. This is nothing more than journalistic propaganda hiding behind a patina of science, and should be viewed as a derogation of ethics.

There is an alternate explanation to Stalin being particularly self-aware of being an evil despot.

The man was profoundly anti-liberal. He fundamentally believed that liberal institutions like free press and representative democracy could not serve the masses, but would ultimately be co-opted by the bourgeoisie and used as tools of opression.

Of course, the man did famously fudge elections himself. At the 17th party congress, he was surprised to receive a very large number of negative votes. He immediately falsified the results. The congress was later known as the congress of the condemned, as during the purges a third of those present, and more than two thirds of those elected during the congress got executed.

I’m no expert, but there may also be a cultural factor at work: all the Russians I’ve ever met enjoy expressing very cynical, “cold-eyed realist”-type attitudes about politics. Of course, this may be because of Stalin to some extent, but it probably predated him.

Thus, as we see with Putin, being openly Machiavellian may be perceived by the Russian public in a more positive light than it would be here: a way of signalling that you are tough and serious and mean business, etc.

I recall on a vacation to Russia someone asked our tour guide: “why do none of the shopkeepers ever smile?” He replied, “Russians think that if someone selling something smiles at you he is probably out to cheat you.”

The famous Russian cynicism about politics is at strange odds with their wildly romantic nationalism. My best approximation is thus: “Our leaders are shit, and we’d like them to be in charge of everyone else too!” I don’t know if it’s just ideological blinders or a “misery loves company” thing, but it is really weird.

You’re conflating nationalism with imperialism here.

And this was the 1920s and 1930s when democracy’s successes as a viable, effective, system of government was much less obvious than it is today.

Isn’t there an extremely obvious reverse causation in the IQ/GDP thing that wealthier countries/states could lead to a more intelligent populace? Not just through better education but also better nutrition.

In US states that would seem really unlikely to be important, esp. regarding nutrition.

There’s a simpler reverse causation. Intellectual ventures (technology, medicine) have been leading GDP growth in the US. The states which have jobs in such industries attract smarter people than the states which don’t.

It’s even more pronounced at a local level. NYC or San Francisco don’t have a high GDP because they’re naturally gifted with a pool of smart people, they attract smart people because of the type of industries that bring about this high GDP.

As I mentioned elsewhere, that’s likely to work both ways. High-tech industry attracts smart people and generates wealth, but high-tech industry requires smart people with wealth to grow. Or even to establish in the first place. The interesting question is why this virtuous cycle takes place in some regions but not in others. I only half-jokingly suggested natural harbors and navigable waterways, am open to others.